[Asia Economy Reporter Park Jihwan] Starting from the 10th, recording of the sales and contract conclusion process will be mandatory when dealing with high-risk financial investment products with a principal loss possibility exceeding 20%, as well as when entering into discretionary investment or money trust contracts. Additionally, a cooling-off period of at least two business days will be guaranteed, allowing investors to reconsider their subscription decisions.

On the 9th, the Financial Services Commission announced that, according to amendments to the Enforcement Decree of the Capital Markets Act and the Financial Investment Business Regulations, a recording and cooling-off system for high-risk financial investment products and elderly investors will be implemented.

First, the concept of high-risk financial investment products will be newly introduced. Derivative-linked securities, derivatives, funds, discretionary investment, and money trust contracts that may incur losses exceeding 20% of the principal and are difficult for investors to understand will be newly defined as high-risk financial investment products.

However, products listed on exchanges, overseas securities and derivatives markets, or those targeted only at professional investors are excluded. If it is unclear whether a specific financial investment product qualifies as a high-risk financial investment product, a review can be requested from the Korea Financial Investment Association and the Financial Services Commission.

A recording and cooling-off period guarantee system will also be introduced for the sales process of high-risk financial investment products. When selling high-risk financial investment products or concluding high-risk discretionary investment or money trust contracts, the sales and contract conclusion process will be recorded, and investors can receive the recording files from financial companies.

When subscribing to high-risk financial investment products or high-risk discretionary investment or money trust contracts, a cooling-off period of at least two business days will be guaranteed, allowing investors to reconsider their subscription decisions. During the cooling-off period, investors can be notified by financial companies about investment risks, the possibility of principal loss, and the maximum possible principal loss amount. After the cooling-off period, the subscription or contract conclusion will only be finalized if the investor reaffirms their intention to subscribe through signature, seal, recording, email, mail, ARS, or other means. If the investor does not confirm their trading intention after the cooling-off period, the subscription will not be executed, and the investment funds can be refunded.

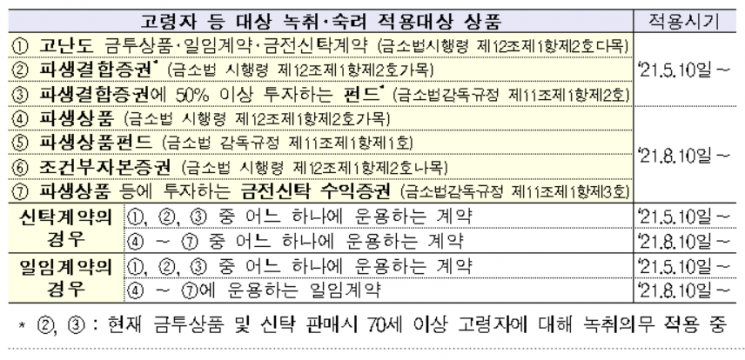

For elderly investors and unsuitable investors, the recording and cooling-off system will also be mandatory when investing in products subject to the suitability principle under the Financial Consumer Protection Act. Applicable products include derivative-linked securities, derivatives, derivative-linked funds, contingent capital securities, and high-risk products. The age criterion for elderly investors has been adjusted from 70 to 65 years.

The high-risk products, discretionary investment, trust contracts, and the elderly age criterion adjustment (from 70 to 65 years) will be implemented starting from the 10th. The existing recording and cooling-off system for elderly investors will continue to apply as before. The newly applied recording and cooling-off system for derivatives and other products for elderly investors will be implemented from August 10th to allow sufficient on-site preparation.

A Financial Services Commission official stated, "With all sales processes being recorded, financial companies are expected to conduct responsible investment recommendations and easy-to-understand product explanations with greater vigilance than before. For investors attempting to invest in products unsuitable for them, the cooling-off system is expected to enable more cautious investment decisions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.