Despite Premium Increase, Risk Loss Ratio at 132.6%

[Asia Economy Reporter Oh Hyung-gil] In the first quarter of this year, non-life insurance companies incurred a loss of approximately 700 billion KRW in the actual expense medical insurance sector.

Insurance companies selling actual expense insurance have implemented premium increases to reduce the loss ratio, but it remains difficult to recover the losses.

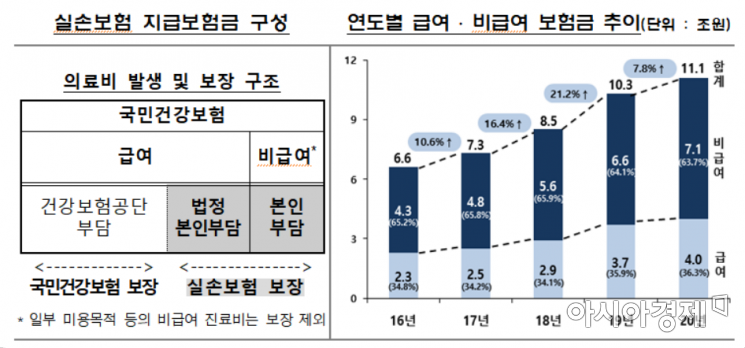

According to 13 non-life insurance companies holding actual expense insurance contracts on the 27th, the 'incurred loss amount' for individual actual expense insurance claims in the first quarter of this year was recorded at 2.729 trillion KRW, a 6.7% increase compared to the first quarter of last year.

Although they collected 2.0573 trillion KRW in 'risk premiums'?the funds for claim payments excluding business operating expenses?from policyholders, which is 10.4% more than the same period last year, it was far from sufficient to cover the claims.

As a result, actual expense insurance recorded a loss of 686.6 billion KRW in the first quarter, a level similar to the 689.1 billion KRW loss in the first quarter of last year.

The ratio of claim payments to risk premiums, known as the risk loss ratio, reached 132.6%. Although premiums for the 'second-generation' standardized actual expense insurance products (sold from October 2009 to March 2017) increased by 8.2% to 23.9% depending on the company (non-life insurers) in January, the risk loss ratio has not decreased.

An industry insider said, "Despite premium increases, the loss ratio and loss amount for actual expense insurance have not changed significantly from last year," expressing concern that "there is a high possibility that the non-life insurance industry will incur losses exceeding 2 trillion KRW again this year."

Last year, the 13 non-life insurance companies recorded a loss of 2.3695 trillion KRW in actual expense insurance, with a risk loss ratio of 130.5%.

Actual expense insurance premiums are being burdened by many policyholders due to excessive medical use by some subscribers. The top diseases in actual expense insurance claims are musculoskeletal disorders (herniated discs, back pain, shoulder lesions) and ophthalmic diseases (cataracts).

Non-life insurers are expected to implement further premium increases for actual expense insurance. Recently, at the first quarter earnings presentation and investor relations (IR) meetings, companies such as Samsung Fire & Marine Insurance announced that actual expense insurance premiums for next year would be raised at levels similar to this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.