- Fixed demand is fundamental, and securing foot traffic makes it an easy and stable investment

- Commercial spaces within complexes near industrial parks and general commercial areas... Differences in price appreciation rates and monthly rents

Despite the prolonged COVID-19 pandemic negatively impacting the commercial market, commercial facilities within residential complexes continue to enjoy high popularity. In particular, commercial facilities located within complexes near business districts or industrial complexes are showing strong performance.

In fact, the ‘Hillstate Yeouido Pine Luce’ commercial facilities within the complex, launched last June in Yeouido, one of Seoul’s major business districts, were fully contracted within a day of the contract start. Similarly, the commercial facilities within the ‘Ulsan Jiwell City Xi’ complex, launched last December right across from Hyundai Heavy Industries, also achieved full sales in a short period.

The hot sales momentum has continued into this year. The first phase of commercial facilities within the ‘Ulsan New City Aileen’s Garden’ complex, located near the Ulsan Industry-Academia Convergence District and the petrochemical industrial complex, recorded an average competition rate of 12.4 to 1 in last month’s bidding, with all units contracted on the same day. Additionally, the ‘Inocity Ashiang’ commercial facilities supplied in Gwangju-Jeonnam Innovation City in the same month were sold out with an average competition rate of 8.4 to 1.

The reason why demand is flocking to commercial facilities within complexes near business districts and industrial complexes is that they can secure resident households as fixed demand, reducing the burden of vacancies. Furthermore, the influx of industrial complex workers and related industry employees rapidly develops the surrounding commercial area, allowing for stable rental income as well as potential capital gains.

According to the National Tax Service’s standard market price data for commercial buildings and officetels, the market price per square meter of the first-floor commercial space in ‘Songdo The Sharp First World E/F Building,’ located directly opposite the Songdo International Business District in Incheon, was 3,528,000 KRW as of January this year, a 15.74% increase from 3,048,000 KRW three years ago. In contrast, the standard market price of a general collective commercial building nearby (Songdo Plaza) rose only 1.32%, from 4,541,000 KRW in January 2018 to 4,601,000 KRW in January 2021, despite similar location conditions.

Monthly rents also differ between commercial facilities within complexes adjacent to industrial complexes and general commercial buildings. For example, a 38㎡ first-floor commercial unit in ‘Yeongtong I-Park Castle,’ near Samsung Digital City in Suwon, Gyeonggi Province, is listed with a deposit of 50 million KRW and a monthly rent of 2.5 million KRW (based on Naver Real Estate), whereas a nearby general commercial unit of 34㎡ is listed with a deposit of 20 million KRW and a monthly rent of 1.1 million KRW.

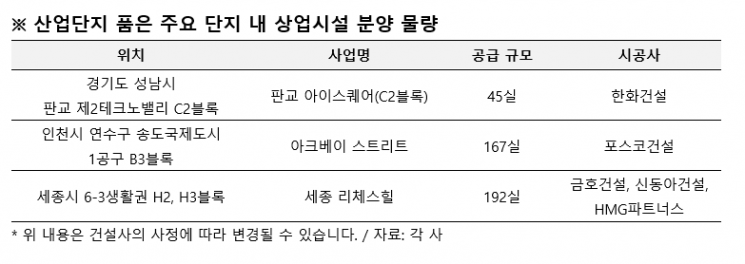

Commercial facilities within complexes near industrial complexes are also scheduled for sale in key areas during the first half of this year, drawing attention.

In Seongnam, Gyeonggi Province, where about 750 companies are expected to move in, ‘Pangyo Ice Square’ is currently being sold. It consists of 45 commercial units from basement level 1 to the 3rd floor, along with 251 officetel units. This complex not only secures fixed demand from approximately 30,000 pyeong of office facilities, officetels, and hotels within the complex but also covers demand from the nearby Pangyo 1st Techno Valley and Pangyo 3rd Techno Valley, providing a hinterland of about 2,500 companies and approximately 130,000 people. Accessibility is excellent with nearby highways including the Gyeongbu Expressway, Seoul Ring Expressway, Daewang Pangyo Road, Bundang Naegok Urban Expressway, and Yongin Seoul Expressway. The Shinbundang Line and Gyeonggang Line passing through Pangyo Station also make commuting to Gangnam easy.

Posco Engineering & Construction is selling the ‘Arc Bay Street,’ a residential-commercial complex in Yeonsu-gu, Incheon. It consists of 167 units across floors 1 to 3. It secures fixed demand from residents of the ‘The Sharp Songdo Arc Bay’ apartment and officetel complex with 1,030 households and is located within the Songdo International Business District, making demand acquisition easy. It is adjacent to the Incheon Subway Line 1 International Business District Station and close to the 2nd Gyeongin Expressway, facilitating convenient access to Incheon International Airport, southwestern Gyeonggi Province, and Seoul.

Kumho Construction, Shindongah Construction, and HMG Partners plan to launch the ‘Sejong Riches Hill’ commercial facilities in Sejong City in May. The complex will have 192 units across floors 1 and 2. It secures fixed demand from the 1,567 households of ‘Sejong Richensia Familier’ residents and benefits from abundant demand from government offices and administrative agencies’ on-site workers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)