New 40-Year Mortgage Introduction in Second Half of This Year

Discrepancy Between Target Housing Price Criteria and Reality

Generational Conflict Over Eligibility for Applicants Aged 39

Experts Say "Need to Broaden Range of Options"

[Asia Economy Reporter Kim Jin-ho] The 40-year mortgage (home loan) introduced by financial authorities to serve as a housing ladder for young people is embroiled in controversy over its "realism and fairness." With housing prices having already surged, the income and housing price criteria are no different from existing policy mortgages, creating a significant "gap" from reality. There are concerns that even if utilized, only some "gold spoon" individuals will benefit. Some also criticize the policy's benefits being limited to youth and newlyweds, questioning whether it "incites intergenerational conflict."

According to financial authorities and the financial sector on the 6th, the Financial Services Commission plans to newly introduce a 40-year ultra-long-term mortgage in the second half of this year to prevent increased difficulties for low-income and young people due to strengthened loan regulations under the "household debt management plan." The product is scheduled to be sold through the Korea Housing Finance Corporation as early as July.

The 40-year mortgage was promoted to help low-income young people purchase their own homes. It is offered to youth under 39 years old and newlyweds within seven years of marriage, and will be prioritized for introduction in the Home Plus Loan and Eligible Loan handled by the Korea Housing Finance Corporation. The current 30-year mortgage term will be extended by 10 years to reduce the burden of principal and interest repayments. For example, a 40-year mortgage reduces the monthly repayment burden by about 15% compared to the existing 30-year term. For a 300 million KRW loan, the monthly principal and interest payment decreases from 1.22 million KRW (Home Plus Loan, 2.75% annual interest) to 1.04 million KRW.

Market Reaction Skeptical... Criticism of "Unrealistic Policy"

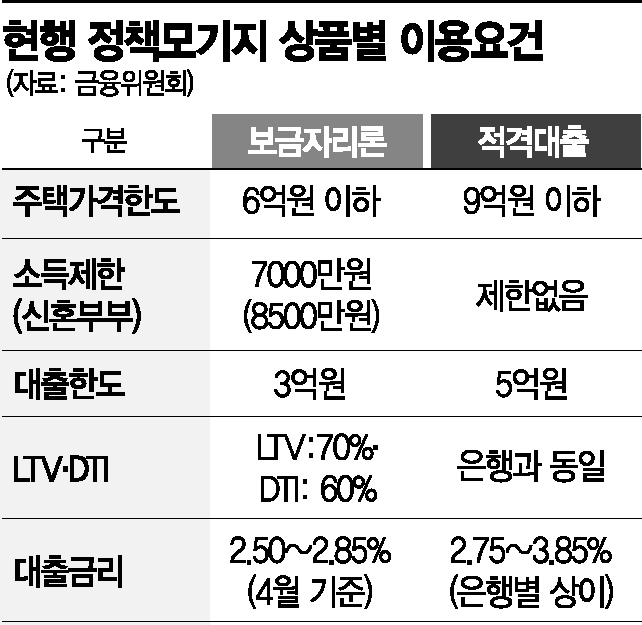

However, contrary to the government's hopes, there is strong criticism in the market even before the launch, labeling it an "unrealistic policy." The housing price criteria for the products (Home Plus Loan and Eligible Loan) where the 40-year mortgage will be introduced (600 million KRW and 900 million KRW) are pointed out as detached from reality.

According to Real Estate 114, apartments priced below 600 million KRW in Seoul account for only 20% (260,000 households). The Nodobang area (Nowon, Dobong, Gangbuk) and Geumgwan district (Geumcheon, Gwanak, Guro), where apartments under 600 million KRW were concentrated, have seen rapid price increases this year, making it likened to "finding a needle in a haystack" to find suitable apartments even if the 40-year mortgage is introduced. In Gyeonggi Province, which is convenient for commuting to Seoul, apartments priced below 600 million KRW have decreased by 290,000 households in the past year.

Even when using the Eligible Loan with a higher limit, the situation is not much different. Last month, the average apartment sale price in Seoul was 1.11123 billion KRW, and the median price was 986.67 million KRW. In particular, the Eligible Loan has a lower loan-to-value ratio (LTV) than the Home Plus Loan, requiring 400 to 500 million KRW in cash liquidity when used. Criticism arises that only so-called "gold spoon" individuals or high-income groups who can receive parental assistance will benefit.

The eligibility criteria for the 40-year mortgage have even sparked intergenerational conflict. The qualification is limited to those under 39 years old, provoking strong backlash from people in their 40s and 50s, especially on real estate communities. Online communities are flooded with posts such as "Having children may make housing stability issues more serious than for young people," and "Are people in their 40s and 50s not allowed to dream of owning a home? I turned 40 this year and feel unfair."

Experts point out that financial authorities lacked delicacy and consideration in policy decisions. A financial real estate expert who requested anonymity said, "From the borrower's perspective, there will inevitably be dissatisfaction as the range of choices should be more diverse," adding, "In Japan, ultra-long-term mortgages include systems such as child succession, and it seems desirable to refer to this and expand eligibility."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.