Financial Services Commission Focuses on Toss Bank Approval... "No Progress or Plans"

Second Half Banking Competition Likely to Be First Hurdle

Challenges Include Internal Financial Groups and Political Opposition

[Asia Economy Reporter Kim Jin-ho] Major domestic financial holding companies have taken the first step toward establishing internet-only banks, but rough roads are expected ahead. They submitted a statement of opinion arguing that "competition is needed in internet finance as well," but financial authorities have decided not to review it for the time being. Even if discussions on establishment begin in the future, there are many hurdles to overcome, from internal opposition within financial holding affiliates to persuading the political circles.

On the 21st, a senior official from the Financial Services Commission said, "At present, there is no progress or plan regarding the financial holding companies' push to establish internet banks," adding, "This issue is something to be observed over time."

The reason why financial authorities have not taken any stance on the financial holding companies' push to establish internet banks lies in the upcoming bank industry competition assessment scheduled for July. The bank industry competition assessment is a procedure that reviews the overall banking industry and licensing policies. The results serve as a policy basis for financial authorities to determine whether additional internet bank licenses are necessary. If the assessment concludes that "new entrants are needed," discussions on establishing internet banks by financial holding companies could gain momentum; however, if the conclusion is that "there are already enough," the issue is likely to be shelved.

Another background factor is that the licensing of the third internet bank, Toss Bank, is a priority. Toss Bank is currently awaiting final approval from the Financial Services Commission, aiming to launch in July. A financial authority official said, "Since the approval of Toss Bank is being prioritized, there is no capacity to review the establishment of internet banks by financial holding companies at the moment," adding, "Discussions are expected to take place only after Toss Bank's launch is completed and the bank industry competition assessment results come out by the end of this year."

Challenges to Overcome: Political Opposition and Internal Resistance

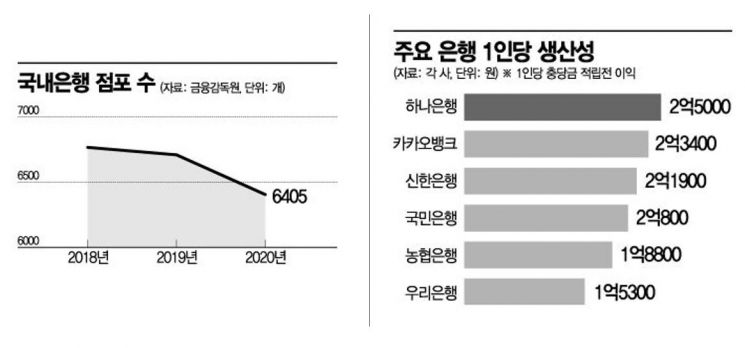

Even if establishment discussions become active based on the competition assessment results, many hurdles remain. Internal opposition within financial holding affiliates is a representative challenge. In particular, the financial labor union is concerned that the entry of financial holding companies into internet banking will accelerate the closure of offline branches, creating job insecurity. They argue that since existing banks already implement all functions of internet banks, dualizing the organization could have adverse effects. A financial industry insider stated, "If internet banks are promoted, manpower and resources will be concentrated there, which would effectively divide the organization into first and second teams, potentially causing relative deprivation among members."

Political opposition is also expected to be strong. There are already strong criticisms that power is concentrated in financial holding companies, and it is anticipated that they will not allow the establishment of internet banks. A financial holding company official said, "If the financial authorities permit it, there would be no reason to refuse," but added, "However, since the purpose of the Internet Bank Special Act is focused on the entry of non-financial major shareholders into innovative finance, there is a strong view that the political circles will challenge the 'justification' and ultimately block it."

Meanwhile, on the 11th, the Korea Federation of Banks held a meeting of strategic department heads from major commercial banks and conveyed the holding companies' intention to establish internet banks to the Financial Services Commission. The statement reportedly included the positions of eight financial holding companies (KB, Shinhan, Hana, Woori, NH Nonghyup, BNK, JB, and DGB Financial Group), overseas cases, expected effects, and justifications. A Korea Federation of Banks official said, "We are currently waiting for the official stance of the financial authorities," adding, "We are focusing first on the bank industry competition assessment to be conducted in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)