[Asia Economy Reporter Park Jihwan] Last month, foreign investors purchased about 670 billion KRW worth of domestic stocks, marking a shift to net buying after four months.

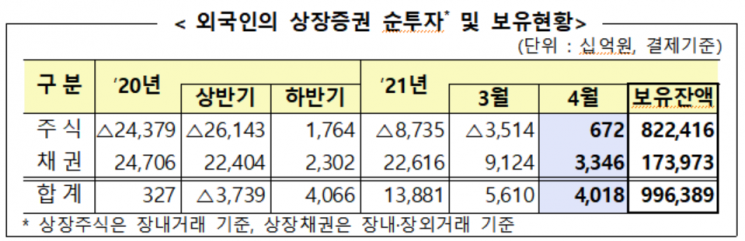

According to the "April Foreign Securities Investment Trends" report released by the Financial Supervisory Service on the 14th, foreign investors net purchased 672 billion KRW in the domestic stock market last month. This is the first time in four months that foreigners have turned to net buying in domestic stocks.

Last month, foreigners net purchased 979 billion KRW in the KOSPI market. On the other hand, they net sold 307 billion KRW in the KOSDAQ market.

By region, the Middle East net purchased 1.1 trillion KRW, and the Americas 500 billion KRW. Asia and Europe net sold 200 billion KRW and 100 billion KRW, respectively.

As of the end of April, foreign investors held 822.4 trillion KRW worth of domestic listed stocks, an increase of 17.2 trillion KRW compared to the previous month. This accounts for 30.8% of the total market capitalization.

In the bond market, last month foreigners net purchased 8.794 trillion KRW in listed bonds and redeemed 5.448 trillion KRW at maturity, resulting in a total net investment of 3.346 trillion KRW.

Bonds held by foreigners amount to 174 trillion KRW, accounting for 8.1% of the total listed balance. This is an increase of 3.1 trillion KRW from the previous month. Net investments were made in Europe (1.7 trillion KRW), Asia (1.3 trillion KRW), the Americas (1.1 trillion KRW), and the Middle East (100 billion KRW).

The holding scale was in the order of Asia 82.5 trillion KRW, Europe 52.8 trillion KRW, and the Americas 15.4 trillion KRW.

By type, net investments were made in government bonds (2.1 trillion KRW) and monetary stabilization bonds (300 billion KRW). By remaining maturity, net investments of 6.5 trillion KRW were made in bonds with maturities between 1 year and less than 5 years. Conversely, bonds with maturities over 5 years and less than 1 year saw net redemptions of 1.1 trillion KRW and 2.1 trillion KRW, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.