Daishin Securities Suggests KOSPI Top at 3380 in May

Samsung Securities Also Forecasts Up to 3300

[Asia Economy Reporter Minwoo Lee] The American stock market adage 'Sell in May,' which typically applies during the sluggish May stock market, is drawing attention to whether it will hold true this year as well. In the securities industry, there is an analysis suggesting the need for a 'Stay in May' approach, meaning to observe rather than sell and leave. This is based on the judgment that, as the global economy is recovering faster than expected, the inflationary pressure expansion and the impact of the resumption of short selling may be less severe than feared.

Expectations Mount for KOSPI to Surpass 3300

On the 6th, Daishin Securities forecast that the KOSPI could rise to as high as 3380 points in May. It could even reach an all-time high. This is based on the assessment that the global economy and trade are recovering faster than expected, leading to upward revisions in domestic corporate earnings forecasts. Samsung Securities also set the upper end of the KOSPI forecast at 3300.

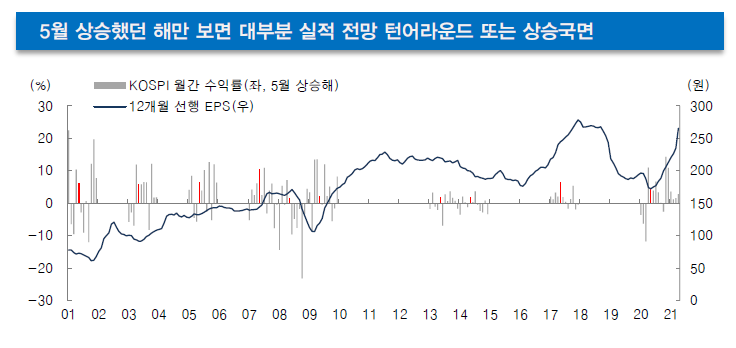

Over the past five years, the phenomenon of 'selling and leaving in May' in the KOSPI market has appeared intermittently. In May 2016, the KOSPI fell by -0.54%, but in May the following year, it rose by 6.44%. Subsequently, in 2018 and 2019, it declined by -3.67% and -7.34%, respectively, realizing the adage. However, after the direct hit of COVID-19, a strong rebound occurred last year with a 4.21% increase.

The securities industry has diagnosed that, with the ongoing economic recovery, an upward market trend will continue in May this year as well. Lee Kyung-min, a researcher at Daishin Securities, said, "The possibility of the stock market adage urging investors to sell and leave in May, which stirs investor anxiety, becoming a reality is low," adding, "The expansion of inflationary pressure and the resumption of short selling will not have a significant impact on the global stock market and KOSPI's upward trend."

Inflation Increase Expected to Be Below Forecast...Possibility of Overseas Liquidity Inflow

The inflation increase is likely to be less than feared, and even that is considered a temporary rise due to the base effect of oil prices. The researcher explained, "Bond yields in the first quarter of this year have already priced in variables such as inflation expectations, monetary policy uncertainty, supply-demand instability, and an increase in bond issuance volume, so bond yields are expected to remain stable," adding, "The resumption of short selling could be a short-term supply-demand disruption factor and increase volatility in individual stocks."

He rather expects overseas liquidity to flow in with a time lag. The researcher said, "As the distortion in spot-futures prices eases, it is expected to have a positive effect on the supply-demand of large-cap stocks," and added, "The weakness of the US dollar is another variable improving foreign investor supply-demand, increasing the likelihood of inflows of various types of overseas funds such as active funds, hedge funds, and long-short funds."

Short-term Volatility Due to Treasury Secretary Yellen's Remarks... 'No Major Change in Policy Stance Expected'

However, there is an analysis that remarks by US Treasury Secretary Janet Yellen suggesting the need for interest rate hikes could be a short-term burden. On the 5th (local time), the Dow Jones Industrial Average closed at a record high of 34,230.34, up 0.29% from the previous session at the New York Stock Exchange (NYSE). The S&P 500 also closed up 0.07% at 4167.59. The Nasdaq Composite, focused on technology stocks, closed down 0.37% at 13,582.42 during the same period.

Yellen's comment that "interest rates may need to be raised somewhat to prevent the economy from overheating" caused the Nasdaq to fall by over 2% the previous day, but she later clarified at a Wall Street Journal (WSJ) hosted event that the remarks did not predict or recommend a rate hike, which somewhat calmed the market.

The researcher explained, "Federal Reserve Chairman Jerome Powell emphasized in the March and April Federal Open Market Committee (FOMC) press conferences that inflationary pressures are unlikely to persist and that tapering (reducing asset purchases) is premature," adding, "There may be concerns about tightening due to tapering and expanding inflationary pressures, but the conditions for maintaining and strengthening the global asset inflation phase remain valid."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.