May Extraordinary Session Not Even Discussed

Fintech Companies Seeking New Business Opportunities Left Perplexed

[Asia Economy Reporter Kiho Sung] The amendment to the Electronic Financial Transactions Act (EFTA) was not even submitted for review during the May extraordinary session of the National Assembly and has been postponed to the next extraordinary session. In particular, with cryptocurrency-related bills emerging as an issue in the June extraordinary session, there are forecasts that discussions on the EFTA may be further delayed. Fintech companies that were exploring new business opportunities are unable to hide their frustration over the delayed parliamentary discussions.

According to the National Assembly on the 31st, although the May extraordinary session is nearing its end, the National Assembly’s Political Affairs Committee has yet to schedule a subcommittee meeting to review the bill for the EFTA amendment.

The core of the EFTA amendment includes the introduction of comprehensive payment settlement operators and payment instruction transmission services (MyPayment), as well as allowing postpaid payments for simple payments. Initially, the Political Affairs Committee planned to hold a public hearing on the EFTA amendment in March and then proceed with detailed discussions in the subcommittee. However, the ‘Conflict of Interest Prevention Act’ arising from the Korea Land and Housing Corporation (LH) scandal became a contentious issue, pushing the EFTA amendment to a lower priority.

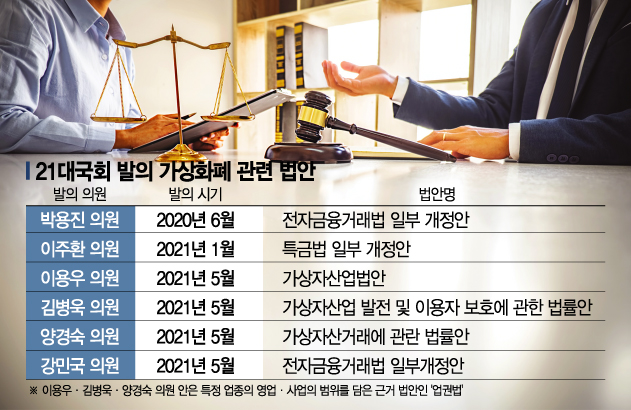

Although the EFTA discussions have been postponed to the June extraordinary session, there appears to be no definite timeline for reviewing the bill. Recently, cryptocurrency has become a hot topic, leading to a series of related bill proposals. Since the 21st National Assembly began, a total of six cryptocurrency-related bills have been proposed. Four of these bills were submitted in May, when cryptocurrency controversies intensified. Additionally, three of these bills are ‘industry-specific laws’ that define the scope of business operations for certain sectors, which means legislative discussions are expected to take even longer.

A bigger problem is that amid the rising issue of cryptocurrency, it is difficult to even set a schedule for bill review. The ruling and opposition parties continue to engage in a tug-of-war over the distribution of chairperson positions for standing committees (Legislation and Judiciary Committee, Political Affairs Committee, and Foreign Affairs and Trade Committee), which will be vacant following the election of the Democratic Party leadership. Due to the formation of the committee leadership, the schedule for standing committee discussions on bills is being disrupted.

An official from the Political Affairs Committee said, "Discussions on the distribution of standing committee chairpersons are still ongoing," and added, "The schedule for the standing committees may be set sometime after mid-next month, once the internal arrangements between the ruling and opposition parties are somewhat finalized."

In this situation, voices opposing the EFTA amendment continue to emerge. On the 11th, the Financial Workers’ Union held a roundtable discussion with the Citizens’ Coalition for Economic Justice, opposing the EFTA amendment as a "big tech (large technology companies) special privilege law." Furthermore, the Financial Workers’ Union’s Local Bank Labor Union Council and the National Association of Mayors, County Governors, and District Heads recently issued a statement saying that the EFTA "runs counter to balanced development."

The inter-ministerial conflicts that surfaced early in the EFTA amendment discussions have yet to reach a consensus. The Bank of Korea insists that the Korea Financial Telecommunications and Clearings Institute, which handles electronic payment transaction clearing, is the only entity supervised by the Bank of Korea, and opposes the Financial Services Commission’s involvement in payment and settlement operations, which are central bank functions. The Financial Services Commission maintains its stance that external clearing must be included in the EFTA to ensure transparency in fintech company transactions. The Ministry of the Interior and Safety and the Ministry of SMEs and Startups have reportedly requested the removal of clauses excluding payment settlement services related to local love gift certificates (local currency) and Onnuri gift certificates from the scope of the EFTA. Both ministries believe that it is more efficient for the Financial Services Commission to manage payment settlement services for these gift certificates.

The fintech industry, which has been waiting for the bill’s passage, expresses frustration. Small and medium-sized fintech companies, in particular, which were planning new business areas through license acquisition, are growing increasingly anxious. A fintech industry official said, "The industry had been paying attention to how the detailed enforcement ordinances would be determined after the bill’s passage, given the bill’s extensive scope," adding, "However, we did not expect the bill’s passage itself to be delayed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)