Prospects for Reappointment Decision in Second Half

Federal Reserve Board May Replace 3 Seats Including Vice Chair

Market Uncertainty Grows, Monetary Tightening Timing May Be Delayed

[Asia Economy Reporter Minwoo Lee] As market attention focuses on inflation, all eyes are on the timing of the U.S. Federal Reserve's (Fed) tapering (reduction of asset purchases). Analysts suggest that the reappointment of Fed Chair Jerome Powell, which will be decided in the second half of this year, should be closely watched.

Uncertainty Increases if Powell Fails Reappointment... Tightening May Be Delayed

On the 19th, Korea Investment & Securities identified the reappointment of Chair Powell as a variable that the market has not yet factored in. Powell's term is scheduled to end in February 2022. Since former Presidents Donald Trump and Barack Obama both announced their successors between October and November, it is highly likely that Powell's reappointment will be decided at least by the second half of this year.

The probability of Powell's reappointment is currently high. In April, a survey conducted by the U.S. economic media CNBC among financial officials (Cnbc Fed Survey) showed a 76% chance of Powell's reappointment. It is also reported that senior officials within the current U.S. government economic team view Powell positively.

Nevertheless, the possibility of a chair replacement cannot be ignored. Some progressive factions within the Democratic Party have expressed dissatisfaction with the Fed. Their grievances include ▲ deregulation of the financial sector since 2018 ▲ passive response to climate change ▲ insufficient efforts to resolve racial inequality. Powell's affiliation with the Republican Party is also a negative factor.

Seonggeun Kim, a researcher at Korea Investment & Securities, explained, "If Powell fails to be reappointed, a more dovish candidate (supporting monetary easing) will likely be nominated, which could strengthen bets on inflation," adding, "Replacement would increase policy uncertainty and could delay the timing of monetary tightening."

Potential Chair Candidates Should Be Reviewed... Possibility of Entering Fed as a Board Member

Lael Brainard, a member of the Board of Governors of the Federal Reserve System, is giving a lecture at the John F. Kennedy School of Government, Harvard University, on March 1, 2017. [Image source=Yonhap News]

Lael Brainard, a member of the Board of Governors of the Federal Reserve System, is giving a lecture at the John F. Kennedy School of Government, Harvard University, on March 1, 2017. [Image source=Yonhap News]

Therefore, there is an analysis that it is necessary to review potential next Fed chair candidates. Researcher Kim pointed to Fed Governor Lael Brainard in terms of financial sector deregulation. Brainard is more dovish than Chair Powell and opposes deregulation of the financial sector, which is a major advantage. In environmental aspects, Sarah Raskin, a Duke University professor and former Treasury Deputy Secretary, is gaining attention. Former Deputy Secretary Raskin specializes in economic resilience and sustainable finance. There have been predictions that she might oversee ESG (Environmental, Social, and Governance) areas in the Biden administration.

Kim identified the most notable area as efforts to resolve racial inequality. Candidates related to this include William Spriggs, chief economist of the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO), the largest labor union in the U.S., and Raphael Bostic, president of the Federal Reserve Bank of Atlanta. Both are African American, fulfilling the Democratic Party's pursuit of 'enhanced diversity,' and hold active positions on racial equality. Last year, they argued that 'structural racism' embedded in economic models has been expanding the racial wealth gap.

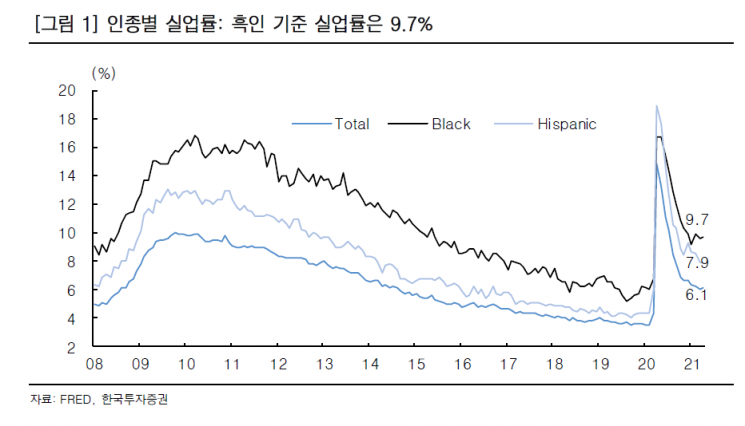

Additionally, there has been a recent argument that to resolve racial inequality, focus should be on unemployment rates by race rather than the general unemployment rate. This is considered a very dovish perspective. The unemployment rates for Black and Hispanic groups have consistently exceeded the overall unemployment rate. In the recently released April employment data, the overall U.S. unemployment rate was 6.1%, while the Black unemployment rate was 9.7% and Hispanic was 7.9%. If monetary policy decisions consider 9.7% instead of 6.1%, the timing of monetary tightening could be further delayed than expected.

Researcher Kim explained, "If a candidate with such tendencies is appointed Fed chair, it would cause a delay in the tightening timing, which could strengthen inflation bets," adding, "The delay in tightening timing also leads to a continued rise in expected inflation." Recently, the U.S. 10-year expected inflation has rapidly exceeded 2.5%, showing an inverse correlation with the market but moving in tandem with the relative strength of cyclical sectors. Uncertainty due to replacement is also increasing. Especially if someone outside the existing Fed is appointed, uncertainty could intensify further.

These candidates could also be nominated as Fed board members even if not appointed chair. Currently, one seat is vacant among the seven-member board. Additionally, Vice Chair Randal Quarles' term ends this October, and Vice Chair Richard Clarida's term ends in January 2022. This means there will be three vacancies on the Fed board excluding the chair position. Researcher Kim said, "Considering this situation, it might be more realistic to reappoint Chair Powell while appointing pro-labor figures to other board positions to satisfy progressive demands," forecasting, "This implies that the Fed's dovish stance could strengthen in 2022 compared to now."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)