[Sejong=Asia Economy Reporter Son Seonhee] An analysis has revealed that South Korea's effective tax rates on real estate holding and transaction taxes relative to its gross domestic product (GDP) are lower than those of the eight major member countries of the Organisation for Economic Co-operation and Development (OECD).

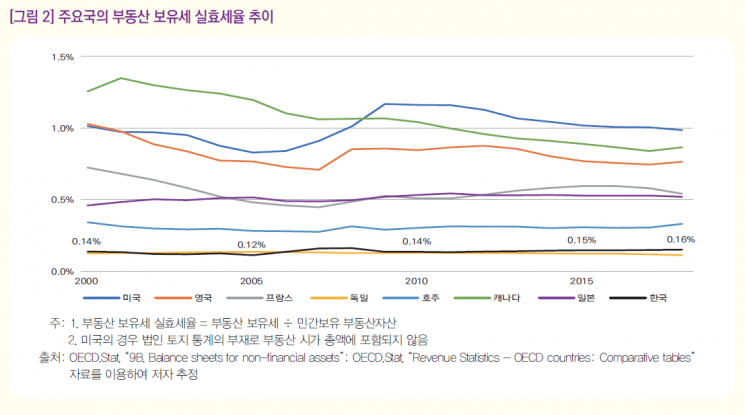

On the 21st, Yoon Younghoon, a visiting researcher at the Korea Institute of Public Finance, stated in the report titled "Comparison of Real Estate-Related Tax Burdens Among Major Countries" that "As of 2018, South Korea's effective tax rate on real estate holding relative to GDP was 0.16%, which is very low compared to the eight major OECD countries."

The effective tax rate on real estate holding is calculated by dividing real estate holding taxes by privately held real estate assets. Since real estate transaction turnover rates and concentration vary by country, Yoon explained that using the effective tax rate is appropriate for comparing the burden level of transaction taxes. Holding taxes include property tax, comprehensive real estate tax, local resource facility tax (real estate portion), and resident tax (property portion).

According to the report, at the same point in time, the United States had an effective holding tax rate of 0.99%, the United Kingdom 0.77%, and Canada 0.87%, ranking higher. The average for the eight major OECD member countries was 0.54%.

When comparing real estate holding taxes relative to GDP, South Korea was 0.82%, which did not reach the OECD average of 1.07%.

Additionally, the effective tax rate on transaction taxes, which are imposed once each time real estate is traded, was estimated at 3.9% as of 2017. This is lower than the United Kingdom's 4.7% and France's 5.2%. However, the report noted that this estimate is based on differences in housing transaction turnover rates and real estate concentration by country, and there are limitations in comparing all eight major OECD countries.

Regarding inheritance and gift taxes relative to GDP, as of 2018, South Korea was 0.39%, lower than France (0.61%) and Japan (0.43%), but higher than the United Kingdom (0.25%), Germany (0.20%), and the United States (0.14%). However, since the proportion of real estate in the taxable property value subject to inheritance and gift taxes is 65% and 57% respectively, it is difficult to accurately estimate real estate-related tax revenues.

Researcher Yoon pointed out, "Caution is needed when using OECD property tax statistics for cross-country comparisons of real estate-related tax burdens. While real estate holding and transaction taxes are appropriate for country-level analysis, inheritance and gift taxes and capital gains taxes include not only real estate but also financial and other assets, making cross-country comparisons inappropriate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.