8 Banks Decide to Suspend Sales of 172 Complex Products

Financial Authorities Face Criticism for Delayed Administrative Rule Notification Leading to Complex Product Handling Suspension

Voices Criticize Haphazard Management... "Complacent Response and Situation Awareness"

[Asia Economy Reporter Jin-ho Kim] "It is difficult to estimate when the suspended funds can be sold again. Not only do we need board approval, but the IT systems also need to be updated, and the time is too tight. It seems the suspension will last at least one to two months." (A Bank official)

The confusion in the banking sector remains even a week after the implementation of the ‘High-Difficulty Financial Products Recording and Reflection System.’ To resume handling the approximately 170 suspended products, there are many hurdles such as board approval, revising product prospectuses, and updating IT systems. Critics point out that this situation is the result of the financial authorities’ laxity in issuing administrative rules just a week before the system’s implementation.

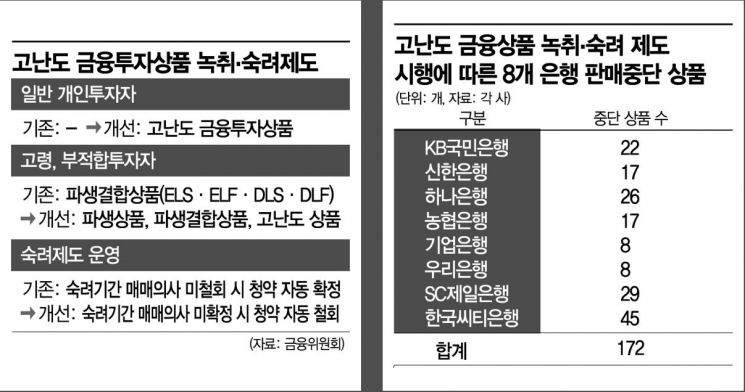

According to the financial sector on the 17th, eight major commercial banks including KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup, IBK Industrial Bank, Korea Citibank, and SC First Bank have suspended sales of 172 funds (including duplicates across banks) as of that day.

KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup, and IBK Industrial Bank have suspended sales of 98 funds, which is four more than the 94 funds suspended on the first day of the system’s implementation on the 10th. The two foreign-affiliated commercial banks, Korea Citibank and SC First Bank, decided to suspend sales of 74 funds. The market evaluates that the number of suspended funds is likely to increase further depending on decisions by asset management companies and banks.

Currently, most of the suspended funds are domestic equity derivative products that include assets from exchange-traded funds (ETFs) such as Samsung KOSDAQ 150, NH Amundi 1.5x Leverage Index, and Korea Investment KOSDAQ Double.

The suspension crisis is largely due to the ‘Partial Amendment to the Financial Investment Business Regulations,’ which defines high-difficulty financial products, the necessary procedures for sales, and the contents required in investment briefings, being announced only on the 3rd, a week before the system’s implementation. Asset management companies that create the funds had to classify high-difficulty products and revise product prospectuses, but there was insufficient physical time, naturally leading to suspension of handling at banks.

It is expected to take at least one to two months to resume sales

The suspension is expected to continue for at least one to two months. Asset management companies must first revise product prospectuses before banks can submit the resumption of sales as an agenda item to the board. Holding a board meeting solely to handle this agenda is also a burden for banks, which may further delay the process.

Updating IT systems due to the system implementation is also problematic. When selling high-difficulty financial products, customer consultations must be recorded, and during the two business days reflection period, investment risks and the possibility of principal loss must be notified. All of this must be recorded in the IT system, making it difficult for banks to make these changes in a short time.

An official from Bank B said, "Changing IT operations is not something that can be done in a short period," and added, "With the new system, every process such as staff product recommendations and customer application dates must be recorded electronically, which will take considerable time."

While the banking sector agrees with the authorities’ consumer protection intent, there are many complaints about the haphazard handling. It was already predicted that such a situation would arise when the administrative rules were announced just a week before implementation. A financial sector official said, "The financial authorities gave very little preparation time while demanding thorough work on IT system and internal regulation updates and staff training, so it was inevitably difficult to cope," and criticized, "The response and awareness of the recurring confusion at the time of system implementation seem too complacent."

In fact, this is not the first time banks have suspended product sales. When the Financial Consumer Protection Act (FCPA) was implemented in March, there was also confusion due to the failure to prepare enforcement decrees and supervisory regulations in time.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.