Big Tech and Fintech Allowed to Register as Insurance Agencies

People Power Party Proposes Amendment to Insurance Business Act

[Asia Economy Reporter Oh Hyung-gil] Legal amendments are once again being pursued to allow big tech companies like Naver, as well as online shopping malls and fintech firms, to register as insurance agencies (GA).

Although online platform companies are accelerating their entry into the financial industry, direct entry into the insurance sector has been difficult due to high entry barriers such as sales regulations.

The insurance industry is wary of the emergence of strong competitors. There are concerns that the appearance of various sales channels could lead to incomplete insurance sales, which would be detrimental to consumer protection.

According to the insurance industry on the 6th, the amendment to the Insurance Business Act, which was introduced by Representative Seong Il-jong of the People Power Party on the 4th, includes provisions allowing electronic financial service providers to register as insurance agencies (GA).

Under the current Insurance Business Act, institutions eligible to register as GAs are limited to financial institutions such as banks, investment brokers, and mutual savings banks.

Because of this, IT companies have had to take a detour by establishing new corporations to register as GAs. When agency registration is restricted, they either recruit insurance indirectly through subsidiaries or provide limited services in the form of advertisements. A representative example is Naver Financial’s establishment of the insurance-specialized corporation ‘NF Insurance Service’ in July last year to start insurance services.

Representative Seong said, "As non-face-to-face transactions become more active, limiting insurance agencies to financial institutions falls behind the changes in the consumer market in the COVID era," adding, "Reflecting insurance consumers’ preference for non-face-to-face transactions, insurance sales should also be allowed to telecommunication sales operators licensed for electronic financial services."

As of the end of April, there are a total of 162 companies registered as electronic financial service providers. These include online shopping companies and payment gateway providers such as Naver Financial, Kakao, T-money, Woowa Brothers, Bank Salad, and Viva Republica (Toss). If GA registration regulations are relaxed for them, new business opportunities are expected to be created.

Insurance Industry Voices Concerns Over Non-Face-to-Face Incomplete Sales

In the 18th and 19th National Assemblies, bills proposing to allow electronic financial service providers to register as insurance agencies were introduced but all failed to pass. However, the atmosphere is different this year. The financial authorities are also pushing for measures to allow various digital recruitment methods.

The Financial Services Commission is reviewing institutional improvements to allow platform operators such as electronic financial service providers and MyData businesses to register as insurance agencies. They also plan to improve regulations unsuitable for platform operators, such as the requirement that at least 10% of GA employees hold insurance planner qualifications.

The insurance industry is visibly tense about platform operators entering the insurance market. Earlier this year, Kakao Pay applied for preliminary approval from financial authorities to establish a digital non-life insurance company and is currently undergoing the formal licensing process. The financial platform Toss is expanding its influence by launching the Toss Insurance Partner, a sales support application exclusively for insurance planners.

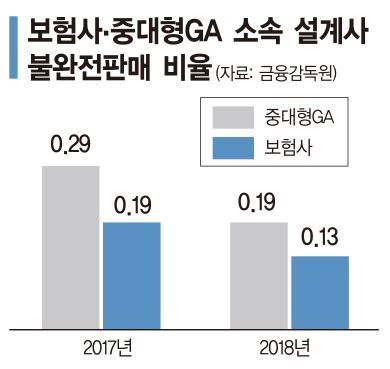

The insurance industry is concerned that insurance recruitment conducted digitally could lead to incomplete sales. There are criticisms that complaints may increase due to insufficient product explanations during the purely non-face-to-face sales of complex products that consumers find difficult to understand. There is also a sense of crisis that, as with the emergence of large GAs, platform operators’ growing influence could lead to insurance companies becoming dependent on them.

An insurance industry official said, "It has been difficult to assign post-sale responsibility, as discussions on strengthening GA sales accountability to improve insurance recruitment order have been ongoing for years," adding, "Just as the Financial Consumer Protection Act has strengthened sales responsibility for incomplete sales, the same regulations should be applied to platform operators."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)