Uncertainty Over New DSR Regulation Application for Remaining Loan Payments by Buyers

Retroactive Application Unlikely... Clear Detailed Guidelines Not Released for Two Weeks

Stopgap Measures Criticized for "Fueling Market Confusion"

[Asia Economy Reporter Kim Jin-ho] "If the DSR 40% regulation is suddenly applied, I feel like I have to give up my dream of owning a home and rent it out instead. I am so frustrated that I can't sleep. (Borrower A, who is about to take out a balance loan)"

"I think it's a policy that can be interpreted in any way depending on the situation. There are floods of inquiries about balance loans, but there are no clear standards, so we are unable to provide guidance. (Bank teller B)"

The aftermath of the ‘April 29 Household Debt Measures,’ which focus on strengthening the Debt Service Ratio (DSR), is intense. In particular, whether the DSR 40% regulation applies to balance loans for apartments already purchased has become a hot issue. Looking at precedents, it is likely that retroactive application will not be enforced, but there is growing criticism that the financial authorities have caused confusion by issuing ‘regulations without clear detailed guidelines.’

According to the financial sector on the 10th, borrowers who need to use balance loans ahead of the new DSR regulation scheduled to take effect in July are in severe confusion. This is because the financial authorities did not clearly state whether the DSR 40% regulation would apply to balance loans for pre-sale buyers when announcing the April 29 household debt measures.

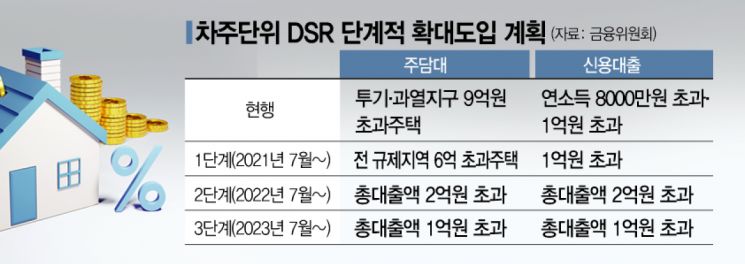

DSR refers to the ratio of the borrower's annual principal and interest repayment amount on financial debts to their annual income. It reflects the repayment burden of all loans, including mortgage loans and other loans such as credit loans, and is called the ‘ultimate loan regulation.’ Currently, personal-level DSR is applied only to high-income earners (annual income of 80 million KRW) who have loans secured by homes worth over 900 million KRW in speculative or overheated speculation areas or have total credit loans exceeding 100 million KRW.

However, with this household debt measure, starting from July, personal-level DSR will be applied to borrowers who take out loans secured by homes worth over 600 million KRW or have total credit loans exceeding 100 million KRW within all regulated areas. As of February, 83.5% of apartments in Seoul and 33.4% of apartments in Gyeonggi-do fall under this expanded regulation.

Therefore, for borrowers who are about to move in, if the DSR regulation is applied, the loan limit will be significantly reduced, inevitably disrupting their funding plans. For example, if an apartment in a regulated area is worth 700 million KRW at the time of move-in, a loan of up to 280 million KRW was possible by applying the original LTV of 40%. However, if the DSR regulation is applied, a borrower with an annual income of 50 million KRW and a 50 million KRW overdraft account will see their loan limit reduced to 230 million KRW starting in July.

A banking official said, "If the DSR 40% that covers all loans is applied, there is practically no way to cover the shortfall in mortgage loans," expressing concern that "borrowers who are about to move in within two months will be very anxious about how to handle their balance loans."

Patchwork Household Debt Measures... Extreme Fatigue for Banks and Borrowers

This confusion is not the first time. During the June 17 real estate measures last year, when the LTV in Incheon’s Geomdan and Songdo was strengthened from 70% to 40-50%, the same standards were applied to borrowers who had purchased apartments before the announcement, causing controversy. As borrowers unable to get balance loans surged and market confusion grew, an exception clause was eventually made to maintain the LTV at 70% for pre-sale buyers as a ‘patchwork solution.’

Although not yet finalized, the financial authorities are reportedly considering not applying the strengthened DSR regulation to balance loans for apartments subscribed or sold before the regulation takes effect to ease market confusion. A financial authority official said, "We are well aware of the confusion caused by the balance loan issue," adding, "We are currently organizing inquiries coming from frontline counters by case." He also said, "We will soon provide guidance by summarizing related inquiries at the frontline counters."

However, despite having experienced similar cases in the past, there is strong criticism that the announcement of regulations without detailed guidelines has fueled market confusion. Currently, critical posts condemning the financial authorities are flooding real estate communities.

A financial sector official pointed out, "The household debt measures were delayed by more than a month compared to the original schedule, and it is puzzling that the detailed guidelines are still unclear," adding, "They just throw out the policy first and then try to fix the controversy later, which is a patchwork approach that leaves both banks and borrowers exhausted."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.