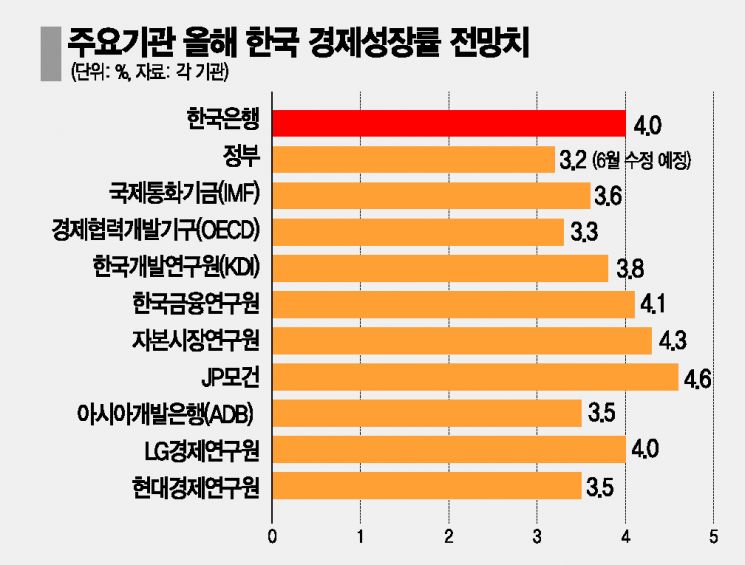

The Bank of Korea Significantly Raises This Year's Economic Growth Forecast to 4%

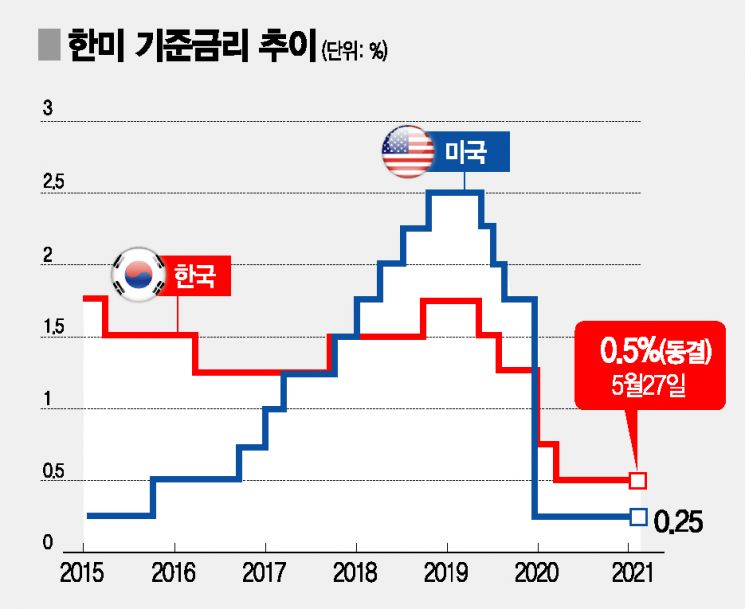

Base Interest Rate Held Steady at 0.50% per Annum... Possibility of Increase Within the Year

Growth Forecast Raised to 4% Due to Faster-than-Expected Economic Recovery

Could Be Higher Considering Supplementary Budget

Initial Expectations of Rate Hike Next Year... Early Hike Theory Gains Momentum Amid Economic Recovery

Need for Household Debt Management Response

The Issue Is Speed... Gradual Increase Needed Considering Household Debt

"If Raised Too Late, Market Shock Cannot Be Avoided"

[Asia Economy Reporters Eunbyeol Kim, Sehee Jang] The Bank of Korea's significant upward revision of this year's economic growth forecast to 4.0% on the 27th reflects the fact that not only exports and facility investment but also domestic demand such as private consumption are recovering faster than expected. If the growth rate reaches 4.0% as the Bank of Korea expects, the annual growth rate will be the highest in 11 years since 2010 (6.8%). Among experts, there are forecasts that the actual economic growth rate could be even higher, considering the distribution of COVID-19 vaccines and the effects of the government's supplementary budget.

Professor Donghyun Ahn of Seoul National University's Department of Economics said, "Lockdowns in the US and Europe have almost been lifted, and herd immunity is becoming visible," adding, "The US economy is rapidly recovering centered on consumption, which will increase our exports, making 4% growth seem possible." He continued, "The US is likely to attempt tapering (reduction of bond purchases) before raising interest rates this year, but there is a high possibility that we will raise rates first," and "The timing of the hike could be moved up to the third quarter." Professor Inho Lee of Seoul National University also predicted a 0.25 percentage point rate hike in the second half of the year and said, "Domestic demand could be further stimulated with the introduction of vaccine incentives."

