Automobile Stocks Hesitate Amid Semiconductor Shortage and External Factors

Production Normalization Underway... US Investments and Achievements Highlighted

The Ioniq 5 is displayed at Hyundai's booth at the 19th Shanghai Motor Show, which opened on the 19th of last month at the National Exhibition and Convention Center (NECC) in Shanghai, China. [Image source=Yonhap News]

The Ioniq 5 is displayed at Hyundai's booth at the 19th Shanghai Motor Show, which opened on the 19th of last month at the National Exhibition and Convention Center (NECC) in Shanghai, China. [Image source=Yonhap News]

[Asia Economy Reporter Minwoo Lee] External factors such as the shortage of automotive semiconductors, rising costs, and the used car market are leading to sluggish stock prices in automobile-related stocks. However, during this process, deferred demand in the automotive industry has been accumulating due to a supply shortage lasting two consecutive years. It is analyzed that once the shortage of automotive semiconductors gradually eases and production normalizes, strong demand will be absorbed, leading to improved profitability.

On the 30th, Shinhan Financial Investment judged that this background makes it the right time to increase the weighting in automobile industry-related stocks.

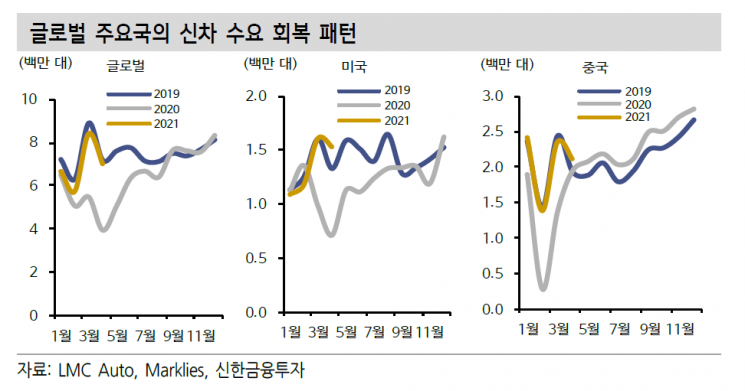

Imbalance Started by the Impact of COVID-19... Demand Accumulated for Two Years

Since the second half of last year, automobile growth was qualitatively possible due to the impact of COVID-19. As supply decreased amid fears of COVID-19 and demand recovered, a supplier's market was formed. Despite the 'surprise earnings' of finished car manufacturers, the outlook for this year was conservative. Overall capital expenditure (Capex) in the automobile industry increased, but most of it was in preparation for future car industries such as electric vehicles and autonomous driving. Investment related to existing internal combustion engines significantly decreased.

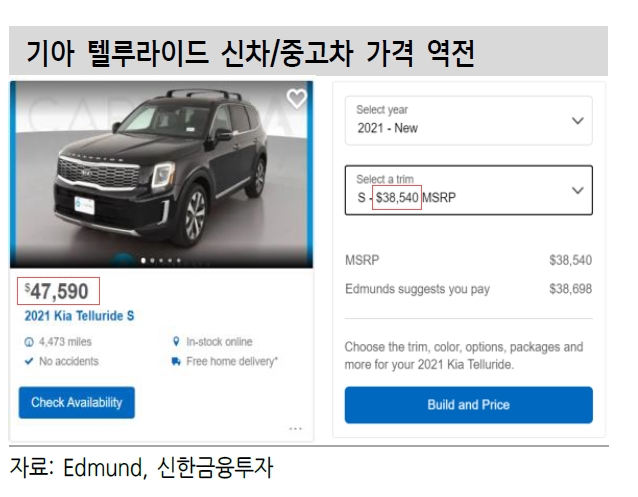

Accordingly, the shortage of automobile supply worsened this year. Senior researcher Yongjin Jung of Shinhan Financial Investment explained, "A clear indicator to observe the supply-demand imbalance in the automobile market is the price of used cars," adding, "In April this year, the US Consumer Price Index (CPI) rose by +4.2%, exceeding expectations, with more than 30% of the increase contributed by the rise in used car prices."

Due to the supply shortage continuing for two consecutive years, deferred demand in the automobile industry has accumulated. Shinhan Financial Investment analyzed that despite this, the overall poor stock returns in the automobile sector are due to external factors determining automobile production (supply), such as COVID-19 quarantine measures last year and the automotive semiconductor shortage this year. Another cause cited is that the benefits of deferred demand are being absorbed not by finished car manufacturers but by distribution channels or used car companies.

