[Asia Economy Reporter Ji Yeon-jin] Attention is focused on the price of Bitcoin, which has surged sharply this year, amid growing concerns about tightening following U.S. Treasury Secretary Janet Yellen's remarks on 'interest rate hikes.'

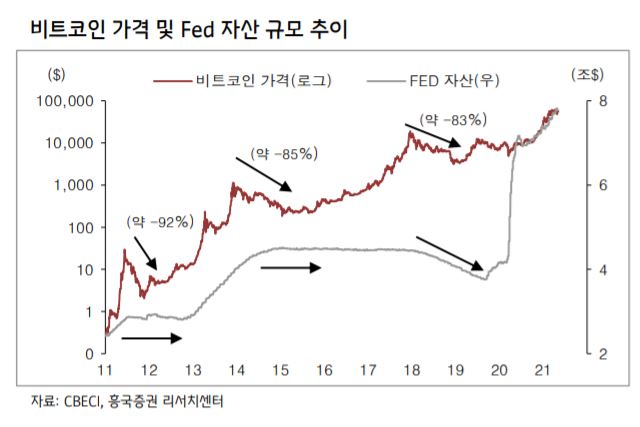

According to Heungkuk Securities on the 8th, Bitcoin prices have shown a sharp decline in the past due to signals from the U.S. Federal Reserve (Fed) about stopping or reducing asset purchases. The Fed stimulated the economy through quantitative easing such as asset purchases after the 2008 financial crisis triggered by the U.S. Lehman Brothers incident. It showed tightening signals in 2011, 2014, and 2018 when the economy showed signs of recovery, and each time, Bitcoin prices were analyzed to have fallen.

Last March, as the global economy faced an unprecedented crisis due to the COVID-19 pandemic, central banks worldwide, including the Fed, implemented accommodative monetary policies, leading to an unprecedented increase in the money supply. As a result, the dollar's value declined and asset prices rose overall, with Bitcoin also showing explosive growth following 2017 and 2019.

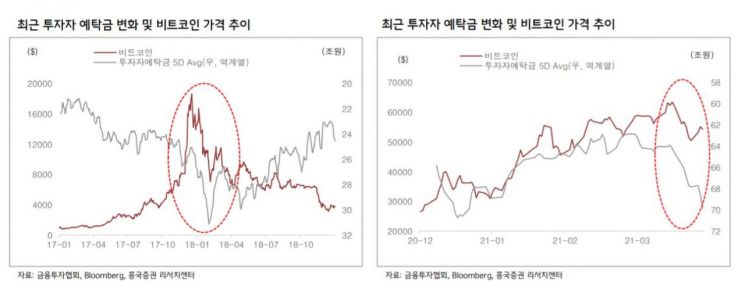

The stock market also rose significantly after the COVID-19 outbreak last year due to bargain buying, but the pace of increase slowed as COVID-19 vaccinations began. With debates over stock market highs and rising U.S. Treasury yields coinciding, the stock market showed sideways movement, and investors are estimated to have moved to the more volatile Bitcoin market after failing to endure the correction in February and March. The number of savings and deposit cancellations among the 2030 generation showed the same trend as Bitcoin prices with a one-month lag since December last year.

For this reason, the financial investment industry predicts that Secretary Yellen's tightening signals may reproduce a decline in Bitcoin prices, potentially causing coin funds to flow back into the stock market. When Bitcoin declined after its 2017 upward cycle, domestic investor deposits also increased, and recently, investor deposits rose following the sharp drop after the rise of Bitcoin and altcoins. Researcher Lim Seong-cheol of Heungkuk Securities said, "Investor deposits can increase or decrease due to various factors such as public offering subscriptions, so we cannot be certain that funds from Bitcoin declines flow into the stock market. However, considering past experiences, recent fund trends, and the correlation with Bitcoin prices, the possibility of re-inflow exists."

Virtual currencies including Bitcoin still carry high regulatory risks and doubts about their practical use remain. Nevertheless, massive funds continue to pour into the coin market. The trading volume of major global exchanges is about $3,300 trillion and has been increasing monthly since October last year. In particular, with companies including Tesla and institutional investors purchasing Bitcoin and launching related products, it is expected to act as a factor supporting the downside in the long term. Researcher Lim predicted, "The ecosystem will be reorganized focusing on large coins and corporate-issued coins that are practically usable."

Meanwhile, Bitcoin soared to 81.69 million won on the 14th of last month but fell to 52.38 million won within ten days. It has since risen again, recently recovering to 67 million won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)