Accounts for 40% of the entire industry

Hanwha Securities leads in year-on-year growth rate

Many complaints about connection delays and system failures

[Asia Economy Reporter Park Jihwan] In the first quarter of this year, Mirae Asset Securities and Korea Investment & Securities accounted for 40% of the total disputes filed in the securities industry.

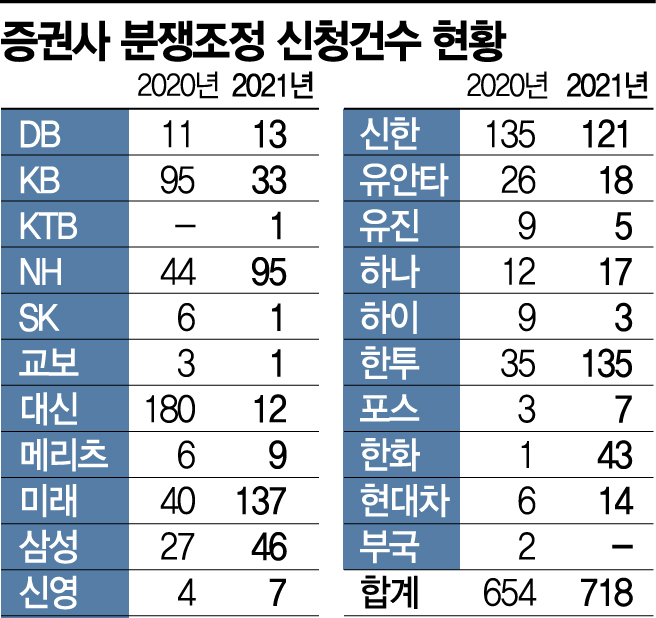

According to the Korea Financial Investment Association on the 17th, the number of dispute resolution applications filed with financial authorities against securities companies until the first quarter of this year (excluding duplicate applications) was 718, a 9.8% increase compared to 654 cases during the same period last year.

Among them, the securities company with the most dispute resolutions was Mirae Asset Securities with 137 cases. This is a 3.4-fold (242.5%) surge compared to 40 cases in the same period last year, accounting for 19.1% of the total dispute resolution applications in the industry. Korea Investment & Securities recorded 135 cases, an increase of 100 cases over one year, representing 18.8%. The dispute resolution applications received by these two companies from customers alone accounted for 40% of the entire industry. They were followed by Shinhan Financial Investment (121 cases, 16.8%), NH Investment & Securities (95 cases, 13.2%), Samsung Securities (46 cases, 6.4%), and Hanwha Investment & Securities (43 cases, 6%).

In terms of growth rate compared to the previous year, Hanwha Investment & Securities showed an overwhelming first place. It had only 1 case until March last year but surged to 43 cases this year. Next were Korea Investment & Securities (286%), Hyundai Motor Securities and Korea Post Securities (133%), and NH Investment & Securities (116%), showing high growth rates. On the other hand, Daishin Securities, which ranked first in dispute resolution cases last year due to the Lime Asset Management redemption suspension incident, drastically decreased from 180 cases last year to 12 cases this year.

Investor complaints mainly stemmed from system failures caused by connection delays as the number of users surged following the recent stock market boom. This differs from last year, when most complaints were due to large-scale fund redemption suspensions such as Optimus and Lime. By type of complaint in securities companies, system failures accounted for 36.0%, trading-related 27.7%, product sales-related 11.9%, and others 27.5%.

In fact, looking at the number of complaints by type for Mirae Asset Securities in the first quarter, system failures accounted for more than half with 122 cases. Other complaints included 5 trading-related cases, 21 product sales cases, and 63 others. This was due to the malfunction of the MTS (Mobile Trading System) during the listing process of SK Bioscience, which was considered a major IPO this year. A Mirae Asset Securities official said, "We have almost completed the compensation process for customers who filed complaints at that time." In the case of Shinhan Financial Investment, system failures accounted for 82 cases, or 52.9%, out of a total of 155 complaints. This was followed by 5 trading-related cases, 46 product sales-related cases, and 22 others.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)