Low Returns and IRP Switching Impact

Default Option Introduction Signals Major Changes

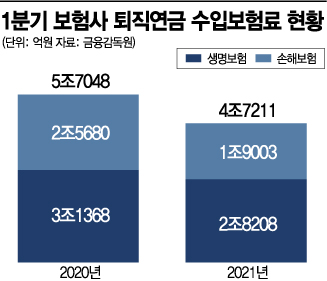

[Asia Economy Reporter Oh Hyung-gil] The insurance industry is experiencing a continued outflow from retirement pensions. In the first quarter alone this year, retirement pension premium income decreased by nearly 1 trillion KRW compared to last year.

Despite last year's stock market boom, the low returns have accelerated the capital outflow. Discussions on the introduction of the default option system for retirement pension pre-designated management have also subsided but could resume at any time, increasing anxiety within the insurance industry.

According to the insurance industry on the 31st, the retirement pension premium income of insurance companies in the first quarter was 4.7211 trillion KRW, down about 983.7 billion KRW from 5.7048 trillion KRW in the same period last year. Life insurance companies recorded 2.82 trillion KRW, and non-life insurance companies 1.9 trillion KRW, decreasing by 10.0% and 26.0%, respectively.

Since most retirement pensions are accumulated at the end of December, the first quarter results are not absolute, but the downward trend continues this year following last year. Last year, life insurers collected 22.5528 trillion KRW in retirement pension premium income, down 2.0859 trillion KRW (8.5%) from the previous year. Non-life insurers recorded premium income of 16.1131 trillion KRW, an increase of 6.9%.

Insurance companies analyze that the outflow is occurring because retirement pension returns were relatively low despite last year's stock market boom.

According to the Financial Supervisory Service, as of the first quarter, the highest retirement pension return among insurance companies was Kyobo Life Insurance's Defined Benefit (DB) plan, with a return of 3.31%. Samsung Life Insurance (2.14%) and Mirae Asset Life Insurance (2.05%) also recorded returns in the 2% range.

On the other hand, most insurers such as KDB Life Insurance (0.86%), Samsung Fire & Marine Insurance (1.66%), Tongyang Life Insurance (1.74%), and DB Insurance (1.79%) showed poor returns in the 1% range.

The average return for insurance companies based on DB plans was 1.91%, higher than the bank return of 1.53% but lower than the securities firms' return of 2.84%. The low returns are attributed to the continued low-interest-rate environment and the high proportion of principal-guaranteed products included.

Yeouido Stock Exchange District

Yeouido Stock Exchange District

In addition to the poor returns, the impact of switching Individual Retirement Pensions (IRP) was significant. The securities industry’s move to eliminate IRP fees proved effective in competition. Samsung Securities, Mirae Asset Securities, Shinhan Investment Corp., Korea Investment & Securities, Daishin Securities, and Yuanta Securities all eliminated IRP fees.

As a result, out of the total IRP accumulated funds of 38.3385 trillion KRW, only about 3 trillion KRW is accumulated with insurance companies.

There are concerns that another major shift may occur in the insurance retirement pension market depending on the outcome of the default option introduction discussions currently underway in the National Assembly’s Environment and Labor Committee.

The default option is a system where Defined Contribution (DC) retirement pension subscribers who do not provide specific management instructions are automatically invested in pre-agreed qualified investment products.

The ruling party has proposed operating the default option as a performance-based dividend type to improve the low returns of retirement pensions. However, the insurance industry opposes this, citing the possibility of principal loss. On the 24th, the amendment to the Employee Retirement Benefit Security Act, which included the introduction of the retirement pension default option, was not discussed in the Environment and Labor Committee’s Employment and Labor Law Review Subcommittee, making the passage of the bill in the first half of the year uncertain.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)