Report on the Regulatory and Supervisory Directions for Virtual Assets by the Korea Institute of Finance

[Asia Economy Reporter Park Sun-mi] A suggestion has been made that it is necessary to strengthen the qualification requirements for virtual asset service providers to enhance transparency and soundness when regulating and supervising the virtual asset market.

According to the 'Direction of Virtual Asset Regulation and Supervision' report by the Korea Institute of Finance on the 31st, the only international consensus reached in discussions related to virtual asset regulation and supervision so far is the FATF (Financial Action Task Force) guidelines, which strengthen the responsibilities of service providers in relation to anti-money laundering and counter-terrorism financing.

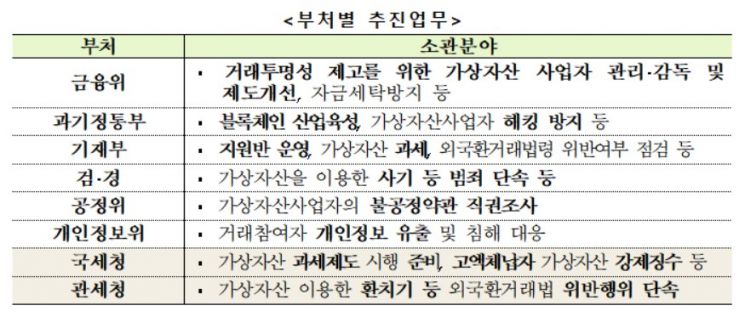

Based on this, major countries are responding by applying existing financial laws to virtual assets or utilizing the regulatory authorities' rule-making powers, and are also considering legislation to establish new regulatory frameworks. The Korean government also announced the 'Virtual Asset Transaction Management Plan' on the 28th, designating the Financial Services Commission as the supervisory authority for virtual asset service providers.

Researcher Lee Sun-ho said, "The number of investors participating in the virtual asset market is rapidly increasing, and concerns about various social problems are being raised, so measures to protect investors and other market participants must be promptly prepared." He added, "First, to enhance the transparency and soundness of the virtual asset market, it is necessary to thoroughly crack down on illegal activities such as manipulating virtual asset prices through the dissemination of false information and to strengthen the qualification requirements for virtual asset service providers."

In this regard, he emphasized the need to transparently disclose whitepapers issued when virtual assets are launched so that market participants can accurately evaluate the value of virtual assets. He stated that it is necessary to specifically regulate the essential contents and format that must be included in the whitepaper, and to establish a system that holds issuers and service providers accountable if the business progress of virtual asset service providers does not proceed as stated in the whitepaper. He explained, "Although such regulatory strengthening will reduce the number of coins, it is a fundamental system because it can prevent fraud through multi-level marketing or false service providers."

Researcher Lee also stressed that not only clearly designating the supervisory authority responsible for virtual asset-related regulations but also organic cooperation among related ministries is very important. Because virtual assets have various characteristics, even if a regulatory supervisory authority is designated, regulation and supervision cannot be smoothly conducted without cooperation from related ministries. He said, "Since virtual assets are traded globally, a whole-of-government response and a solid international cooperation system are also necessary."

Regarding taxation on virtual assets, he explained, "It is reasonable to tax profits from virtual asset investments," adding, "Even income earned from illegal activities is subject to taxation as other income in principle, so whether virtual asset transactions occur within the legal framework only changes the nature of the income, but it is clear that such income is subject to taxation."

Furthermore, he stated that regulation and supervision of the virtual asset market should not become an obstacle to fostering future industries related to digital innovation and digital transformation. He urged, "It is difficult to predict the future direction of virtual asset development, and it is not easy to gauge the positive impact that new technologies related to virtual assets, such as blockchain, will have on future industries. Since blockchain technology is also showing signs of creating new value in generally acceptable ways, such as NFTs (Non-Fungible Tokens), it is necessary to carefully monitor market trends and develop necessary policies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)