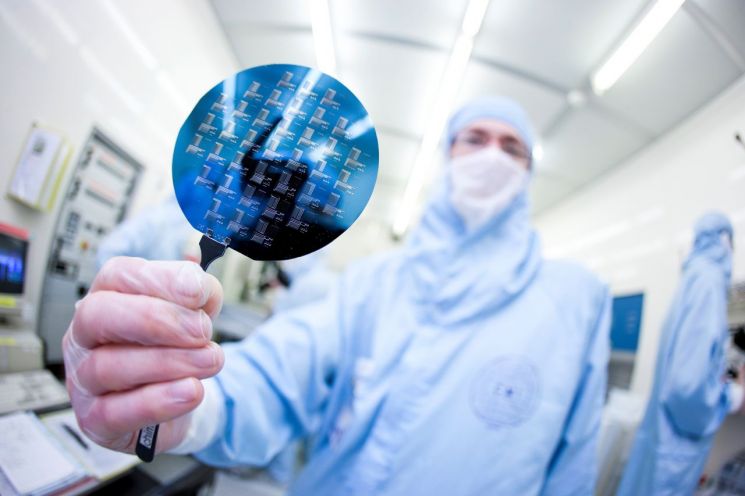

[Asia Economy Reporter Jeong Hyunjin] Global semiconductor sales in the first quarter of this year (January to March) have surpassed those of the previous supercycle peak in the third quarter of 2018. This marks the highest level ever recorded since the statistics were released by the Semiconductor Industry Association (SIA) in the United States, effectively representing the largest scale in history. As the semiconductor market officially entered a supercycle, global companies have responded swiftly by expanding production and advancing investment timelines.

According to the SIA on the 3rd, global semiconductor sales in the first quarter amounted to $123.1 billion (approximately 137.5 trillion KRW), an increase of 17.8% compared to the same period last year. The SIA cites data from the World Semiconductor Trade Statistics (WSTS), reporting monthly sales figures that include about 98% of the U.S. semiconductor industry and roughly two-thirds of semiconductor companies outside the U.S.

Sales in the first quarter of this year exceeded the $122.7 billion recorded in the third quarter of 2018, which was the peak of the semiconductor supercycle. According to figures released by the SIA, the three-month moving average sales were $40.91 billion in Q3 2018, while this year’s first quarter surpassed that with $41.05 billion. John Neuffer, president of the SIA, explained, "Global semiconductor sales have maintained strength throughout the first quarter of this year." Regionally, sales increased across all areas including China, Korea, other parts of Asia, Japan, the U.S., and Europe.

This increase in semiconductor sales is attributed to a surge in demand caused by COVID-19. The rapid growth in products utilizing semiconductors such as artificial intelligence (AI), autonomous vehicles, and the Internet of Things (IoT), combined with demand significantly exceeding supply, has also driven up semiconductor prices, contributing to the sales increase. Market forecasts suggest that the semiconductor shortage will continue through 2023, indicating that this trend is likely to persist for the time being.

The rise in semiconductor prices is clearly evident. According to Taiwanese market research firm TrendForce, the fixed transaction price of DDR4 8Gb PC DRAM last month averaged $3.80, a 26.67% increase from the previous month. This price increase is the highest since January 2017, a period of long-term semiconductor boom. The price rose by about $1 from $2.85 at the end of last year in just four months. Considering that during the super-boom period from April to September 2018, the price of this product exceeded $8, there is potential for further sales growth due to rising prices. Some experts also predict that based on the learning effect from the rapid price surge at that time, the extent of semiconductor price increases may be limited.

In line with the expanding semiconductor demand and rising prices, semiconductor manufacturers such as SK Hynix and Taiwan’s TSMC are accelerating their investments. SK Hynix announced during a conference call held after its Q1 earnings release on the 28th of last month that it plans to advance part of next year’s investments to the second half of this year. TSMC also announced last month that while maintaining its planned capital expenditure of $100 billion over the next three years, it will increase its investment for this year from $28 billion to $30 billion. According to data from research firm Statista, the global semiconductor industry’s capital expenditure this year is expected to reach $125 billion, a 14.6% increase from the previous year and the largest ever. Samsung Electronics is also expected to finalize and announce its semiconductor investment scale as early as this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)