Top-tier Loan Companies' Total Assets and Net Income Decline

Major Firms Also Sequentially Halt Loans and Withdraw from Business

70% of Those Denied Loans Resort to Illegal Private Loans

[Asia Economy Reporter Song Seung-seop] The financial authorities' regulations and successive reductions in the maximum interest rate have severely deteriorated the management indicators of major loan companies. These companies are either halting new loans or contemplating market withdrawal. Experts warn that if the regulated loan market collapses, financially vulnerable low-credit groups could be severely impacted, as they may be driven into the illegal private loan market.

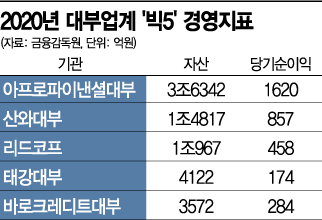

According to the Financial Supervisory Service on the 7th, the total assets of the top five loan companies last year (Apro Financial Loan, Sanwa Loan, Leadcorp, Taegang Loan, Baro Credit Loan) amounted to 6.9822 trillion KRW, down 204 billion KRW from the previous year. Net income also shrank by 32.84% (166 billion KRW) from 505.6 billion KRW to 339.5 billion KRW within one year. Even among the top 10 companies, net income decreased by 21.34% (117.3 billion KRW) from 549.8 billion KRW.

The problem is that these companies are not trying to overcome management difficulties but are instead moving toward shutting down their businesses. In 2019, the Big 5 companies officially announced their withdrawal, causing some ranking changes, and the newly entered Big 5 companies also face uncertainty in continuing their operations. At that time, Welcome Credit Line Loan, which was ranked, planned to withdraw by 2024, and Joy Credit stopped issuing new loans.

Sanwa Loan (company name Sanwa Money), a Japanese loan company that had been the undisputed industry leader for several years, stopped issuing new loans in March 2019. Currently, it is focusing solely on recovering loan principal and interest. The timing for resuming loans is also uncertain. Sanwa Loan states this is for soundness management, but there are speculations that the prolonged suspension of loans effectively means withdrawal from the Korean market.

Loan Companies Withdrawing One After Another... 70% of Low-Credit Borrowers Rejected Face Illegal Private Loans

As Sanwa Loan’s asset ranking shrinks, Apro Financial Loan, which has taken the top industry spot, faces a similar situation. This company launched OK Savings Bank by acquiring Yeju and Yenarae Savings Banks in 2014. As a condition of the acquisition, it promised the financial authorities to withdraw from the loan business by 2024.

Leadcorp, ranked third, shows a steady decline in loan receivables. This year, it slightly increased by 9.3 billion KRW to 893.3 billion KRW compared to the previous year, but this is a small figure compared to the nearly 1 trillion KRW in loan receivables it aggressively managed in the past. This has led to speculation in the market that the loan business might be downsizing.

The loan industry’s trajectory is closely related to the scheduled reduction of the statutory maximum interest rate in July. The cost of funds for loan businesses typically includes a bad debt ratio of 10-12%. Additionally, brokerage fees are 4%, and the cost of funds is known to be in the 6% range. The cost alone reaches at least 20%, and when adding labor and related expenses, operating at a statutory maximum interest rate of 20% inevitably leads to losses.

If the loan industry shrinks, the financial difficulties of vulnerable groups will worsen. Currently, the loan approval rate in the loan industry is around 10%, meaning 9 out of 10 applicants are rejected. Vulnerable groups who urgently need funds but find it difficult to secure loans are highly likely to turn to illegal private lenders.

According to recent research published by the Institute for Financial Inclusion, 69.9% of those rejected by loan companies obtained loans from illegal private lenders at rates exceeding the legal interest rate. It is estimated that 30% of borrowers pay interest exceeding the principal, and 12.3% of vulnerable groups pay annual interest rates exceeding 240%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)