A graph showing the KOSPI 200 stock price (red) and KOSDAQ 150 stock price (blue) was displayed on the afternoon of the 3rd, when short selling of the constituent stocks of the KOSPI 200 and KOSDAQ 150 indices was partially resumed after 1 year and 2 months. [Image source=Yonhap News]

A graph showing the KOSPI 200 stock price (red) and KOSDAQ 150 stock price (blue) was displayed on the afternoon of the 3rd, when short selling of the constituent stocks of the KOSPI 200 and KOSDAQ 150 indices was partially resumed after 1 year and 2 months. [Image source=Yonhap News]

[Asia Economy Reporter Lee Seon-ae] Since short selling resumed only for the components of KOSPI 200 and KOSDAQ 150, individual investors have been voicing strong complaints against institutions and foreigners for their short selling activities in stock discussion forums on portal sites. A petition requesting the Blue House to set a repayment period for institutional short selling has even appeared, and various investment communities and stock-related open chat rooms (KakaoTalk, Telegram) are sharing the petition posts and encouraging agreement.

According to the Blue House petition site on the 6th, a petition titled "Please set a repayment period for short selling for institutions as well as individuals in the securities market" was posted on the 3rd. As of 9:20 AM, this petition has garnered 55,711 supporters.

The petitioner stated, "I agree with maintaining the system because short selling has positive functions such as price discovery," but added, "However, despite some improvements made by the government to the related system, the playing field is still unfairly tilted against individuals, so I petition for system improvement."

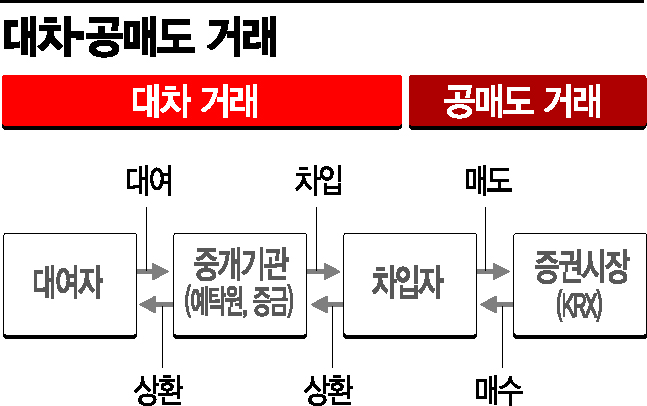

The issue pointed out by the petitioner is the "repayment period." The petitioner explained, "Individuals must repay borrowed stocks for short selling within 60 days unconditionally, but institutions and foreigners can set the period by mutual agreement after borrowing stocks, effectively making it indefinite," and argued, "If even a repayment period of about one year is set, institutions and foreigners will be much more cautious when executing short selling, and the Korean stock market will transform from a playground into a more mature capital market."

Various open chat rooms and communities are filled with posts encouraging agreement with the petition and complaints about the resumption of short selling. One individual investor lamented, "I bought Doosan Fuel Cell and KM Double U seeing their growth potential, but I did not expect to suffer losses due to such a short selling bomb." Jeong Ui-jeong, head of the Korea Stock Investors Association, emphasized, "With short selling resuming after one year and two months, short selling entities are expected to move actively," adding, "Short selling will definitely have an impact, such as exerting downward pressure on the index."

Meanwhile, despite individual investors’ complaints, the securities industry still expects the impact of short selling on index rises to be limited. Lee Seung-woo, head of the Eugene Investment & Securities Research Center, said, "In the long term, the impact of short selling is likely to be short-lived," and forecasted, "If corporate earnings support it, the stock price will return to its original level." Hwang Se-woon, a research fellow at the Korea Capital Market Institute, also stated, "The probability of a trend decline is limited," and added, "It can be interpreted as a factor increasing volatility."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.