Demand Deposits Surge by 52 Trillion Won Over 3 Months

Credit Loans Increased by 6.84 Trillion Won Last Month

Funds Shift to Cryptocurrency and Public Offering Stocks

[Asia Economy Reporter Kim Hyo-jin] The 'money move' phenomenon, where market funds shift due to the virtual currency and public offering stock investment craze, is intensifying. This means that as speculative and investment asset prices soar, more people are trying to actively manage their money rather than just leaving it idle.

Credit loans are also surging, raising concerns about potential defaults and the side effects of 'debt investment' (borrowing to invest).

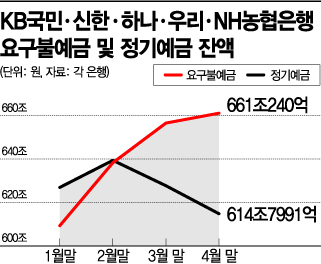

According to the banking sector on the 4th, the demand deposit balance of the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?stood at 661.024 trillion won as of the end of last month, increasing by 4.54 trillion won compared to the end of March. In February, it rose by about 29 trillion won, and in March by about 18 trillion won. This means it surged by nearly 52 trillion won over three months.

Demand deposits include checking accounts and money market deposit accounts (MMDA) that depositors can withdraw at any time, serving as a waiting place for funds before investment.

Conversely, time deposits, which are meant to be deposited and managed, are rapidly declining like a receding tide. At the end of last month, the time deposit balance of the five major banks was 614.7991 trillion won, down by 12.8814 trillion won compared to the end of March. Considering that 2.6667 trillion won was withdrawn in March, this is an unusual level of decrease.

Time Deposits Recede... Credit Loans Surge Again

Meanwhile, credit loans, which had slowed at the beginning of the year, have turned to a rapid increase. The credit loan balance of these banks at the end of last month was 142.2278 trillion won, up by 6.8401 trillion won compared to the end of March. The increase far exceeded the financial authorities' management target of 2 trillion won by more than three times.

It is analyzed that this recent trend of loosening the reins on safe assets and taking out loans to jump into investment destinations is fully reflected in these figures.

The banking sector views that a significant portion of market liquidity is flowing into the virtual currency market. For example, NH Nonghyup Bank, which partners with Bithumb and Coinone, saw newly opened accounts increase by about 145% in the first quarter alone, and K Bank, an internet-only bank providing real-name accounts to Upbit, added about 1.46 million customers last month.

Domestic virtual currency trading volume on the 15th of last month reached approximately 21.63 billion dollars (about 24 trillion won) in a single day, surpassing the combined domestic stock investment and overseas investment amount of 21 trillion won, demonstrating strong momentum.

A representative from a commercial bank explained, "Money moves such as the sharp decline in time deposits and the increase in demand deposits are caused by very strong factors," adding, "It can also be seen as a new flow of money created by the virtual currency craze."

'Debt Investment' Reemerges Centered on Virtual Currency

The enthusiasm for SK IE Technology (SKIET) public offering stock subscription also appears to have fueled this flow of money. During the SKIET public offering subscription on the 28th and 29th of last month, a record-high subscription deposit of 80.9017 trillion won was gathered, and credit loans at the five major banks increased by about 5.54 trillion won over the two days. This accounts for 80% of the increase in April.

Professor Sung Tae-yoon of Yonsei University's Department of Economics emphasized the need for moderation, saying, "Among those who borrow credit loans to invest, low-credit borrowers are very vulnerable to interest rate hikes, so the market could become unstable due to pressure for interest rate increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.