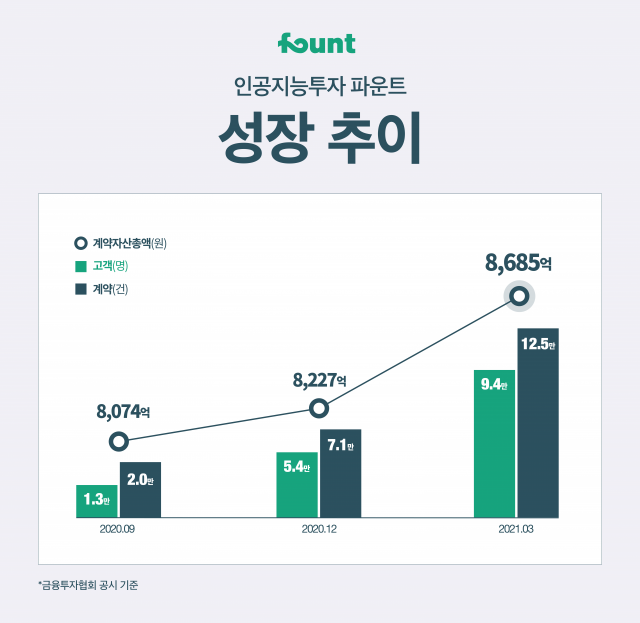

[Asia Economy Reporter Minji Lee] Fount, an AI investment specialist company, announced on the 17th that its total contract assets based on the Financial Investment Association's Q1 disclosure exceeded 868.5 billion KRW.

As of March, the number of customers is about 94,000, and advisory and discretionary contracts are recorded at about 125,000. Fount, which had total contract assets of 822.7 billion KRW at the end of last year based on disclosure standards, attracted more than 45.7 billion KRW in investment funds over three months despite the unstable stock market marked by fluctuations originating from the US earlier this year.

Fount is a non-face-to-face AI investment solution that allows investment starting from a minimum of 100,000 KRW in a customized global asset allocation portfolio tailored to individual investment preferences through AI algorithms. It has gained great popularity, especially among the millennial generation interested in finance, by word of mouth that personal asset management (PB) services, which were previously available only to high-net-worth individuals, can now be easily accessed within the app with a small amount of money.

Kim Youngbin, CEO of Fount, explained, “Due to zero interest rates, investors are increasingly seeking robo-advisors as alternative investment options to replace savings and deposits. We will focus on investing in AI technology to stably manage customers' assets and provide solutions for comfortable investment life.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.