Impact of Short Selling, Fundamentals Ultimately Important

Celltrion Short Selling Yield -4.7%

Samsung Heavy Industries with Deficit, Capital Reduction, and Increase 9.7%

[Asia Economy Reporter Lee Seon-ae] How was the return on short selling resumed after 1 year and 2 months? One week after the resumption of short selling, the return on short selling for Celltrion, which attracted attention as a short selling target, was negative, while Samsung Heavy Industries recorded the highest return.

According to the Korea Exchange on the 9th, the short selling return of Celltrion during the regular market from the 3rd to the 7th was -4.7%. The return was calculated by comparing the average short selling price (the short selling transaction amount divided by the short selling transaction volume) with the closing price on the 7th. In other words, this is the average expected return for investors who short sold Celltrion from the 3rd to the 7th and have not yet covered their short positions.

Celltrion is one of the stocks frequently mentioned as a likely target for short selling. As of the 4th, it also had the largest short selling balance (the amount of shares short sold but not yet repaid). Celltrion’s stock price fluctuated significantly over the week, closing recently at 266,500 KRW, higher than the closing price just before the resumption of short selling (266,000 KRW).

Samsung Card, which had the highest proportion of short selling transaction amount relative to total transaction amount during the four days of regular trading, recorded a short selling return of -1.1%. During this period, Samsung Card’s stock price fell by 2.97%. Among the top 10 stocks with a high proportion of short selling transaction amounts besides Samsung Card, five stocks (Ottogi, Hyundai Marine & Fire Insurance, Hanjin KAL, Lotte Holdings, LG Display) recorded negative returns, while four stocks (Cafe24, Seegene, Korea Investors Service, Caregen) recorded positive returns, showing mixed results.

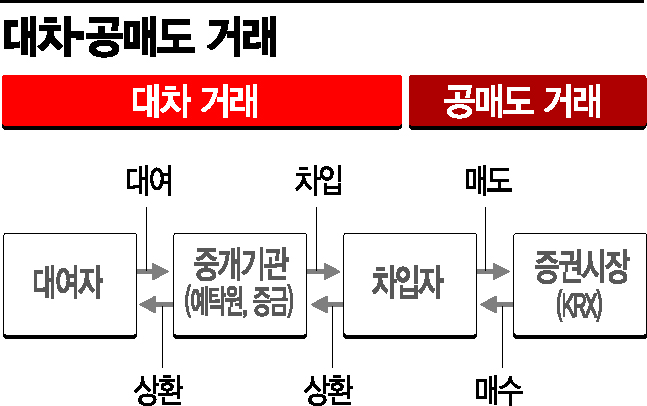

Short selling is an investment technique where stocks are sold first and then bought later to profit from the price difference, so profits are made when the stock price falls. However, the price decline must continue. If the stock price reverses and rises, borrowing costs and other expenses become burdensome. Therefore, when the price decline does not continue, short sellers may cover their positions, which can become a demand factor that pushes the stock price up.

On the 4th, about 260,000 shares of Celltrion were short sold, but the short selling balance decreased by about 30,000 shares compared to the previous day. Considering that only investors holding a certain proportion of the listed shares as short selling balance report their balances, it is estimated that a certain amount of short covering occurred that day. Celltrion’s stock price, which plunged 6.2% on the first day of short selling resumption on the 3rd, rebounded 4.2% on the 4th.

In conclusion, to profit from short selling, the stock price decline must be sustainable, meaning the company’s fundamentals should be poor. This explains why the earnings-driven market accelerated after the resumption of short selling and why investors need to pay attention to corporate fundamentals when investing. Short selling tends to target companies with weak fundamentals, accelerating their stock price decline.

The stock with the highest short selling return over the week was Samsung Heavy Industries, with a return of 9.7%. Samsung Heavy Industries’ stock price plunged due to a large first-quarter loss and efforts to improve its financial structure through capital reduction and increase.

Seol Tae-hyun, a researcher at DB Financial Investment, said, "Considering that the positive function of short selling is to discover the appropriate price, companies expected to improve profits are likely to experience only short-term negative effects from short selling," adding, "It is difficult for the stock price of companies expected to improve fundamentals to continue falling due to supply-demand effects."

Kim Kwang-hyun, a researcher at Yuanta Securities, analyzed, "Looking at the two previous stock market peaks when short selling was not banned (2015, 2018), the peaks of the stock market and short selling do not coincide," and "The point when short selling increases significantly is when the market begins a substantial decline after the peak." He added, "Short selling should be understood not as a movement anticipating a decline but as a process where selling pressure intensifies in response to a decline," and "Short selling accelerates stock price declines but does not reverse the upward direction of a rising market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)