DSR Regulation Tightening

Home Purchase Harder for 2030 Generation Using All-In Loans

Seoul Exodus Demand Expected to Accelerate

[Asia Economy Reporter Kwangho Lee] As financial authorities tighten the total debt service ratio (DSR) regulations on mortgage loans starting in July, the concerns of genuine homebuyers preparing to purchase their own homes are deepening. While the financial authorities aim to prevent household debt from increasing excessively and leading to defaults, young people are voicing that it makes homeownership even more difficult amid a situation where housing prices are rising faster than incomes. The surge in inquiries to get loans before the regulations take effect is also due to this reason.

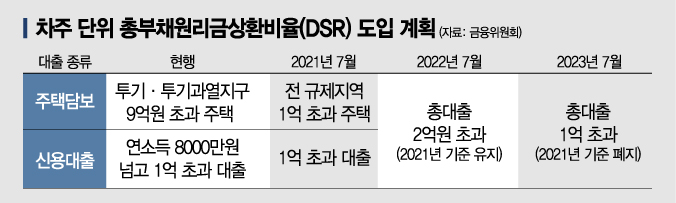

According to financial authorities on the 3rd, from July, a DSR 40% regulation will apply when obtaining a mortgage loan for houses priced over 600 million KRW in regulated areas or when taking out credit loans exceeding 100 million KRW. This means borrowing money within the range that can be managed by income. For example, if the annual income is 30 million KRW, the annual principal and interest burden should not exceed 12 million KRW.

Accordingly, once the DSR regulation is fully enforced, it is expected to be difficult for people in their 20s and 30s to pool all their resources (Yeongkkeul) to buy a home. Previously, besides mortgage loans, other loans such as credit loans and card loans could all be combined and used for housing funds, but DSR regulates so that the principal and interest of all debts held by the borrower do not exceed a certain percentage of annual income. The lower the annual income, the smaller the loan amount becomes.

Various real estate communities have seen an increase in inquiries from young people trying to get loans before the DSR regulation applies. Seong Unha (pseudonym), a 30-year-old preparing for marriage at the end of this year, posted, "As a newcomer to society, I am worried that I won’t be able to get a loan once the DSR regulation is introduced," inquiring about mortgage loan products. Mr. B, who has been working for four years, wrote, "I don’t plan to use a large sum of money immediately, but I might need it for stock or real estate investments in the future, so I want to borrow more before loans get blocked."

A representative from a commercial bank said, "Just as credit loans surged after the financial authorities announced the total credit loan volume regulation at the end of last year, many inquiries about loans have been coming to branches since the announcement of the new regulations," and predicted, "The demand to create funds through loans is expected to increase significantly this month."

Some expect that the DSR regulation will accelerate the demand to move out of Seoul and look for homes in suburban areas. Under the government’s new regulation, 83.5% of apartments in Seoul will be subject to DSR restrictions. According to KB Kookmin Bank’s ‘Monthly KB Housing Market Trends,’ the average sale price of medium-sized apartments (60~85㎡, 18~25 pyeong) in April was 986.56 million KRW, an increase of 292.37 million KRW compared to two years ago.

A financial authority official said, "For genuine homebuyers, we plan to increase financial support so that there are no difficulties in purchasing a home," and added, "For young people with a high possibility of future income growth, we will actively utilize the ‘future income recognition criteria’ when calculating DSR."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.