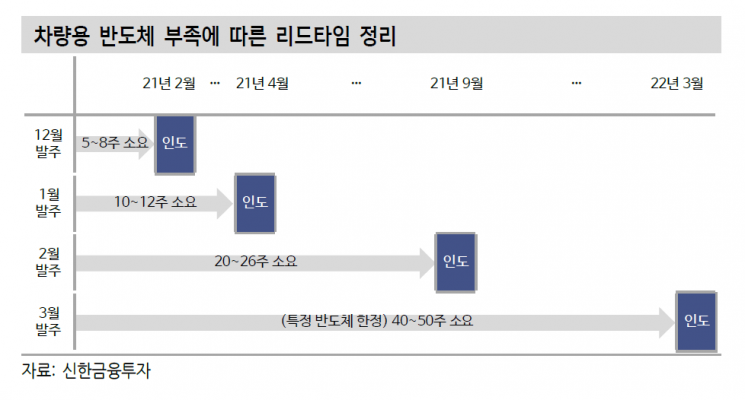

Production Normalization is Key... "Resolution of Automotive Semiconductor Shortage"

It is analyzed that production normalization is necessary for finished car manufacturers to absorb the added value generated from deferred automobile demand. Ultimately, resolving the automotive semiconductor shortage is crucial. The shortage is expanding across various fields such as power semiconductors and SSD controllers. To secure normal inventory even for custom semiconductors required for automobile options, foundries need to release additional production capacity. Researcher Jung explained, "If additional capacity from TSMC, the world's largest foundry in Taiwan, is released in June to July, the urgent issue can be resolved," adding, "However, concerns about production disruptions due to the recent power outage in Taiwan appear to have been unfounded."

The full-scale rebound is expected to begin from the point of production normalization. Researcher Jung forecasted, "Concerns such as semiconductor shortages, rising costs, and labor cost burdens have diluted expectations for deferred demand," adding, "Once the fear of production cuts disappears, these concerns will be offset, and profitability improvement based on strong demand is expected."

"Hyundai Motor Group's Domestic Achievements to be Revealed, Including US Investment Announcement"

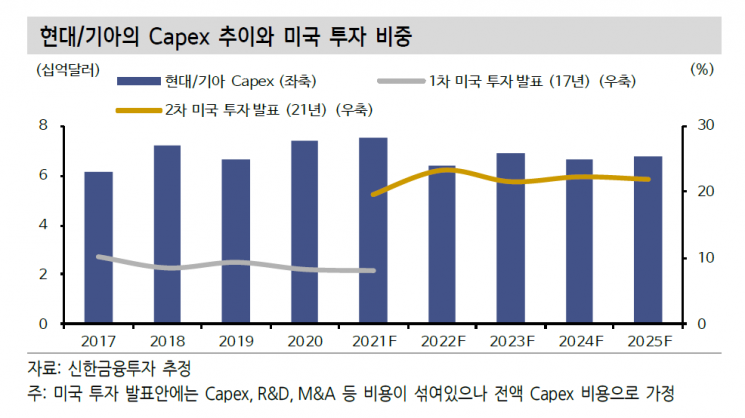

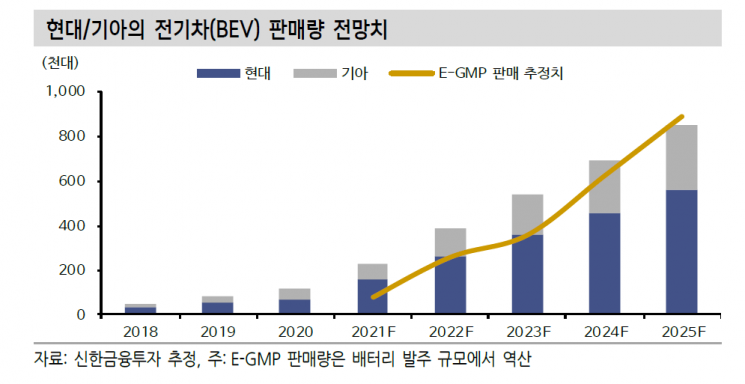

External adverse factors are also overshadowing Hyundai Motor Group's domestic achievements. The successful launch of the electric vehicle-exclusive platform E-GMP and the announcement of additional investment in the United States are representative examples. The next-generation electric vehicle Ioniq 5, developed on the E-GMP platform, is scheduled for an early release in the US during the third quarter. The early US launch of E-GMP models coincides with expanded US investment. Researcher Jung stated, "In 2017, under former US President Donald Trump's administration, Hyundai Motor Group announced and executed a $3.1 billion investment plan over five years, and recently confirmed a strengthened investment plan of $7.4 billion (approximately 8.25 trillion KRW) over five years," adding, "The proportion of US capital expenditure is expected to more than double compared to before."

Therefore, in the production normalization phase, internal factors such as product improvement of Hyundai and Kia, response to future cars, and expansion of capital investment are expected to act as catalysts for stock price increases. The top beneficiaries identified are Kia, Hyundai Motor, Mando, and Hyundai Wia.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.