"EV Battery Market Heats Up with Emergence of New Entrants"

"Low Threat to Korean Batteries in the Next 5 Years"

[Asia Economy Reporter Ji Yeon-jin] Since the partial resumption of short selling on the 3rd of last month, foreign investment banks have been issuing consecutive sell reports on domestic electric vehicle battery manufacturers. Coincidentally, short selling attacks on the three major K-battery companies have also intensified.

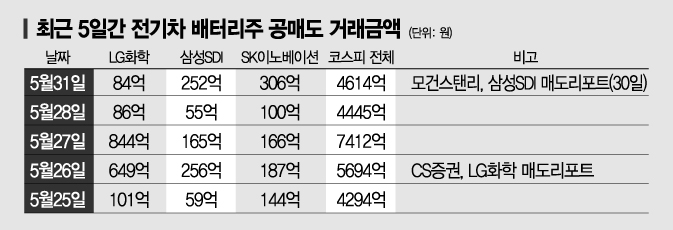

According to the financial investment industry on the 1st, the US-based investment bank Morgan Stanley lowered its target price for Samsung SDI to 550,000 KRW along with a reduction in weight in a report released on the 30th of last month (local time). This was due to the expectation that battery prices would fall amid intensified competition as new entrants emerge in the global electric vehicle battery market. Immediately after this sell report was released, Samsung SDI plunged more than 5% intraday in the KOSPI market the previous day. At that time, foreigners and institutions net sold approximately 67 billion KRW and 54.3 billion KRW respectively, driving the stock price down. Notably, short selling amounted to 25.2 billion KRW, nearly five times the 5.5 billion KRW recorded the previous trading day. The gloomy outlook on global electric vehicle battery manufacturers led to a sell-off, with SK Innovation closing down 3.28% and LG Chem falling 1.56% that day. In contrast to the KOSPI’s rise and recovery above the 3,200 mark the previous day, K-battery stocks showed weakness.

Earlier, LG Chem’s stock price dropped sharply following a sell report published on the 26th of last month by Swiss-based Credit Suisse (CS Securities). CS Securities lowered LG Chem’s target price from 1,300,000 KRW to 680,000 KRW, citing that LG Chem would become a holding company once its battery subsidiary LG Energy Solution goes public this month, thus requiring a high discount rate and dilution of share value similar to other domestic holding companies. On the day this report was released, short selling on LG Chem surged to 64.9 billion KRW, more than six times the previous trading day. Over two days starting from the 26th, short selling exceeded 150 billion KRW, and the stock price fell nearly 10% (9.98%).

These foreign securities firms have targeted K-battery companies due to the expectation that intensified competition in the global electric vehicle battery market will lead to price declines and margin reductions. Recently, global electric vehicle manufacturers have declared battery internalization, and with increased battery investments in Europe and the US, new entrants are emerging rapidly, making it inevitable that existing battery manufacturers’ growth momentum will weaken. Morgan Stanley stated, "Electric vehicle OEMs and battery material suppliers are neutral to technological changes and have high entry barriers and service execution capabilities, whereas battery manufacturers are already experiencing technological disruption and intensified competition."

On the other hand, the domestic financial investment industry has presented the opposite analysis. Kim Hyun-soo, a researcher at Hana Financial Investment, said, "The possibility that new battery companies and automakers’ internalization will pose a real threat to Korean battery companies within the next five years is low," adding, "These companies have no battery mass production references at all, and it takes considerable time and capital to guarantee uniform product quality while establishing mass production capabilities." IBK Investment & Securities projected an improvement in Samsung SDI’s electric vehicle battery profitability on the 24th of last month, setting a target price of 850,000 KRW, and HN Investment & Securities maintained a target price of 970,000 KRW on the 4th of last month, citing the expanding influence of Korean battery companies in the US.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.