[Asia Economy Reporter Byunghee Park] The Wall Street Journal (WSJ) reported on the 12th (local time) that tin prices are approaching an all-time high as demand for laptops, mobile phones, and other devices increases.

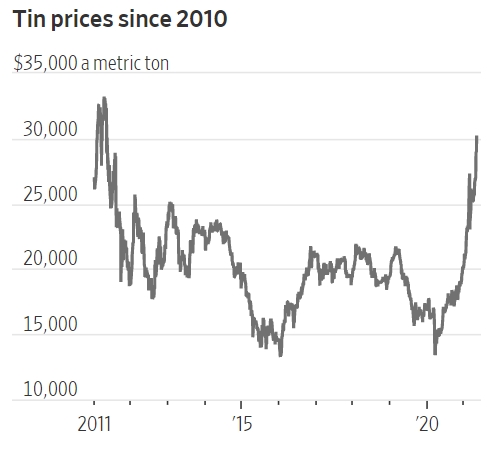

The London Metal Exchange (LME) tin futures price has risen by 46% so far this year, surpassing the gains of copper and aluminum this year. Currently, the tin price stands at $29,785 per ton, marking the highest level in 10 years. Tin prices previously reached an all-time high of over $33,000 per ton in 2011.

The recent rise in tin prices is due to increased demand for electronic products such as laptops, mobile phones, and TVs during the COVID-19 pandemic.

James Willoughby, an analyst at the International Tin Association, stated, "Half of the world's tin demand is used for soldering in electronic products."

Therefore, tin prices are closely related to semiconductor demand. Global semiconductor sales in the first quarter of this year increased by 3.6% compared to the previous quarter and by 17.8% compared to the same period last year.

The housing market boom is also supporting the rise in tin prices. Tin is used to enhance the heat resistance of some plastics, so as new housing construction increases, tin demand also rises. Additionally, the shortage of container ships, which is driving up freight rates, is another factor contributing to the strength of tin prices.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.