Despite Accumulated Deficits in Car Insurance, Justification for Premium Hikes Weakens

Losses Covered by Investment Gains Continue... Premium Increase Variables Remain in Q2

[Asia Economy Reporter Oh Hyung-gil] As major non-life insurance companies record their highest-ever earnings this year, the atmosphere suggests that a hike in car insurance premiums within the year is virtually off the table. Although car insurance losses continue to accumulate, the justification for raising premiums has weakened. The trend of offsetting losses from car insurance with investment gains and other sources is expected to continue.

On the 13th, Hyundai Marine & Fire Insurance announced that its net profit for the first quarter increased by 41.0% year-on-year to 126.5 billion KRW, marking the highest quarterly earnings ever. Hyundai Marine & Fire Insurance posted an underwriting loss of 121.2 billion KRW but recorded an investment income of 310.9 billion KRW, resulting in an operating profit of 189.7 billion KRW.

Following Samsung Fire & Marine Insurance’s announcement the previous day of a net profit of 431.5 billion KRW?more than double that of the same period last year?Hyundai Marine & Fire Insurance continued the record-breaking performance.

A Hyundai Marine & Fire Insurance official explained, "Long-term life insurance sales have increased by more than 10% compared to last year, maintaining a very stable level. Since the improvement in recruitment commissions in January, there has been no commission competition, and underwriting guidelines are being operated conservatively, preventing excessive competition."

There are also expectations that the strong performance of non-life insurers will continue. Although KB Insurance, one of the ‘Big 4’ non-life insurers, saw its first-quarter net profit decrease by 10.9% year-on-year to 68.8 billion KRW, DB Insurance, which is about to announce its earnings, is expected to report results exceeding market forecasts.

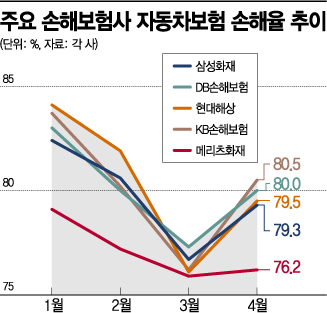

The loss ratio for car insurance, a major product of non-life insurers, has stabilized amid the ongoing impact of COVID-19. From January to April, car insurance loss ratios were 79.7% for Samsung Fire & Marine Insurance, 80.3% for Hyundai Marine & Fire Insurance, 80.3% for DB Insurance, and 80.2% for KB Insurance. All fall within the industry’s estimated appropriate loss ratio range of 78?80%.

Non-life insurers had expected an increase in car usage in the first quarter compared to last year, but actual recovery was minimal due to the prolonged COVID-19 pandemic. In particular, with the promotion of car insurance system improvements, there is now some relief in managing loss ratios going forward. The Ministry of Land, Infrastructure and Transport plans to significantly strengthen the so-called accident burden fee, allowing insurance companies to seek reimbursement from perpetrators for part of the insurance payouts made to victims in cases of drunk driving, unlicensed driving, and hit-and-run accidents. Additionally, financial authorities plan to introduce a system applying fault ratios to bodily injury compensation in the second half of the year.

Although raising car insurance premiums seems difficult for the time being, if outings increase in the second quarter, there remains a variable that could push up car insurance repair fees. The repair industry is currently requesting an 8.2% increase, considering the rise in minimum wages and operating expenses.

An industry insider said, "The first quarter tends to show a low loss ratio due to seasonal factors, so it is somewhat premature to discuss premium hikes. It is necessary to monitor whether the loss ratio worsens after April."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.