Q1 Operating Profit 275.6 Billion

Both Sales and Service Revenue Increased

Strong Performance in Wireless Business and Smart Up Division

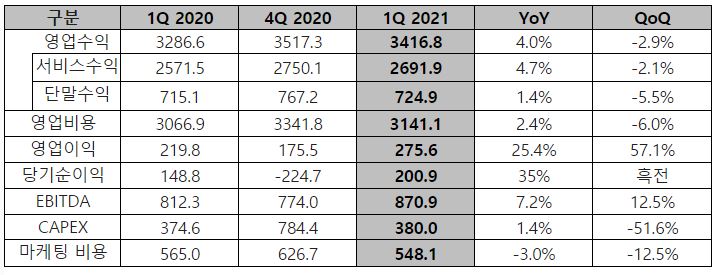

[Asia Economy Reporter Cha Min-young] LG Uplus announced on the 12th that it achieved an operating profit of 275.6 billion KRW in the first quarter based on consolidated financial statements. This represents a 25.4% increase compared to the same period last year.

Operating revenue (sales) and service revenue also increased. In the first quarter of this year, operating revenue recorded 3.4168 trillion KRW, and service revenue recorded 2.6919 trillion KRW, marking increases of 4.0% and 4.7% respectively compared to the same period last year. Service revenue refers to the revenue excluding device revenue from operating revenue.

The balanced growth in operating revenue and operating profit is attributed to the wireless business segment, driven by subscriber growth, and the steady growth of the smart home business segment including IPTV and high-speed internet. Reduced marketing expenses also contributed to improved performance.

Impact of Increased Wired and Wireless Subscribers

In the first quarter, wireless business revenue reached 1.4971 trillion KRW, up 6.1% year-on-year, influenced by net subscriber additions and the expansion of 5G penetration. Wireless service revenue excluding connection revenue was 1.4081 trillion KRW, a 5.4% increase from the previous year. Wireless service revenue includes basic fees, call charges, value-added services, and data related to wireless services.

The net subscriber increase in the first quarter was approximately 329,000, a 25.1% rise compared to the same period last year. Notably, 5G subscribers increased by 129.2% compared to the same period last year, bringing the cumulative number of subscribers to about 3.335 million. Differentiated products such as ‘U+ Together’ and mid-to-low priced 5G plans launched earlier this year are analyzed as the main drivers of subscriber growth.

The growth trend of MVNO (Mobile Virtual Network Operator) subscribers also continued. In the first quarter, MVNO subscribers reached approximately 2.154 million, an 80.8% increase year-on-year. Promotions such as ‘U+ Affordable Coupon Pack’ and ‘Honey Combination Promotion’ centered on MVNO partners are considered to have positively influenced subscriber growth.

The smart home business segment, including IPTV and high-speed internet, also maintained its growth trend. Supported by steady subscriber growth, the smart home business segment revenue in the first quarter was 530 billion KRW, an 8.8% increase compared to the same period last year.

IPTV business segment revenue recorded 300.7 billion KRW, a 7.0% increase year-on-year. Despite a decline in VOD sales, performance improved as subscribers increased based on differentiated service competitiveness such as the child-exclusive content platform ‘U+ Idle Nara’ and Netflix. In fact, IPTV subscribers increased by 10.4% compared to the first quarter of last year, reaching a cumulative total of 5.076 million.

High-speed internet revenue was 229.3 billion KRW, up 11.2% year-on-year. Subscribers increased by 5.5% to 4.59 million. The proportion of gigabit internet subscribers rose to 66.4%, an 8.1 percentage point increase compared to the same period last year, driving the upward trend in performance.

Revenue from the B2B business, the enterprise infrastructure segment, also steadily increased. The enterprise infrastructure segment recorded 341.5 billion KRW, a 9% increase year-on-year, driven by stable growth in solutions and IDC (Internet Data Center) and growth in existing businesses such as enterprise lines. IDC business sales increased by 8.4% to 56.2 billion KRW compared to the same period last year, and solution business sales including relay messaging, web hard, and NW solutions rose 11.3% to 98.8 billion KRW. Enterprise internet and dedicated line sales increased 7.9% to 186.5 billion KRW.

Marketing expenses decreased. Marketing expenses in the first quarter were 548.1 billion KRW, down 3% compared to the same period last year. The ratio of marketing expenses to service revenue was 22.1%, a 2 percentage point decrease year-on-year. Capital expenditures (CAPEX) increased by 1.4% compared to the first quarter of last year, totaling 380 billion KRW. In particular, investment in wireless networks increased by 10.8% year-on-year to 173.4 billion KRW, focusing on strengthening network competitiveness such as expanding 5G coverage.

Strengthening Media, Plans, Network, and New Businesses

LG Uplus aims to achieve its goal this year of ‘qualitative growth through customer value innovation’ by strengthening competitiveness in new business areas such as ▲media ▲content ▲network and plans. In the media sector, services such as the infant and toddler exclusive platform ‘U+ Idle Nara’, ‘U+ Pro Baseball’, and ‘U+ Golf’ have been significantly enhanced from the customer perspective. The revamped ‘Idle Nara 4.0’ added content linked to homeschooling, and U+ Pro Baseball and U+ Golf added entertaining variety content.

The core of content competitiveness enhancement is the ‘XR Alliance’. The ‘XR Alliance’, led by LG Uplus, welcomed global telecom operators this year including Verizon from the U.S., Orange from France, and Tsinghua Telecom from Taiwan. The XR Alliance plans to sequentially service episodes within this year that vividly show the actual space outside the space station.

Efforts to reduce customers’ cost burdens continue. Earlier, LG Uplus led price competition in the market by sequentially launching Korea’s first acquaintance bundling product ‘U+ Together’, the lowest priced 5G direct plan at around 30,000 KRW per month, and mid-to-low priced 5G plans. Going forward, LG Uplus plans to release new products that enhance the benefits of ‘U+ Together’, which was launched in January and has gained explosive popularity.

Investment in wired and wireless networks will also be expanded. Investments to expand 5G coverage will be increased within the year, and in-building investments will continue to enable 5G service usage inside buildings. By analyzing 5G signal quality, investments and optimizations will be focused on areas with weak signals to continuously improve user convenience.

Additionally, LG Uplus plans to expand demand in new B2B and B2G business areas such as ▲smart ports ▲smart cities ▲smart industrial complexes. In the promising future growth field of digital healthcare, LG Uplus continues to explore new business opportunities through collaboration with companies such as M3 Solution and Theragen Bio.

Lee Hyuk-joo, Vice President and Chief Financial Officer (CFO) of LG Uplus, stated, “LG Uplus will continue stable growth in consumer and enterprise infrastructure businesses while continuously exploring new business opportunities in promising future growth areas. In the second quarter, we will focus on innovating services and securing competitiveness in new businesses for our loyal Uplus customers, making the goal of 10 trillion KRW in service revenue set at the beginning of the year more tangible and doing our best to enhance shareholder value.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.