Economy Improved Compared to Last Half of Last Year... Some Assets at All-Time High Valuations

Investment Risks Rise for Non-Bank Financial Institutions like Hedge Funds... Financial System Shaken if Bubble Bursts

Yellen's "Rate Hike" Remarks, but Fed Officials Say "Not Time to Discuss Tapering"

[Asia Economy New York=Special Correspondent Baek Jong-min, Reporter Kim Su-hwan] On the 6th (local time), the Federal Reserve (Fed) of the United States released its Semiannual Financial Stability Report, which judged that the financial conditions of the U.S. economy, households, and businesses have improved compared to the second half report released last year, but issued a "red light" warning regarding the asset market.

The Fed assessed that some assets could experience significant declines and identified risk factors that could shake the financial market. This is interpreted as a preemptive warning about the market bubbles that have emerged this year and the potential damage they could cause. Although Fed officials deny the need for early interest rate hikes or asset purchase reductions, some cautiously raise the possibility of early tightening.

The semiannual financial stability report released on this day is the first analysis report on the global financial market issued by the Fed since the inauguration of the Joe Biden administration.

Concerns Over a ‘Second Archegos Incident’

In the second half report last year, the Fed only expressed concerns about commercial real estate, but this time it was different. The Fed diagnosed that "some assets are highly valued compared to historical standards." The assessment in the second half of last year was that "the risk-adjusted price levels of most assets generally correspond to long-term average levels (historical norms)." This means the Fed judged that if bubbles spreading mainly in some asset markets burst, it could adversely affect the financial system. Earlier, Fed Chair Jerome Powell also mentioned that some asset markets have bubbles.

A particularly notable change in this report is the Fed's strong emphasis on the risks of non-bank financial institutions such as hedge funds. This is because of concerns about a recurrence of the situation during the 2008 financial crisis, when large investment banks collapsed one after another due to indiscriminately sold derivative financial products. In the second half report last year, the Fed evaluated that some non-bank financial institutions were vulnerable to risks but that their vulnerabilities were considerably mitigated by Fed support. However, this time, hedge funds were directly mentioned and identified as a source of instability.

Regarding this, a major foreign media outlet evaluated that the Fed sent a warning about the risks of leveraged investments revealed by the collapse of Archegos Capital. The Fed also expressed concern that despite various regulatory expansions, the Archegos Capital incident was not detected in advance. This vulnerability is judged to potentially shake the global financial system and hinder economic recovery from COVID-19.

Rayel Brainard, Fed Governor who led the preparation of this report, stated in a separate statement that "more detailed disclosure of investment information is necessary to prevent the pain that hedge funds could cause."

The warning of a crisis originating from hedge funds is not limited to the U.S. If COVID-19 worsens again, the highly leveraged investments of hedge funds could backfire. The Fed forecasted that if COVID-19 worsens again, problems could arise in the financial systems of emerging markets and some European countries. Archegos Capital also suffered huge losses after heavily investing in Chinese stocks. The damage to investment banks caused by Archegos is estimated to exceed $10 billion. The Fed also identified the GameStop stock surge case and the boom in Special Purpose Acquisition Company (SPAC) investments as risk cases.

Despite Fed Denials... Early Tightening Theory Gains Ground

The focus is on whether the Fed's judgment will lead to early interest rate hikes or asset purchase reductions. Despite Treasury Secretary Janet Yellen mentioning the need for interest rate hikes, many Fed officials maintain that it is not yet time to discuss rate hikes or asset purchase reductions.

A major foreign media outlet reported that although the weekly initial jobless claims announced on this day fell below 500,000, the lowest since the COVID-19 crisis, U.S. Treasury yields declined, reflecting the market's view that the Fed will not pursue monetary policy normalization.

Contrary to the stance of most Fed officials, there are opinions that monetary policy should be normalized early. Robert Kaplan, President of the Federal Reserve Bank of Dallas, said on this day, "The Fed should soon begin discussions on tapering (asset purchase reduction)" and added, "Imbalances and bubble issues are appearing in the capital markets."

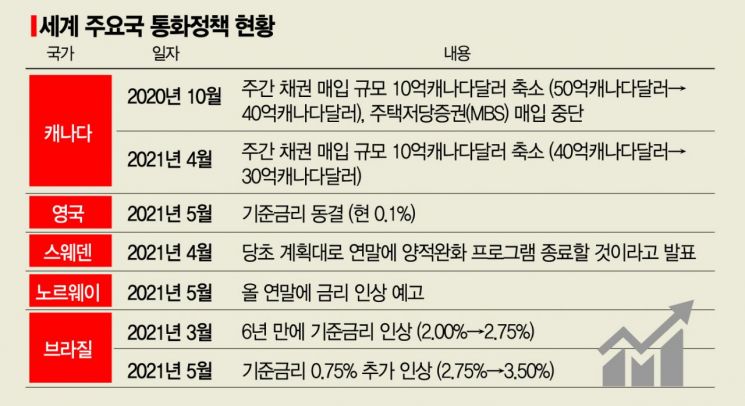

Countries outside the U.S. are accelerating monetary policy normalization. At the Monetary Policy Committee (MPC) of the Bank of England (BOE), the UK central bank, there was a minority opinion advocating tapering. Andy Haldane, the Chief Economist who is retiring from the MPC in June, was the only one to vote for reducing bond purchases at the meeting and argued that the purchase volume should be reduced by about 50 billion pounds.

Earlier, the Bank of Canada announced a reduction in asset purchases, and the Swedish central bank also announced the end of its quantitative easing program. The Norwegian central bank announced it would raise interest rates by the end of the year. Bloomberg News analyzed that "discussions on how long to maintain the current quantitative easing stance are actively underway in major countries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.