Financial Authorities Begin Discussing Implementation Plans

Small Businesses Protest "Concentration on Large Firms"

[Asia Economy Reporter Kiho Sung] Ahead of the MyData (Personal Credit Information Verification) service launch scheduled for August, the government’s plan to limit each consumer’s subscription to fewer than five services has emerged as a major issue. Financial authorities argue that storing sensitive personal information in multiple locations increases the risk of data leaks. However, companies operating MyData services strongly oppose this, warning that users may concentrate only on a few large providers.

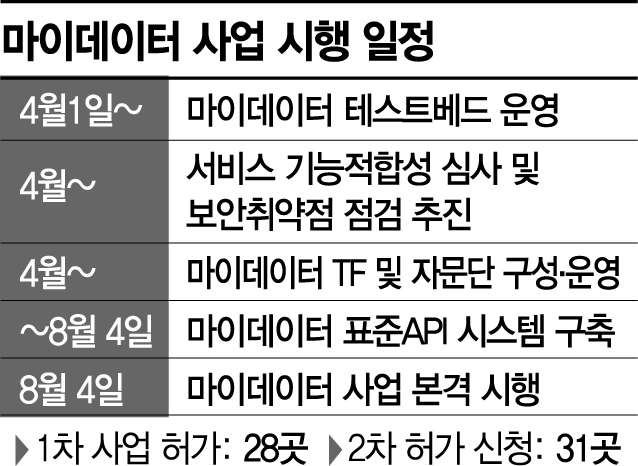

According to the financial industry on the 17th, the Financial Services Commission is expected to coordinate regulatory adjustments through the MyData Task Force (TF) meeting as early as this week. The MyData TF operates separate subgroups for service providers and information providers to ensure effective management. After gathering opinions, representatives from each TF participate to discuss key issues. So far, the TF has focused on topics such as the number of services a consumer can subscribe to, the scope of private certificate acceptance, and whether to display transaction details.

The core issue among these is the limit on the number of services. Financial authorities are considering restricting the number of MyData services per consumer to between three and five. MyData is a service that allows individuals to manage their scattered personal credit information in one place of their choice. Since sensitive credit information is integrated and managed, the authorities believe that limiting the number of services is necessary to reduce the risk of potentially fatal data breaches.

On the other hand, most private companies are opposing this. They are concerned that limiting the number of services will make it difficult for smaller or lesser-known companies to be chosen by consumers.

A senior official from a financial company said, "If the number of service subscriptions is limited, customers will flock to a few large financial companies and big tech firms. Ultimately, a project that started to provide equal opportunities to all providers could end up handing over data and customers only to large companies."

The issue of transaction detail display is also critical. The term "jeogyo," referring to remitter and recipient information, is expected to be excluded from the scope of information provision, which has caused backlash in the fintech industry. If jeogyo is excluded, the date and amount of account transactions can be confirmed, but the transaction counterpart cannot be identified. For example, if A sends 100,000 won to B, it would be displayed as "Sent 100,000 won to (unknown)." A fintech industry representative said, "Currently, many services provide jeogyo information through household account books or deposit/withdrawal management services. If excluded, users will not receive the information they originally had, which could be a regression for the service."

Meanwhile, the previously controversial mandatory use of the joint certificate has recently shifted, with financial authorities reportedly leaning toward allowing private certificates as the integrated authentication method for MyData services.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)