[Asia Economy Reporter Lee Seon-ae] An analysis has been raised that the performance momentum and valuation attractiveness of Simtek should be examined.

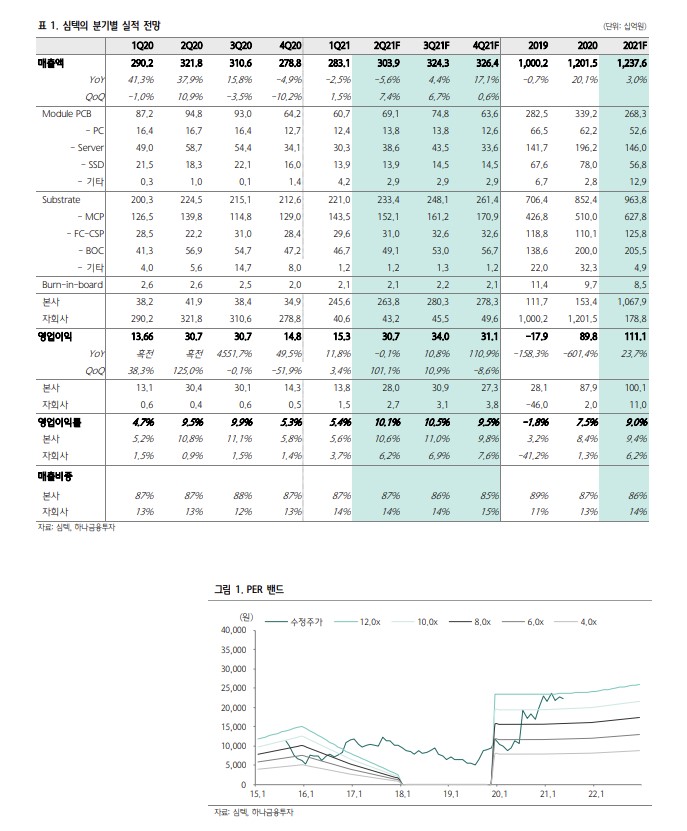

According to Hana Financial Investment on the 19th, Simtek's sales for the second quarter of this year are expected to be 303.9 billion KRW (YoY -6%, QoQ +7%), and operating profit is expected to be 30.7 billion KRW (YoY -0.1%, QoQ +101%). The performance seems to have slowed compared to the same period last year, as last year, due to COVID-19, competitors' factories were shut down, resulting in concentrated reflex benefits. The module PCB division's sales in the first half of 2020 were 182 billion KRW, exceeding the average of 130 billion KRW over the past four years. The first half of this year is estimated to return to normal sales levels at 129.9 billion KRW. For Simtek's investment point, the package substrate is expected to show a solid growth rate of 4% compared to the same period last year, and within that, meaningful profitability is expected due to the expansion of the relatively high value-added MSAP substrate. Accordingly, operating profit is expected to increase significantly compared to the increase in sales from the previous quarter.

Simtek has secured not only short-term performance momentum but also mid- to long-term momentum for the second half of 2021 and beyond 2022. The investment announced last February was a disclosure to supply package substrates to global RF-related semiconductor companies. Due to the expansion of 5G device distribution, demand for RF-related package substrates is rapidly increasing, and this is an expansion to respond to that. The expansion of non-memory sales is a positive event that can catch two rabbits: diversification of customers and front-end industries. Also, due to specification changes in DRAM, GDDR6 and LPDDR5 are ongoing, and DDR5 volume is expected to ramp up in 2022.

Accordingly, Hana Financial Investment maintains its investment opinion of 'Buy' and target price of 30,000 KRW for Simtek.

Kim Rok-ho, a researcher at Hana Financial Investment, emphasized, "In the second quarter, due to production disruptions caused by semiconductor supply shortages, the rarity of companies showing performance increases compared to the previous quarter will stand out," adding, "Simtek, as the leader in package substrates, has secured momentum for expanding sales to global non-memory customers, and its price-to-earnings ratio (PER) based on 12-month forward estimates is only 11.24 times, indicating undervaluation attractiveness. Therefore, it is judged to be a stock that can be held not only in the short term but also in the mid to long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)