KOSPI Starts Higher

Foreigners Continue Net Selling

Inflation Risk Persists

Interest Rates Actually Fall

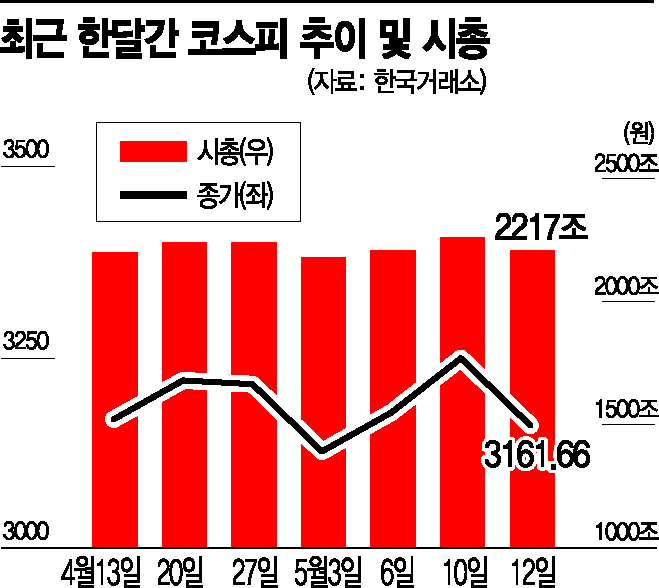

[Asia Economy Reporter Junho Hwang] On the 14th, the KOSPI started higher. Foreigners continued their net selling trend from the previous day. However, the announcement by the Federal Reserve, the central bank of the United States, to extend the maturity of government bond purchases led to a decline in market interest rates, represented by the 10-year Treasury yield, reducing the possibility of tightening and reviving investor sentiment.

On this day, the KOSPI opened at 3,131.35, up 9.24 points. It continued trading 0.30% higher than the previous day’s close. As of 9:16 AM, the KOSPI recorded a 0.78% increase at 3,146.32. Among all listed stocks, 592 stocks were rising, while 248 stocks were declining.

At this time, foreigners were net sellers of 134.1 billion KRW. Institutions were also net sellers of 142.4 billion KRW, but individuals supported the market by net buying 275.5 billion KRW. The previous day, foreigners net sold stocks worth 1.4293 trillion KRW. Following 2.0222 trillion KRW on the 11th and 2.7005 trillion KRW on the 12th, they sold over 6 trillion KRW for three consecutive trading days.

By sector, the medical and precision industries showed a 2.64% rise. Electrical and electronics rose 1.56%, transportation equipment 1.27%, logistics and warehousing 1.18%, and telecommunications 1.01%.

Among the top market capitalization stocks, Samsung Electronics’ rise stood out. It was trading at 79,800 KRW, up 1.66% from the previous day’s closing price. SK Hynix also rose 1.70% to 119,500 KRW. Hyundai Motor increased 1.53%, and Samsung SDI rose 1.66%.

The KOSDAQ opened at 953.91, up 2.14 points (0.22%). As of this time, the KOSDAQ surged 1.03% to 961.59. Among all listed stocks, 1,047 stocks were rising, while 242 stocks were declining.

In the KOSDAQ, institutions and foreigners were net sellers of 38.7 billion KRW and 23.7 billion KRW, respectively. In contrast, individuals were net buyers of 64 billion KRW.

By sector, the computer services sector showed a 2.97% rise. Semiconductor, paper and wood, construction, non-metallic minerals, chemicals, telecommunication services, transportation and parts, textiles and apparel, electrical and electronics, medical and precision, information devices, and IT parts all showed gains in the 1% range.

Among the top market capitalization stocks, Kakao Games and EcoPro BM rose 2.11% and 2.02%, respectively. SK Materials (1.14%) and CJ ENM (1.72%) also showed gains.

The stabilization of indicators due to easing concerns about U.S. tightening appears to have influenced the market on this day. On the 13th (local time), the U.S. 10-year Treasury yield fell 0.03 percentage points (178%) from the previous trading day to 1.666%. The yield, which had risen for four consecutive trading days since the 7th, reaching 1.69% the day before, declined slightly on this day. Although signals of inflation strengthened, bond yields declined amid Federal Reserve officials’ remarks that the inflation rise is temporary.

The Producer Price Index (PPI) released on this day significantly exceeded market expectations. April’s PPI rose 0.6% month-on-month, surpassing the market forecast of 0.3%. Core PPI also increased 0.7%, exceeding the expected 0.4%. This is an indicator that raises the possibility of inflation following the Consumer Price Index.

However, the New York Federal Reserve suggested adjusting the maturity composition of government bond purchases. In particular, it stated that purchases would be segmented toward long-term bonds. Jae-kyun Ahn, a researcher at Korea Investment & Securities Research Center, said, "U.S. inflationary pressure is higher than expected, and due to a mixture of base effects and temporary factors, the indicator numbers are also high. Although it is not easy to predict whether temporary factors will ease within 1-2 months, if the Fed increases long-term bond purchases, the upward trend in long-term interest rates may pause."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.