Possibility of Base Rate Hike in the Second Half Gains Weight

As the economic growth forecast was set higher than the initially expected high 3% range, the argument for an early base rate hike is expected to gain momentum. The Bank of Korea also raised this year's inflation forecast to 1.8%. Many had expected a rate hike to be possible next year, but the possibility of an earlier timing has increased.

Experts evaluated that there is a possibility of raising the base rate around the end of this year or as early as the third quarter. The rapid pace of economic rebound and increased inflationary pressure provide grounds for raising rates. There is advice to proactively raise rates in advance, considering the household debt, which has ballooned to a record high (1765 trillion won). This is to control the pace of debt increase and prevent a sudden outflow of funds from real estate and stocks, thereby reducing the shock to economic agents.

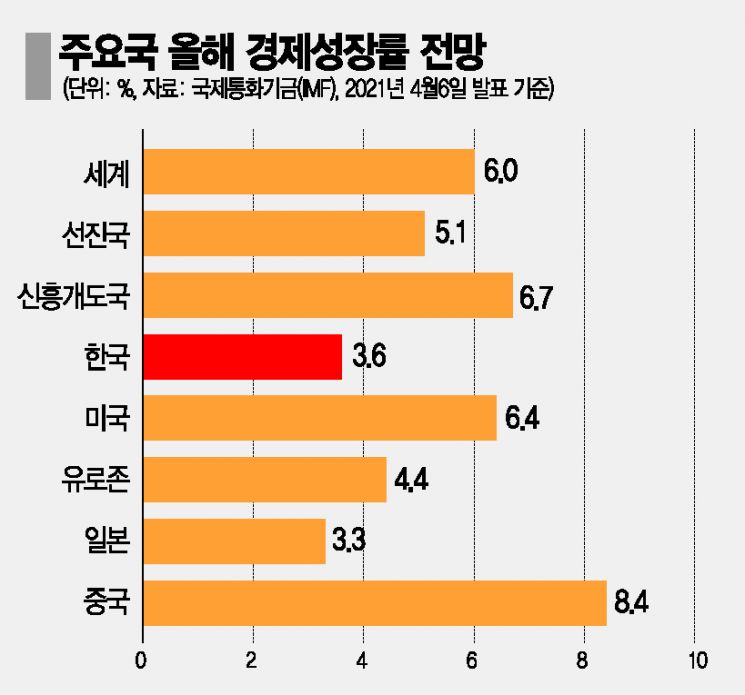

In particular, according to the International Monetary Fund (IMF) forecast, the global economic recovery is steep in the US (6.4%), Eurozone (19 countries using the euro, 4.4%), and China (8.4%). In the US, there was also a view that if overheating is detected, not only tapering but also an earlier rate hike could be implemented. Professor Inho Lee pointed out that US housing prices recorded the highest increase in 15 years, evaluating that "the effects of liquidity injection are beginning to appear." He also said, "If the US raises its base rate sharply, we will have no choice but to follow (considering capital outflows)." Professor Soyoung Kim of Seoul National University also saw a possibility that the US would raise rates immediately if it detects overheating signals through inflation indicators.

Missing the Timing of Rate Hike Could Cause Greater Shock... Must Consider Money Movement

The timing of the rate hike is expected to become even more important. South Korea has often waited until the US raised rates after a crisis and then followed belatedly. However, this time, with household debt ballooning to a record high, a different approach is needed. If rates are raised sharply too late, the interest burden could become too heavy, causing a ‘reverse money move’ where funds exit risky assets.

There are forecasts that a sharp rate hike could severely damage the real estate market. South Korea's household debt has a high proportion of mortgage loans, and the variable interest rate portion reaches 70%. If the interest burden becomes excessively large when rates rise, it could turn into a selling wave, causing housing prices to plummet. In the late 1980s, Japan raised rates belatedly, which led to a rapid burst of the real estate bubble and a decade-long recession. The three Nordic countries also experienced a financial crisis after missing the timing of rate hikes.

However, the securities industry still considers a rate hike premature. Analyst Gong Dongrak of Daishin Securities expects the Bank of Korea's rate hike timing to be in the second half of next year and predicts that tightening will be carried out cautiously as many sectors have not yet recovered from the COVID-19 shock.

Professor Jinil Kim of Korea University’s Department of Economics said, "(Market shock) depends on how quickly rates are raised," adding, "Some experts argue that it is better to signal as soon as possible and then raise rates slowly." Professor Soyoung Kim also said, "If rates are raised too late, they will have to be raised sharply, and market shocks cannot be avoided."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)