Ssangyong Motor Public Bidding Not Conducted This Month

Possibility of Investment Fund Participation in Consortium Form of Corporations and Private Equity Funds

[Asia Economy Reporter Park Sun-mi] The Corporate Restructuring Innovation Fund, which is being additionally raised to the scale of 1 trillion won to activate market-led restructuring, is opening up the possibility of revival not only for Ssangyong Motor but also for the auto parts industry facing liquidity crises.

According to the automotive and financial industries on the 12th, a public bidding for Ssangyong Motor, which is undergoing corporate rehabilitation procedures, is scheduled to take place within this month. Considering the tight financial conditions of mid-sized and small companies interested in Ssangyong Motor, it is highly likely that a consortium-type investment fund between companies and private equity funds will be formed to carry out the acquisition and merger (M&A) of Ssangyong Motor.

In the industry, since a consortium seeking funding and rehabilitation plans for acquiring Ssangyong Motor is being mentioned, it is expected that if a smooth environment for forming investment funds is established, the activities of such consortia could become more active. This is also why there is growing anticipation that the third Corporate Restructuring Innovation Fund, recently announced by the Financial Services Commission with a scale of 1 trillion won, could act as a savior not only for Ssangyong Motor but also for the auto parts industry facing liquidity crises.

The third Corporate Restructuring Innovation Fund, whose additional raising has been confirmed this time, will start recruiting fund management companies within this month and can begin investments from June. A financial authority official stated, "The additional raising of the Corporate Restructuring Innovation Fund was not specifically intended to save Ssangyong Motor," but added, "If a specific company lacks funds to acquire Ssangyong Motor, and forms an investment fund in a consortium form with private equity funds, funds from the Corporate Restructuring Innovation Fund can be injected." He further added, "The key issue is whether a private equity fund management company interested in investing in Ssangyong Motor will appear."

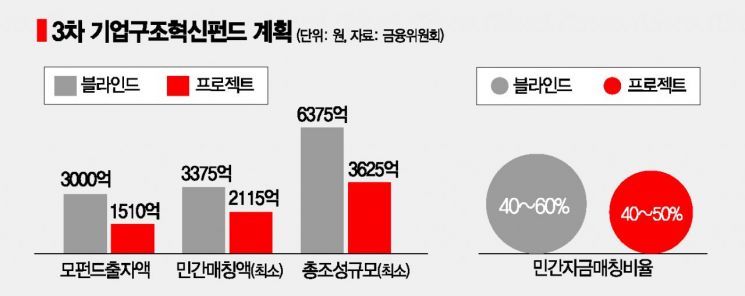

The third Corporate Restructuring Innovation Fund is based on 67.5 billion won of government finances, and if policy financial institutions such as KDB Industrial Bank, Export-Import Bank, IBK Industrial Bank, and Korea Asset Management Corporation (KAMCO), as well as private banks and securities firms, invest to form a mother fund of 451 billion won, more than 550 billion won of private investment will be added, creating a total fund of over 1 trillion won. Among the 1 trillion won, the project fund, which selects investment targets first and then raises funds for investment, will be at least 362.5 billion won, and the blind fund, which raises funds first and then finds investment targets, will be at least 637.5 billion won in scale.

Wider Scope of Fund Managers and Expanded Investment Targets Compared to 1st and 2nd Rounds

Unlike the past 1st and 2nd Corporate Restructuring Innovation Funds, a separate allocation of investment resources was made for newly established and small fund managers, broadening the range of participating fund managers. The investment targets were expanded to include companies with capital erosion, excessive debt (pre-structural restructuring), as well as companies undergoing workout and rehabilitation procedures (post-structural restructuring).

For post-structural restructuring companies, incentives were also strengthened by increasing the performance fee from the existing 10% to 15% when investing above a certain ratio. Given the government and financial authorities’ strong will to save Ssangyong Motor, it can be interpreted that by broadly laying the groundwork to expand corporate restructuring into the private investment sector in line with the timing of Ssangyong Motor’s public bidding, a breakthrough to resolve the Ssangyong Motor issue has been prepared.

Previously, Dongbu Steel, which was in a workout state, and Sungdong Shipbuilding & Marine Engineering, which was on the verge of bankruptcy, successfully revived by receiving funds from the Corporate Restructuring Innovation Fund through a consortium between companies and private equity funds. These cases are regarded as successful examples of the Corporate Restructuring Innovation Fund activating market-led restructuring.

Some expect that since the Corporate Restructuring Innovation Fund was created with the purpose of reviving companies that have technology and competitiveness but may collapse due to temporary liquidity problems, it could provide a lifeline not only to Ssangyong Motor but also to the auto parts industry struggling with management difficulties due to liquidity shortages.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.