KOSPI and KOSDAQ Holding Steady... Limited Market Impact

"Focus on Growth Companies Rather Than Fear of Short Selling"

[Asia Economy Reporter Minwoo Lee] Although short selling resumed after 14 months, the market appears largely stable. While the market impact of short selling is still expected to be limited, there is a forecast that investors should focus on cyclical stocks that are free from short selling effects and have a rapid pace of earnings improvement.

On the 8th, Samsung Securities analyzed that the recent impact of resumed short selling is limited. In fact, since short selling resumed on the 3rd, the KOSPI has risen 2.2% based on closing prices up to the previous day. The KOSDAQ also increased by 1.7% during the same period. In the case of KOSDAQ, concerns were priced in ahead of the short selling start, causing the 1000-point level, which was broken through for the first time in 20 years, to collapse, but after the resumption of short selling, it is showing a rebound trend. The famous U.S. stock market adage "Sell in May and go away" seems irrelevant.

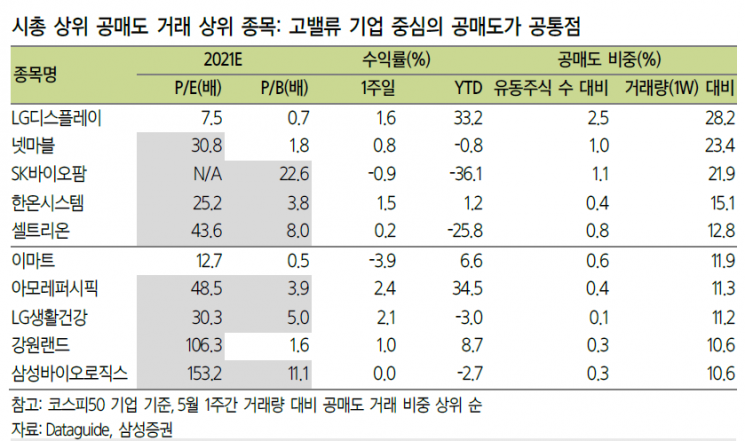

Shin Seung-jin, a researcher at Samsung Securities, explained, "We still believe the market impact from short selling will be limited," adding, "Considering that recent short selling has been concentrated on sectors with expensive valuations, cyclical stocks that are free from short selling effects and have a fast pace of earnings improvement should be the top priority for response."

Samsung Securities cited industries such as chemicals, steel, and refining as examples. Researcher Shin analyzed, "The first-quarter earnings of major stocks in these sectors have shown a series of 'surprise earnings' far exceeding market consensus," adding, "Demand is rapidly increasing due to economic recovery, but investment has been delayed due to COVID-19, and supply increase is limited due to eco-friendly policies."

It was also noted as a positive factor that the recent U.S. government is strengthening procurement of domestically produced parts and products under the 'Buy American' policy. It is expected that Korean semiconductor, secondary battery, and automotive electronics companies could benefit from investment momentum and gains. Samsung Securities particularly pointed out Kia, SK Innovation, and LG Electronics as representative companies of eco-friendly vehicles.

Researcher Shin advised, "Stock prices ultimately follow the growth potential of a company's future profits, so if you have invested in companies with no growth issues, there is no need to fear short selling," adding, "Just as there is no guarantee that a particular investor's buying leads to stock price increases, there is also no basis that short selling leads to price declines. Therefore, rather than being obsessed with short selling issues, it is better to discover and invest in undervalued companies with continued growth potential."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.