Two-Year Integration Process

Application for Final Approval to Financial Services Commission

'Shinhan Life' Launch in July

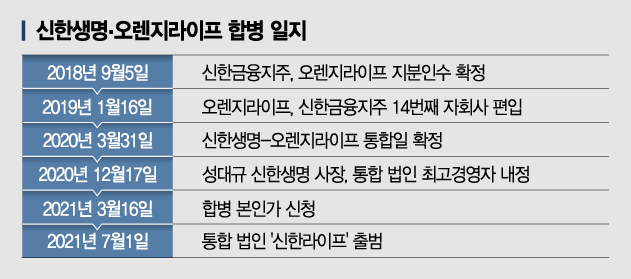

[Asia Economy Reporter Oh Hyung-gil] The two-year integration process between Shinhan Life Insurance and Orange Life, which heralds the birth of a new ‘Big 4’ in the life insurance industry, has entered its final stage.

They are expected to receive merger approval from financial authorities as early as mid-this month and make a fresh start as ‘Shinhan Life’ on July 1. Both companies have achieved strong performances consecutively last year and this year, signaling the emergence of a major life insurer.

According to financial authorities and the insurance industry on the 4th, the two companies applied for final approval of the merger to the Financial Services Commission on March 16 and are currently awaiting the final decision by the Commission. Insurance company mergers are required to be processed within 60 days after the application for final approval, so a final conclusion is expected next week.

The insurance industry anticipates that the merger approval between Shinhan Life and Orange Life will be granted without difficulty. The financial authorities comprehensively review the applicant insurer’s capital adequacy ratio, liabilities, solvency ratio, and the suitability of major shareholders.

In particular, the variable related to sanctions on Shinhan Financial Group (Shinhan Jiju), the major shareholder of Shinhan Life, has been resolved, and it is widely expected that there will be no surprises.

Regarding the Lime incident, Shinhan Financial had been preliminarily notified of a severe sanction of ‘institutional warning,’ but at the Financial Supervisory Service’s disciplinary committee held last month, the level was lowered by one step to ‘institutional caution,’ easing the burden of the major shareholder suitability review.

Shinhan Life and Orange Life have been conducting full-scale integration work since January 2019, after Orange Life became a group subsidiary, by launching the ‘New Life Promotion Committee.’

To minimize the burden of the merger, they chose to apply integration projects by department, starting with ICT and finance. Last month, they also secured new talent by recruiting the first batch of new employees for Shinhan Life.

They also minimized confusion in management leadership by early appointing Sung Dae-gyu, president of Shinhan Life, as the CEO of the integrated corporation. President Sung is an insurance expert who has experience with financial authorities, research institutions, and CEOs of private life insurers, and he has been leading the practical integration work alongside Lee Young-jong, vice president of Orange Life.

Cho Yong-byeong, chairman of Shinhan Financial Group, expressed his ambition, saying, "We will combine the capabilities of both companies in developing new products from the customer’s perspective, enhancing digital convenience, and consumer protection to provide differentiated value to customers who transact with Shinhan. Through Shinhan’s unique success DNA that turns crises into opportunities, we will nurture it into a top-tier insurer that shakes the industry’s landscape."

The launch of the integrated corporation ‘Shinhan Life’ is expected to change the rankings in the life insurance industry.

As of the end of last year, the total assets of Shinhan Life and Orange Life amounted to KRW 36.7592 trillion and KRW 34.7504 trillion, respectively. This ranks them fourth after Samsung Life (KRW 309 trillion), Hanwha Life (KRW 127 trillion), and Kyobo Life (KRW 115 trillion). In terms of net income, they recorded KRW 168.6 billion and KRW 227.5 billion, respectively, surpassing Hanwha Life (KRW 196.9 billion) and Kyobo Life (KRW 382.8 billion).

The strong performance trend has continued this year. Shinhan Life’s net income for the first quarter of this year was KRW 72.8 billion, an 83% increase compared to the same period last year. It is evaluated that they succeeded in adjusting their portfolio mainly to protection insurance through a sales strategy focused on profitability.

Orange Life also achieved a net income of KRW 107.7 billion, an 81% increase compared to the same period last year. Despite the COVID-19 pandemic and sluggish insurance market conditions, both companies have grown over 80%, raising expectations for synergy from the integration.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.