[Asia Economy Reporter Minji Lee] As the outlook for continued steel price increases gains momentum, steel stocks are also experiencing sharp rises in their share prices.

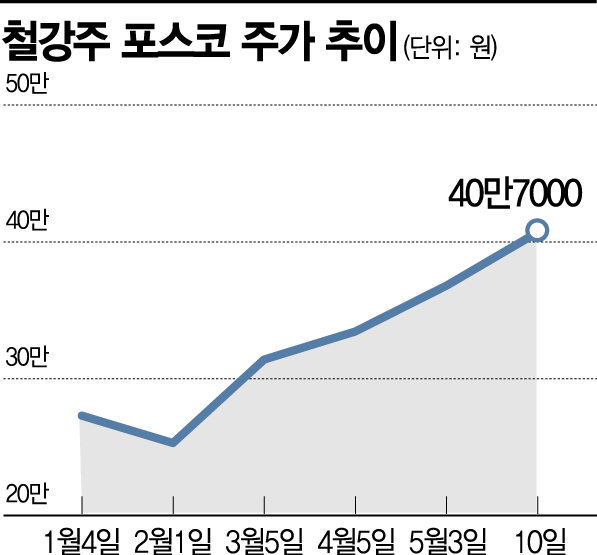

According to the Korea Exchange on the 11th, POSCO soared to 413,500 KRW during the previous trading session, setting a new 52-week high. As of 9:40 AM that day, POSCO was trading at 402,000 KRW, down 1.23% from the previous day but still holding above the 400,000 KRW mark. Since the beginning of this year, POSCO's stock price has risen by 50%, with a sharp 23% increase in the past month.

Other steel companies are also showing upward trends in their stock prices. Over the past month, POSCO Steel Sheet (97%), Dongyang STEC (65%), Dongkuk Steel (47%), KG Dongbu Steel (34%), SeAH Besteel (55%), Korea Zinc (15%), and Hyundai Steel (18%) have all seen significant gains. This is interpreted as a response from domestic steel companies’ stock prices to the tight steel supply and rising steel prices.

This is because steel supply is decreasing while manufacturing in China is booming, increasing demand. The abolition of China's export VAT rebate (a subsidy policy that refunds value-added tax on exports) and the government's carbon emission reduction policies have raised expectations for steel production cuts, leading to forecasts of further reduced steel supply. Starting next month, China will require new production facilities to be built with the latest equipment capable of switching to clean energy to reduce carbon emissions, and pollutant emissions must meet strict environmental standards.

The fact that iron ore and steel prices are rising sharply together, with iron ore prices reaching record highs, also supports the upward trend in steel prices. Australian iron ore prices reached $228 per ton as of the previous day, surging about 8.7% in one day. This is about a 34% increase in just over a month, driven not only by the resumption of economic activities but also by deteriorating relations between China and Australia, which appear to have fueled the price rise. Jongman Byun, a researcher at NH Investment & Securities, said, "China depends on Australia for 61% of its iron ore," adding, "Recently, China declared a suspension of talks with Australia, signaling prolonged friction, which is expected to extend the price increase trend."

Buoyed by the rising steel prices, the securities industry expects steel companies' earnings growth to continue into the second quarter. According to financial information provider FnGuide, the securities industry forecasts POSCO's second-quarter sales at 16.4023 trillion KRW and operating profit at 1.5835 trillion KRW, representing growth of 19% and 844%, respectively, compared to the same period last year. In addition, SeAH Besteel is expected to record an operating profit of 52.5 billion KRW in the second quarter, a 176% increase year-on-year, and Hyundai Steel (2725%) and Dongkuk Steel (32%) are also projected to post solid earnings.

Researcher Sunwoo Kwon of SK Securities explained, "The product price increases that contributed to strong first-quarter results are continuing into the second quarter," adding, "Considering inventory levels are lower than usual and supply shortages are occurring in the US and Europe, the price increase trend is expected to persist."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.