[Asia Economy Reporter Lee Seon-ae] Although the KOSPI has not broken out of a narrow box range due to concerns about monetary policy, advice has emerged that it is now a time to respond by sector from the perspective of economic normalization. Considering the employment conditions, tapering is unlikely to materialize immediately, but it should be taken into account that economic normalization is already underway.

On the 29th, IBK Investment & Securities advised that until recently, sectors benefiting from inflation and rising interest rates such as raw materials, freight, and others (materials, industrials, financials) were highlighted, but attention should also be paid to face-to-face service sectors (retail, hotels, leisure) where expectations for economic reopening have been less reflected in stock prices.

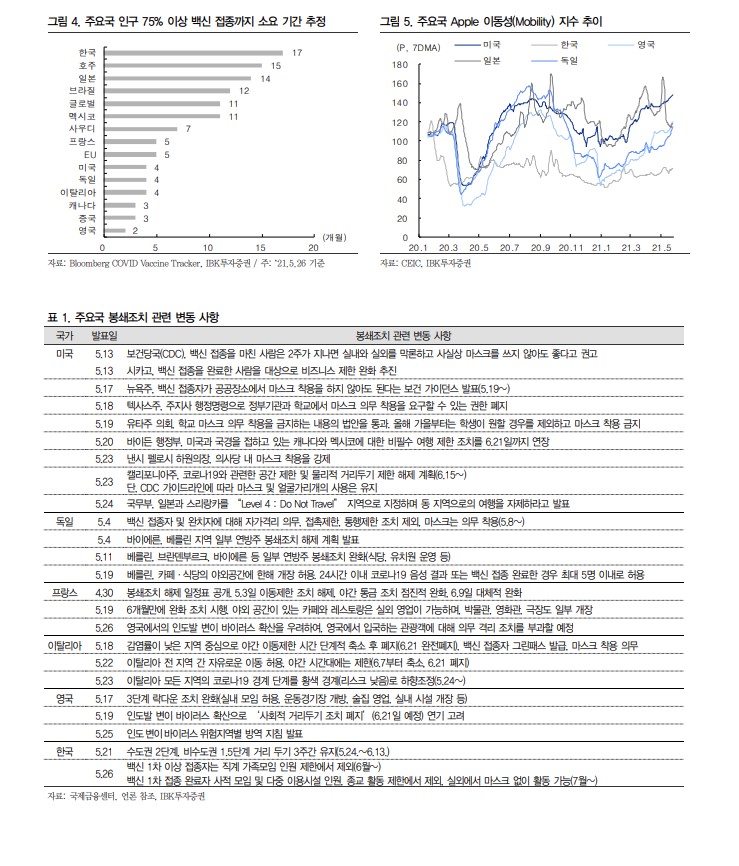

Since the beginning of the year, sectors related to reflation have shown relative superiority due to expectations of economic reopening. In particular, the rise of industrials (transportation, shipbuilding), materials (steel), and financials (banks), which benefit from inflation and rising interest rates such as raw materials and freight costs, has been remarkable. On the other hand, sectors benefiting from economic reopening and recovery in face-to-face service demand such as retail, hotels, and leisure have only slightly exceeded pre-COVID-19 stock price levels. Although the reflation trade phase is expected to continue, since some price burdens have accumulated, selective responses focusing on sectors where economic reopening expectations are less reflected are necessary.

The relatively slow recovery of face-to-face service sectors is likely due to uncertainties about domestic COVID-19 control and sluggish domestic demand. In fact, given the current vaccination speed in Korea, it is estimated that achieving herd immunity will take more than four times the time required in the United States. However, if the direction of expanding vaccination and easing social distancing does not change, despite the slow pace being a problem, stock prices can preemptively reflect expectations for normalization of face-to-face service demand.

Researcher Ahn So-eun of IBK Investment & Securities said, "Looking at the trend of U.S. consumer spending by category after COVID-19, dining out, lodging, leisure, and transportation services have hardly recovered under lockdown measures, which means that once lockdowns are lifted, there could be concentrated pent-up and deferred consumption in these sectors." She added, "The domestic trend is expected to be not much different, and among the Bank of Korea's consumer sentiment survey items, the expenditure outlook (next 6 months) has recently shown a sharp rise in dining out, travel, and culture/entertainment sectors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)