[Asia Economy Reporter Minji Lee] Amid the ongoing boom in the raw materials market, the sharp rise in industrial metals such as copper and aluminum stands out. The surge in metal prices has accelerated due to the expansion of demand following the full-scale resumption of global economic activities after COVID-19 and the interplay with eco-friendly energy policies.

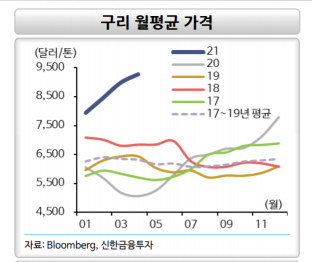

On the 8th, copper spot prices on the London Metal Exchange (LME) closed at $10,361 per ton as of the previous day, reaching an all-time high. This surpassed the $10,000 level for the first time in 10 years since February 2011. Copper, which began its price rally in mid-last month, has surged more than 11% in a month, maintaining an upward trend. This reflects a robust global manufacturing economy centered on China. The price increase rate has exceeded 30% since the beginning of this year.

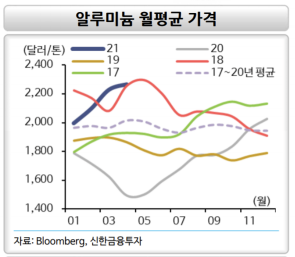

Aluminum prices, used in automobiles, aircraft, and construction, have also shown a sharp rise, joining the industrial metals rally. According to the LME, aluminum prices have surged about 10% in the past month. As China, the largest consumer, enters an expansion phase in its manufacturing economy and advanced countries significantly increase aluminum demand for eco-friendly energy projects, prices have risen about 26% compared to this year's low point (1951.5).

The performance of industrial metals has outpaced the returns of crude oil (WTI). Although concerns over gradual production increases by OPEC+ (the Organization of the Petroleum Exporting Countries and major oil-producing countries including Russia) led to a peak in March ($66.09 per barrel), prices soon dropped to around $58. Even looking at commodities based on raw materials, the KODEX Copper Futures rose 25% over the past three months, while KODEX Crude Oil Futures increased only 15%.

The price uptrend is also expected to be more pronounced in industrial metals. Considering the resurgence of COVID-19 in emerging countries such as India and OPEC+'s oil production increase policy, the market expects that crude oil prices will not rise further beyond the $65 level. Conversely, copper is expected to continue its trend of rising prices. Global investment bank Goldman Sachs stated, "Copper will be highlighted as a key energy source for eco-friendly infrastructure," and projected that "it could rise to $15,000 by 2025." Domestic securities experts have also left the upper limit of copper prices open above $10,000.

Aluminum is also expected to see price increases driven by tight supply amid surging demand in China, along with demand related to renewables such as electric vehicles, solar power, and wind power. Hwang Byung-jin, a researcher at NH Investment & Securities, said, "The expansion of aluminum demand for the automotive industry in Europe, Japan, Korea, and the United States will continue," adding, "Considering that China, both a consumer and producer, will implement carbon emission regulations for aluminum production, concerns about supply will also disappear."

Meanwhile, among domestic listed products, investors can invest in aluminum through the ‘Daeshin Aluminum Futures Exchange-Traded Note (ETN).’ In overseas markets, the ‘iPath Series B Bloomberg Aluminum ETN’ is available. Products that allow investment in industrial metals such as copper and aluminum include the ‘Invesco DB Base Metals Fund’ and the ‘WisdomTree Industrial Metals Exchange-Traded Fund (ETF).’

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)