7 Major Credit Card Companies as of March

Average Interest Rate Reduced by 0.36%p Compared to End of Last Year

[Asia Economy Reporter Ki Ha-young] Ahead of the statutory maximum interest rate reduction scheduled for July, cash advance (short-term loan) interest rates at credit card companies are decreasing. With the maximum interest rate set to be lowered from the current 24% to 20%, it is interpreted that card companies have begun adjusting their rates.

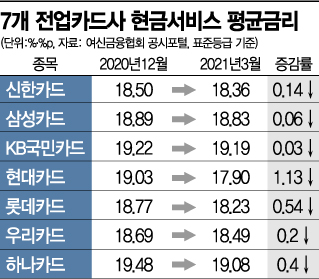

According to the credit finance association's disclosure on the 4th, as of the end of March, the average cash advance interest rates (operating price) based on standard grades of seven major credit card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Woori, Hana) ranged from 17.90% to 19.19%. The average rate among the seven companies was 18.58%, which is 0.36 percentage points lower than the average of 18.94% recorded at the end of December last year.

All seven companies saw their average interest rates over three months decrease by at least 0.03 percentage points and up to 1.13 percentage points. In particular, Hyundai Card offered the lowest average interest rate, dropping from 19.03% at the end of last year to 17.90% at the end of March this year, a decrease of 1.13 percentage points. Lotte Card also experienced a significant decline of 0.54 percentage points during the same period. Hyundai Card explained that it lowered its rates independently ahead of the statutory maximum interest rate reduction.

The credit card company with the highest average cash advance interest rate was KB Kookmin Card at 19.19%. Hana Card maintained a rate of 19% following last year, at 19.08%. Samsung (18.83%), Woori (18.49%), Shinhan (18.36%), and Lotte Card (18.23%) followed.

Cash Advance Usage Amount 4 Trillion Won in February... Interest Rate Reduction as a Last Resort

The move to lower cash advance interest rates is influenced by the maximum interest rate reduction, but there are also opinions that it is a desperate measure by card companies to secure the shrinking cash advance customer base. Since cash advances have higher interest rates than card loans (long-term loans) or loans from internet banks and no longer hold an advantage in terms of convenience, card companies have no choice but to take measures such as lowering interest rates.

In fact, cash advance interest rates are about 5-6% higher than card loans. As of the end of March, the average card loan interest rate among the seven major credit card companies was 13.21%, while cash advances averaged 18.58%, which is 5.37 percentage points higher.

For this reason, cash advance usage has been steadily declining. According to the Bank of Korea's economic statistics system, the amount of personal cash advance usage by credit card companies recorded 4.02 trillion won as of the end of February. This is a 16.8% decrease compared to the previous year (4.83 trillion won) and marks the lowest level since 2003. The cash advance usage amount, which reached 26 trillion won in 2003, has decreased to the 4 trillion won level over 18 years.

Cash advance usage is expected to continue declining. Since cash advance customers generally have lower credit ratings than card loan customers, they are more affected by the statutory maximum interest rate reduction. According to the credit finance association, as of the end of March, nearly 50% of cash advance users among the seven major credit card companies were subject to interest rates exceeding 20% per annum. Hana Card's proportion reaches 60.46%, followed by Hyundai Card at 56.52% and KB Kookmin Card at 54.92%.

An industry official said, "Ahead of the statutory maximum interest rate reduction, we are adjusting cash advance interest rates," adding, "With the increasing number of services competing with cash advances, such as fintech, card companies have no choice but to use interest rate reductions as a means to secure the shrinking cash advance customer base."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.