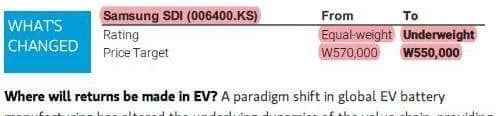

[Asia Economy Reporter Ji Yeon-jin] U.S. investment bank Morgan Stanley lowered its target price for Samsung SDI to 550,000 KRW and downgraded its rating to 'underweight,' citing expected intensified competition among battery manufacturers due to a paradigm shift in the electric vehicle (EV) battery industry.

In a report released on the 30th (local time), Morgan Stanley downgraded its investment ratings for Chinese EV battery maker CATL and Samsung SDI to 'underweight.' Samsung SDI's target price was lowered from 570,000 KRW to 550,000 KRW.

Morgan Stanley stated, "EV battery manufacturers face intensified competitive pressure from new entrants, limiting relatively the stock price upside," and added, "We prefer EV OEMs and place greater weight on the corporate value and sustained earnings of infrastructure players."

According to Morgan Stanley, although the global EV market has shown an average annual growth rate of 20% over the past decade, the profitability of battery manufacturers has not kept pace. Battery manufacturers have focused on increasing sales scale and market share, but as competition overheats, profitability has weakened. On the other hand, EV OEMs and battery parts suppliers are ultimately generating profits.

Morgan Stanley forecasted, "Significant competitive pressure from new entrants in the EV battery market is inevitable, accelerating battery price declines, and (the profits lost from price declines) will eventually penetrate the EV market, leading to earnings and high margins."

Due to these factors, battery parts suppliers are expected to see a 65% increase in return on equity (ROE) by 2025, while battery manufacturers are projected to experience a 15% decline.

Morgan Stanley pointed out, "OEMs and battery parts suppliers have the advantages of being neutral to technological changes, having high entry barriers, and possessing service execution capabilities, whereas battery manufacturers are already facing technological disruption and overheated competition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)