Life Insurance New Contract APE Plummets

Decline in Protection Insurance Sales Performance

Non-Cancellation and Low-Cancellation Insurance Faces Incomplete Sales Regulation

Consumer Attrition as Refunds Decrease

[Asia Economy Reporter Oh Hyung-gil] The protection-type insurance policies of life insurance companies are turning into "a wolf in sheep's clothing."

In the midst of record-breaking performance by insurance companies in the first quarter of this year, the sales performance of protection-type insurance by life insurers has declined compared to last year. It is analyzed that face-to-face sales have become difficult due to the COVID-19 pandemic, and the sales of no (low) surrender value refund-type insurance products, which were revised starting this year, have sharply decreased.

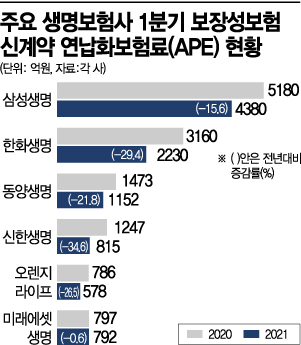

According to the insurance industry on the 17th, Samsung Life Insurance's premium income, which exceeded 1 trillion won in net profit in the first quarter, was 5.184 trillion won, a slight decrease of 0.4% compared to the same period last year. The new business annualized premium equivalent (APE), which converts premiums from new contracts into an annual basis, was 677 billion won, down 2.2% from the same period last year. In particular, protection-type APE shrank by 15.6%, from 518 billion won to 438 billion won.

Hanwha Life Insurance's premium income also remained at 3.197 trillion won, down 6.4% from the same period last year. New business APE dropped sharply by 35.9% to 359 billion won. Protection-type APE plunged 29.4%, from 316 billion won in the first quarter last year to 223 billion won this year.

During the same period, Dongyang Life Insurance's protection-type APE also fell 21.8%, from 147.3 billion won to 115.2 billion won, and Mirae Asset Life Insurance showed a slight decrease of 0.6%. Shinhan Life Insurance and Orange Life, which announced their results last month, also decreased by 34.6% and 26.5%, respectively.

Life insurers cite the COVID-19 pandemic and the suspension of no-surrender insurance sales as the reasons for the decline in protection-type APE, which is a barometer of insurance sales performance.

Lee Joo-kyung, head of the CPC Planning Team at Samsung Life Insurance (Executive Director), explained at a conference call held on the 14th, "The life insurance market shrank by about 24 percentage points in the first quarter compared to the same period last year," adding, "The main reasons were the sharp increase in COVID-19 cases at the end of last year, which reduced performance in January and February, and the sales contraction due to the no-surrender product regulations implemented this year."

Hanwha Life Insurance also stated, "The sales scale of the life insurance market in the first quarter decreased by 8% compared to the same period last year, and the protection-type market size decreased by about 24%. The new business APE decreased more than the market contraction."

[Image source=Yonhap News]

[Image source=Yonhap News]

Revision of No-Surrender Insurance Refund Rates... Cited as Main Cause of Sharp Sales Decline

The financial authorities implemented a revision on no (low) surrender value refund-type whole life insurance starting January this year.

No (low) surrender value insurance offers the same coverage as standard insurance but with premiums 15-30% cheaper. However, if the policyholder cancels early, they receive little or no refund. It became a hit product, selling over 7.2 million policies in five years since its debut in 2015, due to word of mouth about its low premiums.

However, the authorities recently tightened regulations, citing consumer harm concerns due to incomplete sales practices where no (low) surrender whole life insurance was marketed with high refund rates but disguised as savings products. The product structure was changed so that refund rates cannot exceed those of standard insurance.

As a result, the refund amount upon full payment has significantly decreased, leading to a loss of consumer demand, according to the insurance industry. The industry's warnings about market contraction at the time of the revision have become a reality.

The problem is that such sales regulations could further shrink the life insurance market, which is already experiencing long-term stagnation. The Korea Insurance Research Institute forecasts a 0.4% decrease in life insurance premium income this year.

A life insurer official lamented, "If the regulation had been implemented by strengthening supervision against incomplete sales instead of removing the unique features of no-surrender products, the market situation might have been different," adding, "If the types of products available for sale decrease, the competitiveness of the insurance market will inevitably weaken."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.