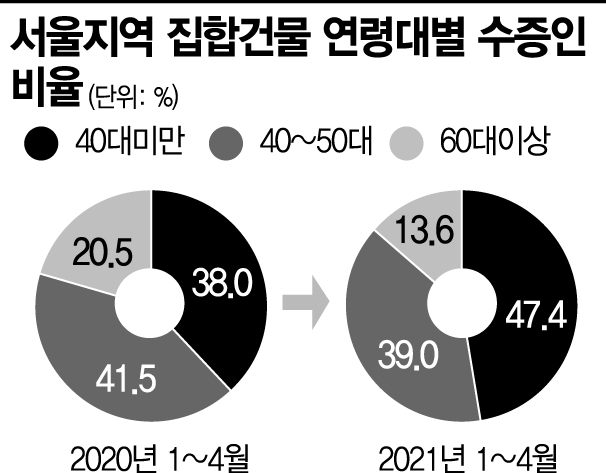

Proportion of Recipients Under 30 from January to April at 47%

Increased by 9.4 Percentage Points Compared to a Year Ago

Advance Gift Transfers to Children as Property Tax Burden Rises

[Asia Economy Reporter Moon Jiwon] This year, about half of the people who received ownership of multi-unit buildings in Seoul through gifts are under their 40s. The age of the donors has also decreased from their 70s to their 60s. This is interpreted as many multi-homeowners preemptively gifting surplus homes to their children to avoid the rapidly increasing property tax burden.

On the 17th, according to an analysis of ownership transfer registration statistics due to gifts of multi-unit buildings in Seoul by Zigbang, the proportion of recipients aged 30 or younger from January to April this year was 47.4%, an increase of 9.4 percentage points compared to the same period last year. Meanwhile, the proportion of recipients in their 40s to 50s and those aged 60 and above decreased by 2.5 percentage points and 6.9 percentage points, respectively, during the same period.

Multi-unit buildings refer to buildings such as apartments, row houses, multi-family houses, officetels, commercial buildings, and shopping malls, where multiple independent sections structurally divided within one building can be used or owned separately.

From 2016 to the first quarter of last year, the highest proportion of recipients by age group was in their 40s to 50s, but from the second quarter of the same year, the proportion of recipients aged 30 or younger rose to the 40% range (43.3%). In particular, in the past month alone, the proportion of recipients aged 30 or younger reached 50.3%, exceeding half.

The age group of donors has also been analyzed to have decreased. From January to April last year, the proportions of donors in their 60s and those aged 70 and above were similar at 32.2% and 32.1%, respectively. However, from January to April this year, the proportion of donors in their 60s increased to 34.0%, while those aged 70 and above decreased to 27.9%. The proportion of donors in their 50s also grew from 21.2% to 24.0%.

It is analyzed that the age groups of donors and recipients have lowered as cases of multi-homeowners choosing gifting increased following the temporary exclusion of multi-homeowners from capital gains tax surcharges in designated adjustment areas until June last year and the government's announcement of the July 10 measures.

Zigbang stated, "With the strengthening of capital gains tax and comprehensive real estate tax for multi-homeowners scheduled for June this year, gifting will continue to increase. However, since many gifts have already been made and expectations for tax relief have arisen after the April re-election, the growth rate will not be greater than last year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)