In Q1, K Bank Earned 5 Billion KRW in Fees from Upbit Only

Recent 3-Year Trends in Deposit and Withdrawal Amounts of Real-Name Verified Accounts for Virtual Asset Transactions

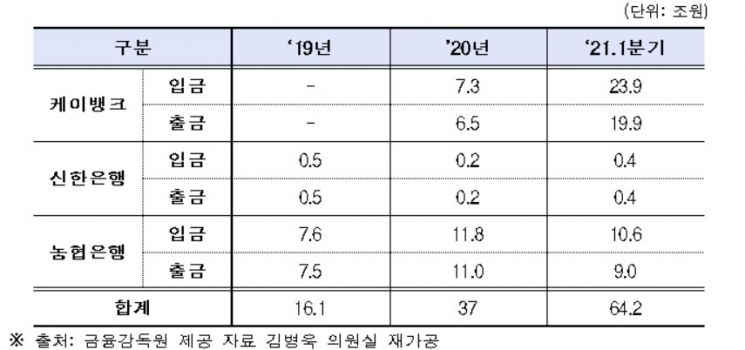

Recent 3-Year Trends in Deposit and Withdrawal Amounts of Real-Name Verified Accounts for Virtual Asset Transactions

[Asia Economy Reporter Park Sun-mi] Due to the cryptocurrency investment boom, the scale of cryptocurrency account deposits and withdrawals in the domestic banking sector exceeded 64 trillion won in the first quarter of this year. The fee income collected from providing real-name verified deposit and withdrawal accounts to cryptocurrency exchanges also reached tens of billions of won per bank per quarter, deepening the banking sector's dilemma as they must decide whether to open real-name verified deposit and withdrawal accounts for exchanges through verification by September 24.

According to the 'Trends in Deposit and Withdrawal Amounts and Fees of Banks Providing Real-Name Verified Account Linkage Services to Virtual Asset Exchanges over the Past Three Years,' submitted by the Financial Supervisory Service to Kim Byung-wook, a member of the National Assembly's Political Affairs Committee from the Democratic Party of Korea, the scale of bank deposits and withdrawals for domestic cryptocurrency trading exceeded 64 trillion won in the first quarter of this year.

Currently, four cryptocurrency exchanges operating with real-name verified accounts through banks and customer real-name account verification are Upbit, Bithumb, Korbit, and Coinone. The cryptocurrency deposit and withdrawal amount traded through real-name verified accounts with K Bank, Shinhan Bank, and NH Nonghyup Bank, which transact with these four exchanges, reached 64.2 trillion won from January to March this year. Compared to last year's total deposit and withdrawal amount of 37 trillion won, this is a 1.7-fold increase, and it has quadrupled compared to 16.1 trillion won in 2019. By bank, K Bank recorded the highest amount at 43.8 trillion won, followed by Nonghyup Bank at 19.6 trillion won, and Shinhan Bank at 800 billion won.

Fees collected by banks from cryptocurrency exchanges also surged accordingly. In the first quarter of this year, K Bank received approximately 5.041 billion won in fees from Upbit. This is nearly a tenfold increase compared to 562 million won in the fourth quarter of last year. Nonghyup Bank collected 1.3 billion won in fees from Bithumb, and 333 million won from Coinone. Shinhan Bank received 145 million won in fees from Korbit, which also increased nearly tenfold from 16 million won last year.

Cryptocurrency Management System Takes First Steps... Banks Face 'Dilemma'

It is known that banks contract to receive 0.5~0.8% of the fees charged by cryptocurrency exchanges per buy-sell transaction. Except for K Bank, which trades with Upbit with a large cryptocurrency trading volume, the fee income collected by Nonghyup Bank and Shinhan Bank through contracts with cryptocurrency exchanges accounts for less than 1% of their total net profit. However, riding the cryptocurrency investment boom, the number of real-name verified deposit and withdrawal accounts and fee income are increasing rapidly, and from the perspective of expanding the customer base mainly among investors in their 20s and 30s, banks find it difficult to give this up. This is why the banking sector is struggling between cryptocurrency market risks and diversifying income structures and expanding customer bases.

Currently operating cryptocurrency exchanges must submit a report to the Financial Intelligence Unit (FIU) under the Financial Services Commission by September 24, in accordance with the amended Act on Reporting and Using Specified Financial Transaction Information (Special Financial Transactions Act). To submit the report, a 'real-name verified account confirmation certificate' approved by bank screening is required. Banks contracted with cryptocurrency exchanges are conducting due diligence on the exchanges based on internal standards created from the standard guidelines presented by the Korea Federation of Banks.

In the political sphere, voices are pouring out that establishing related laws and systems to protect users is urgent as the cryptocurrency management system has just taken its first steps.

Currently, several bills have been proposed in the National Assembly, including the 'Act on the Development of the Virtual Asset Industry and Protection of Users,' led by Representative Kim Byung-wook, the 'Virtual Asset Industry Act' (proposed by Lee Yong-woo and others), and the 'Act on Virtual Asset Transactions' (proposed by Yang Kyung-sook and others). Representative Kim emphasized, "Due to the investment boom, the number of real-name verified deposit and withdrawal accounts and fee income have already surged," adding, "Financial authorities and banks must strive to protect investors from cryptocurrency fraud and hacking, and it is urgent to establish related laws and systems for domestic cryptocurrency."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.