[Asia Economy Reporter Song Hwajeong] Since last year, the domestic IPO fever has not cooled down as large-scale initial public offerings (IPOs) have continued. Overseas, IPOs of growth companies are also ongoing, leading to opinions that it is necessary to understand IPO trends as an indicator to gauge growth potential.

According to Hanwha Investment & Securities on the 5th, IPOs are active in both domestic and international stock markets. Overseas, unicorn companies of the 4th Industrial Revolution, which began listing in earnest from 2018, took a brief pause in the first half of last year due to the COVID-19 pandemic but have since resumed IPOs. The domestic market, in particular, has many large-scale IPOs scheduled for this year.

Researcher Kim Suyeon of Hanwha Investment & Securities said, "IPOs are important as an indicator to gauge growth potential," adding, "By observing where IPOs occur most frequently and in which industries the scale and number of IPOs increase, we can understand the relative strength of growth."

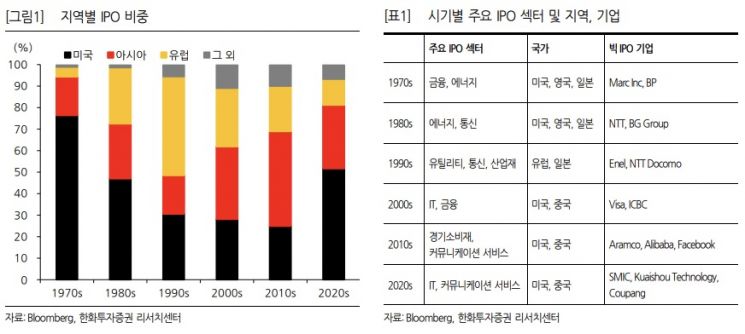

Looking at each decade since the 1970s, the 1970s were dominated by the United States, the 1980s and 1990s by Japan and Europe, and since the 2000s, IPOs have been active in Asia, including China.

While finance and energy were the representative IPO sectors in the 1970s and 1980s, the 1990s saw utilities and telecommunications, and from the 2000s onward, IPOs have centered around IT, consumer discretionary, and communication services.

Until the 1970s, the U.S. financial market was relatively large, and IPOs mainly took place in the U.S. Researcher Kim explained, "In the 1970s, 76% of global IPOs were U.S. companies," adding, "The sectors were also prominent in traditional cyclical areas such as finance and energy."

In the 1980s, the U.S. still accounted for the largest share of IPOs at 47%, but there were slight changes in leading sectors by region. In the U.S., companies focused on research and development (R&D) such as IT and healthcare began to list. Companies that now dominate the stock market, including Apple, Microsoft, Nike, and Merck, went public during this period, and 26 of the top 100 U.S. companies by market capitalization entered the stock market in the 1980s.

Since IT was not yet the leading sector in the 1980s, the IPO sizes of Apple, Microsoft, and others were not large, and traditional companies still entered the stock market with large IPOs in Europe and Japan. Japan’s telecommunications company NTT, the UK’s energy company BG Group, and France’s financial company Soci?t? G?n?rale were representative listed companies in the 1980s. Researcher Kim said, "This trend continued into the 1990s, especially with many European companies going public," adding, "With expectations for a unified EU, the Euro Stoxx 50 rose from 1500 points in 1995 to 5450 points in the early 2000s, fueling enthusiasm in the public offering market." The IPO amount of European companies in the 1990s was $600 billion, exceeding the $536 billion of the 2010s.

In the 2000s, the Chinese financial market opened and began to lead the IPO market. Chinese financial stocks such as Industrial and Commercial Bank of China (ICBC) and Bank of China were listed in Hong Kong, and energy companies like PetroChina were listed sequentially in Hong Kong in the early 2000s and on the mainland in 2007. Notably, listings were prominent during the sharp rise of the Chinese stock index from 2005 to 2007.

A characteristic of the 2010s is the increase in large-scale IPOs capable of entering the top market capitalization rankings worldwide, excluding Aramco’s 2019 listing as the world’s largest by market cap. Researcher Kim analyzed, "Facebook, which went public in 2012, immediately entered the 57th position in the U.S. stock market that year, and Alibaba, listed in the U.S. in 2014, had a market capitalization comparable to PetroChina right after listing," adding, "Growth companies in IT and communication services led large IPOs and established themselves as representative stocks in their sectors after listing."

There is an opinion that the current IPO market can be seen as a continuation of the late 2010s. Asian and U.S. IT-based growth companies such as Kuaishou, Coupang, and Airbnb are entering the stock market through IPOs. Researcher Kim said, "The scale of IPO markets in Europe and Japan has relatively decreased, indicating that the center of growth has shifted to Asia and the U.S."

Large growth stock IPOs are also scheduled one after another domestically this year. Researcher Kim analyzed, "The entry of large growth stocks into the stock market may pose short-term supply and demand burdens, but since these companies reflect global trends and represent future growth, it is positive in the long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.