Q1 Operating Profit of 502.5 Billion KRW... Inventory Valuation Gains Drive Performance

Petroleum Business Expected to Surpass Break-Even Point from Q3

Accelerated Battery Investment... Profitability Expected from End of 2022

Top 4 Petroleum Companies Reach Operating Profit of 2 Trillion KRW Range

[Asia Economy Reporter Hwang Yoon-joo] SK Innovation has successfully returned to profitability after one year, overcoming the impact of COVID-19. Although inventory valuation gains due to rising international oil prices significantly influenced the improvement in performance, meaningful performance improvements are expected to accelerate from the second half of the year as margins recover. The battery business, a new growth engine, saw an increase in losses due to initial investment costs, but it is expected to break even starting next year.

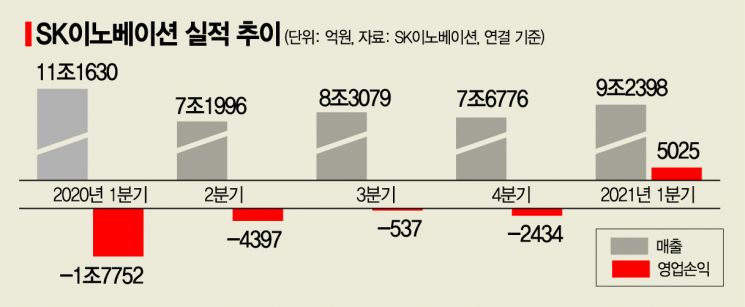

SK Innovation announced on the 13th that its consolidated operating profit for the first quarter of this year was 502.5 billion KRW, turning profitable compared to the same period last year. In the first quarter of last year, the company posted an operating loss of 1.7752 trillion KRW due to the impact of COVID-19, marking the largest loss in its history. However, in the first quarter of this year, the increase in inventory gains significantly improved the performance of major businesses such as petroleum, chemicals, and lubricants.

However, pre-tax profit recorded a loss of 527.6 billion KRW due to the reflection of a 1 trillion KRW settlement payment related to the battery lawsuit and a foreign exchange loss of 1.0301 trillion KRW. Earlier, SK Innovation ended a two-year dispute by agreeing last month to pay a total of 2 trillion KRW to LG Energy Solution, consisting of 1 trillion KRW in cash and 1 trillion KRW in royalties, regarding the battery trade secret infringement dispute in the United States.

Looking at the performance by business division, the petroleum business recorded an operating profit of 416.1 billion KRW as refining margins improved significantly due to supply disruptions caused by the US cold wave and inventory-related gains expanded due to rising oil prices. The chemical business posted an operating profit of 118.3 billion KRW, driven by improved spreads of aromatic products such as paraxylene (PX) and benzene, increased sales volume following the end of regular maintenance in the previous quarter, and inventory-related gains. The lubricant business also recorded an operating profit of 137.1 billion KRW, influenced by inventory-related gains due to rising oil prices.

The battery business recorded an operating loss of 176.7 billion KRW, an increase of about 67.8 billion KRW compared to the previous quarter due to increased initial costs at overseas plants. However, its sales attracted attention by increasing 80% year-on-year to 526.3 billion KRW. SK Innovation’s battery business, a new growth engine, has shown a steady growth trend since 2019, achieving record sales every quarter. In the first quarter of this year, the plants in Yancheng and Huizhou, China, began mass production, and sales are expected to increase significantly in the future, leading to substantial performance improvements.

Kim Jun, President of SK Innovation, said, "The business environment affected by the COVID-19 pandemic is gradually improving, leading to better performance in core businesses such as petrochemicals, while growth in new businesses such as batteries and materials continues. We will focus on strengthening our fundamental competitiveness to leap forward as an eco-friendly energy and materials company."

Meanwhile, the four refining companies, which recorded operating losses of 4 trillion KRW last year due to the COVID-19 shock, all returned to profitability in the first quarter of this year, posting operating profits in the 2 trillion KRW range. S-OIL recorded an operating profit of 629.2 billion KRW, the largest in five years, while GS Caltex and Hyundai Oilbank achieved 623.6 billion KRW and 412.8 billion KRW, respectively.

An official from the refining industry explained, "Inventory valuation gains had the greatest impact on the return to profitability, and refining margins improved as demand gradually increased. Operating profit is expected to decrease in the second quarter but surpass the break-even point from the third quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.