Leading Business Operator Management, Supervision, and System Improvement Efforts

[Asia Economy Reporter Park Sun-mi] The Financial Services Commission (FSC) has been appointed as the lead agency for managing and supervising virtual currency (virtual asset) operators and improving related systems to enhance transaction transparency.

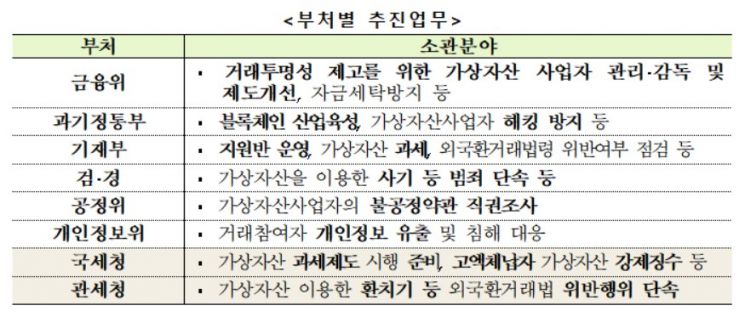

According to the "Virtual Asset Transaction Management Plan" announced by the government on the 28th, the FSC will take the lead in managing and supervising operators to improve transaction transparency and work on system improvements, while reinforcing related organizations and personnel. The Ministry of Science and ICT will be responsible for blockchain technology development and industry promotion.

The FSC, together with the Financial Supervisory Service (FSS) and the Ministry of Science and ICT, will provide consulting on reporting requirements and necessary improvements to encourage virtual asset operators to promptly submit their reports before the reporting grace period ends on September 24. Upon receipt of reports from virtual asset operators, the FSC plans to conduct swift reviews to facilitate a rapid market restructuring centered on early reporters. To enable market participants to prepare for possible closures of virtual asset operators, the FSC will continuously publicize the status of report applications and approvals, as well as transaction precautions.

After September 25, management and supervision of reported operators will be strengthened, and anti-money laundering obligations will be strictly enforced to ensure transaction transparency. Basic obligations such as customer identification, suspicious transaction reporting, establishment of internal control standards, and provision of information during virtual asset transfers will be inspected, with penalties such as fines and business suspension imposed for non-compliance. Reports will be rejected or canceled if real-name verified deposit and withdrawal accounts are not opened.

Officials from related ministries participating in the meeting agreed on the need to further enhance transaction transparency amid the surge in virtual asset transaction participants and to strengthen prevention of damages caused by illegal activities such as fraud and unauthorized fundraising.

The FSC has identified about 60 virtual asset trading operators through the FSS, banks, and private data. Although no operators have yet had their reports approved, 20 companies have obtained ISMS (Information Security Management System) certification, and among them, four operate real-name verified deposit and withdrawal accounts. However, even these four companies must receive an evaluation from banks and obtain a real-name verified deposit and withdrawal account confirmation letter to comply with the Special Act on Reporting and Use of Specific Financial Transaction Information (Special Act on Virtual Assets).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)