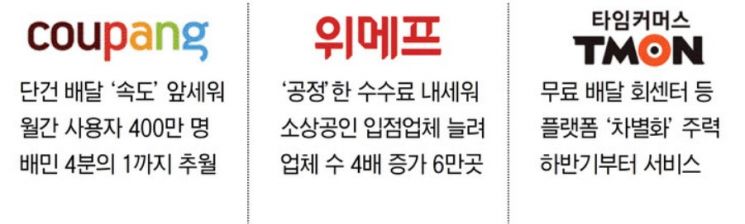

Coupang Focuses on 'Speed' · Wemakeprice on 'Fairness' · Tmon on 'Differentiation'

In 2010, three companies that started their services simultaneously and were known as the ‘three social commerce companies’ at the time are now competing again in the delivery service market. With TMON officially entering this market, it is set to battle Coupang and WEMAKEPRICE, who had already laid the groundwork. Although the distinction of ‘social commerce’ has become ambiguous and each company’s status and direction have diverged, just like over a decade ago, these three companies are entering a market dominated by existing leaders and launching offensives with different strategies. Coupang’s strategy emphasizes ‘speed’ through single-order delivery, while WEMAKEPRICE highlights ‘fair’ commissions for small business owners. As a latecomer preparing its delivery service, TMON is focusing on ‘differentiation’ as its strategy.

◆ TMON Focuses on ‘Differentiation’ = According to industry sources on the 6th, TMON is preparing a delivery service as one of its various new businesses, and this service is expected to launch by the second half of this year at the latest. TMON is concentrating on strengthening its function as a platform. The explanation is that TMON is preparing various services to provide customers with more experiences when they enter the TMON platform, and delivery is one of these new businesses. The surge in demand for delivery services after COVID-19 and the emergence of such services as necessities for platform users are understood to be the background for TMON’s push into this business.

In fact, TMON is already making several attempts to provide new value to platform users. For example, a recently launched service called ‘TMON Hoe Center’ delivers spring seasonal sashimi and seafood from Noryangjin Fish Market free of charge to all areas of Seoul and some parts of Gyeonggi and Incheon. If ordered by noon, seafood secured through same-day auctions is prepared and delivered immediately. This means customers can put freshly caught fish sashimi on their dinner table with just one click without visiting the fish market. Although it was already possible to order delivery from Noryangjin Fish Market, TMON focuses on providing users with a simple and safe service.

Since TMON is starting its delivery service late, the industry predicts it will take a different form. A TMON official said, “We continue to pursue new businesses and attempts to provide value, experience, and various services to customers using TMON. Accordingly, we are preparing as planned, so please stay tuned.”

◆ Coupang Eats’ ‘Speed’ and WEMAKEPRICE O’s ‘Fairness’ = On the other hand, Coupang, which started its delivery service in 2019, is increasing its market share by emphasizing ‘speed.’ Coupang Eats’ core strategy is single-order delivery, where one delivery rider handles one order at a time. Through this, it has secured 4 million monthly users, catching up to about a quarter of the users of Baedal Minjok (Baemin), the market leader. Unlike the existing method where one rider handles 3 to 4 orders at once, this strategy requires securing enough delivery riders and capital investment to guarantee rider earnings. Coupang is actively investing to enable customers to receive food about 30 minutes faster at a similar price.

WEMAKEPRICE O, which was launched by WEMAKEPRICE in 2019 and spun off as an independent corporation in November last year, is increasing the number of partner stores by emphasizing fairness in this commission-sensitive market. In September last year, WEMAKEPRICE O introduced a ‘0% brokerage commission’ policy, charging only a server fee of 8,000 KRW per week. This policy proved effective, with the number of partner dining establishments reaching 60,000 as of March this year, a fourfold increase compared to the previous year. Compared to May 2019, when the service was in its early stages, this represents a staggering 32.4-fold (3,149%) increase. Additionally, since December last year, WEMAKEPRICE O has participated in the Zero Delivery Union, lowering the flat-rate commission to 2%, resulting in a 3.4-fold (248%) increase in the number of partner dining establishments in the Seoul area compared to the same period last year.

A WEMAKEPRICE O official explained, “By consistently maintaining a fair delivery policy, the number of restaurant owners choosing WEMAKEPRICE O has increased, and this has led to a virtuous cycle where order customers and transaction amounts are also growing.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.