Villa transaction volume exceeds apartments for 4 consecutive months

Officetel sale prices also surpass apartments

As substitutes amid apartment price surge and loan regulations

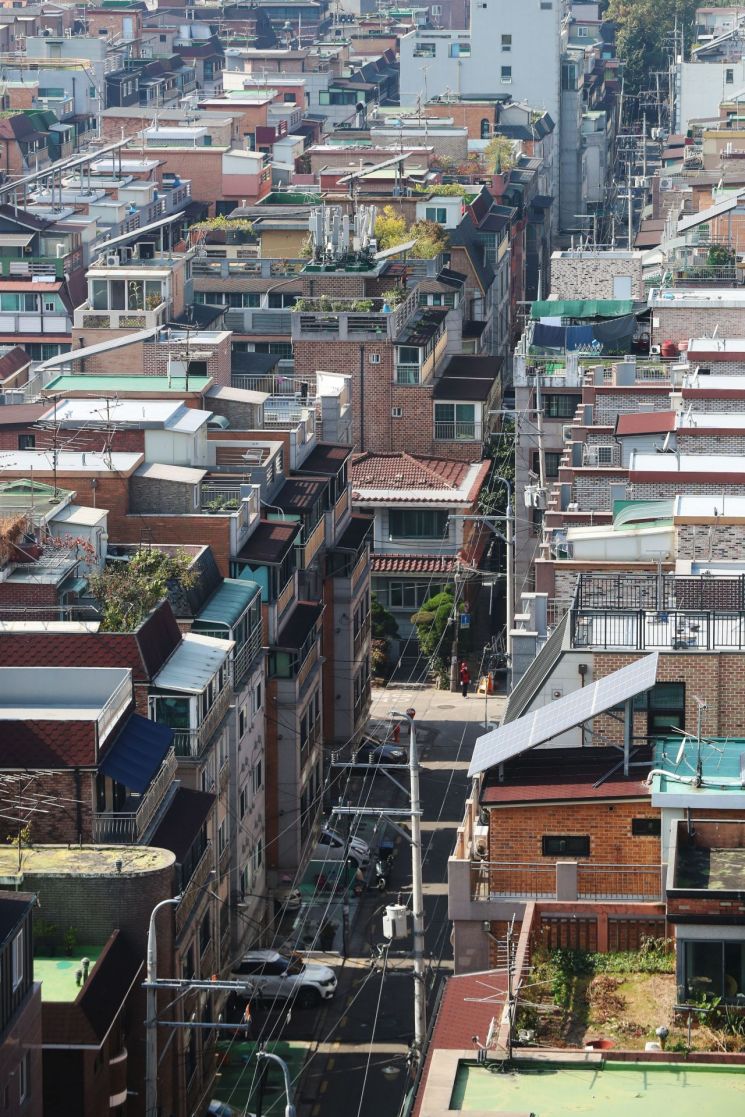

With apartment prices soaring to unprecedented heights and the government's stringent loan regulations blocking homebuyers, demand is shifting towards multi-family and row houses such as villas and officetels. The unusual phenomenon of villa transaction volumes surpassing apartment transactions has continued for four consecutive months, while officetels are also seeing soaring subscription competition rates and price increases in the sales market that outpace apartments.

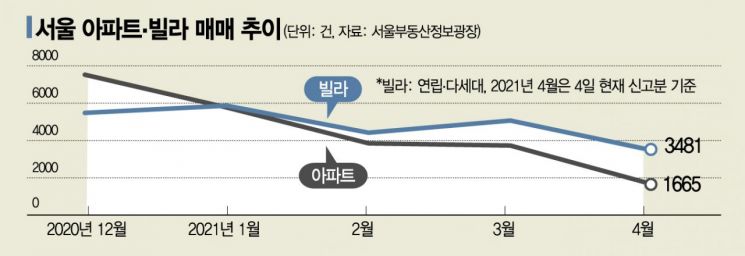

According to the Seoul Real Estate Information Plaza on the 4th, last month the number of villa sales transactions in Seoul (based on reporting date) totaled 3,217, which is 2.2 times higher than apartment sales transactions (1,450). Since about four weeks remain in the reporting period, the figures are expected to increase further, but as the reference point is the same for both villas and apartments, the trend is not expected to change significantly.

Until last year, apartment transaction volumes were typically two to three times higher than villa transactions due to larger price increases and higher liquidity. However, this year has seen a reversal in transaction volumes for four consecutive months. In January, villa transactions were 5,883, slightly surpassing apartment transactions (5,771). In February, villas recorded 4,422 transactions, 14.7% more than apartments (3,854). In March, villas reached 5,056 transactions, 35.5% more than apartments (3,730), and last month the gap doubled.

Prices have also steadily risen. According to the KB Live Real Estate monthly survey, the average sale price of row houses in Seoul first exceeded 300 million KRW in August last year at 301.13 million KRW and rose 8.4% to 326.48 million KRW last month.

This phenomenon is interpreted as young adults and others with limited financial capacity seeking villas as substitutes instead of purchasing apartments. Villas are relatively cheaper and have lower loan thresholds compared to apartments. Seojinhyung, president of the Korea Real Estate Society and professor at Gyeongin Women's University, analyzed, "As non-homeowners who are actual demanders cannot purchase apartments due to various regulations, they have turned their attention to villas. Additionally, redevelopment prospects have highlighted investment demand targeting these properties."

The balloon effect has already spread to officetels. According to the Korea Real Estate Board, as of last month, the nationwide officetel price increase rate was 22.89% year-on-year, about 2.3 times higher than the nationwide apartment price increase rate of 10% during the same period.

Residential officetels are especially popular among younger generations. In speculative overheated zones such as Seoul, the loan-to-value ratio (LTV) for apartments is limited to 40%, and for amounts exceeding 900 million KRW, it drops to 20%. In contrast, residential officetels can receive loans up to 70% regardless of market price. Winning a subscription does not count towards the number of houses owned, allowing buyers to maintain non-homeowner status, and officetel pre-sale rights are not included in acquisition or capital gains tax calculations for the number of houses owned, which also seems to be reflected in demand.

In some areas, short-term buying of officetels is also expected. The government announced household debt management measures last week, deciding to limit the LTV for new non-residential mortgage loans, including officetels, to 40% starting in July within land transaction permission zones. For example, currently, when purchasing a 400 million KRW officetel, applying an LTV of 70% (based on 100% appraisal value) allows a loan of up to 280 million KRW. However, from July, with an LTV of 40%, the loanable amount will decrease to 160 million KRW. Professor Seo said, "For non-investor actual demanders without homes, purchasing villas instead of apartments may not be a bad choice at present."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.